Securing the right mortgage is a crucial step in making homeownership affordable and manageable, as interest rates and loan terms significantly impact your monthly payments and overall financial health. Understanding different mortgage options, such as fixed-rate and adjustable-rate loans, helps you choose a plan that aligns with your long-term goals. Explore the rest of this article to learn how to navigate mortgage complexities and make informed decisions.

Table of Comparison

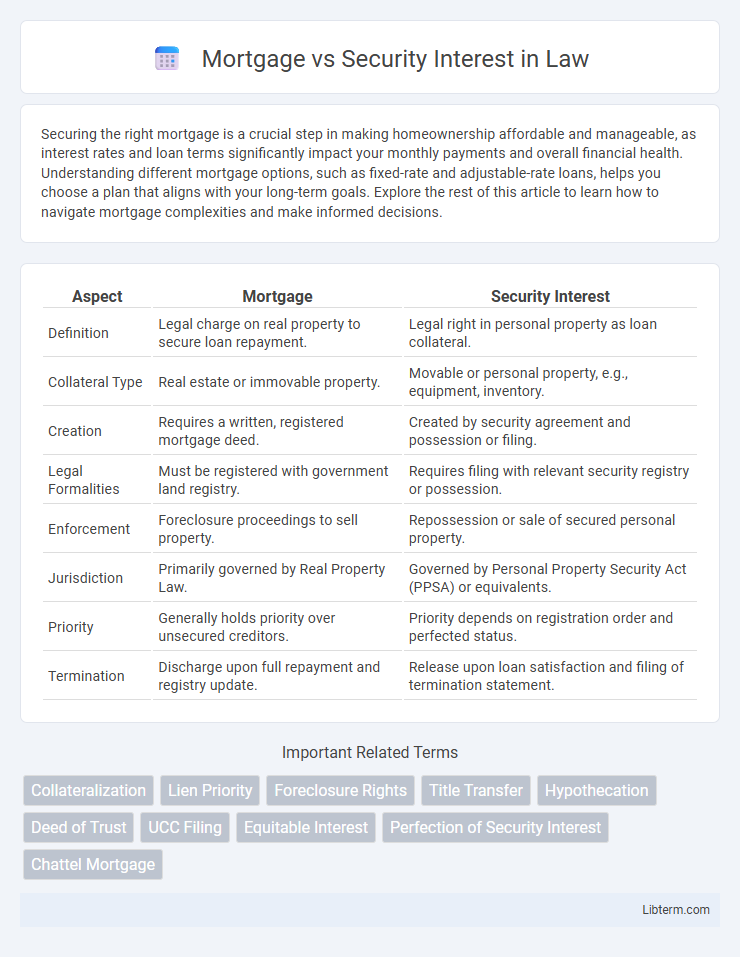

| Aspect | Mortgage | Security Interest |

|---|---|---|

| Definition | Legal charge on real property to secure loan repayment. | Legal right in personal property as loan collateral. |

| Collateral Type | Real estate or immovable property. | Movable or personal property, e.g., equipment, inventory. |

| Creation | Requires a written, registered mortgage deed. | Created by security agreement and possession or filing. |

| Legal Formalities | Must be registered with government land registry. | Requires filing with relevant security registry or possession. |

| Enforcement | Foreclosure proceedings to sell property. | Repossession or sale of secured personal property. |

| Jurisdiction | Primarily governed by Real Property Law. | Governed by Personal Property Security Act (PPSA) or equivalents. |

| Priority | Generally holds priority over unsecured creditors. | Priority depends on registration order and perfected status. |

| Termination | Discharge upon full repayment and registry update. | Release upon loan satisfaction and filing of termination statement. |

Understanding Mortgages: Definition and Basics

A mortgage is a legal agreement where a borrower pledges real property as collateral to secure a loan, ensuring the lender can claim the property if repayment defaults. It creates a specific type of security interest tied to real estate, designed to protect the lender's investment while allowing the borrower to retain possession. Mortgages typically involve formal documentation and recording requirements to establish priority and enforceability in property law.

What is a Security Interest? Key Concepts

A security interest is a legal claim granted by a debtor to a creditor over the debtor's property, serving as collateral to secure a loan or obligation. It allows the creditor to repossess or sell the asset if the debtor defaults, ensuring repayment of the debt. Key concepts include attachment, perfection, and priority, which determine the enforceability and hierarchy of the security interest against other creditors.

Legal Foundations: Mortgage vs Security Interest

A mortgage represents a specific type of security interest primarily used in real estate transactions, where the borrower grants the lender a lien on the property as collateral for the loan. Security interests encompass a broader legal concept under the Uniform Commercial Code (UCC), allowing creditors to claim rights over various types of collateral, including personal property, to secure debt repayment. The legal foundation of a mortgage is grounded in property law, requiring formalities such as recording, while security interests are governed by secured transactions law focusing on attachment and perfection procedures.

Types of Mortgages and Security Interests

Types of mortgages include fixed-rate, adjustable-rate, interest-only, and reverse mortgages, each offering different payment structures and borrower benefits tailored to financial goals. Security interests encompass mortgages, liens, and pledges, serving as legal claims on assets to secure repayment of debt obligations. Understanding these distinctions helps in selecting the appropriate type based on asset type, risk factors, and legal protections.

Key Differences Between Mortgages and Security Interests

Mortgages specifically involve real property as collateral and create a lien transferring an interest in real estate to secure a loan, whereas security interests can apply to various types of personal property under the Uniform Commercial Code (UCC). Mortgages typically require a formal recorded document that grants rights against the property, while security interests may be established through possession or a security agreement without recording. The enforcement of a mortgage often involves foreclosure proceedings, contrasting with security interests where repossession or UCC Article 9 remedies are used.

Creation and Perfection: Processes Compared

A mortgage is created through a written agreement granting the lender a lien on real property as security for a loan, requiring registration in the land records for perfection, which provides public notice and priority. Security interests arise from a security agreement granting rights in personal property, and perfection is achieved typically by filing a financing statement under the Uniform Commercial Code or by possession of the collateral, establishing priority and enforceability against third parties. The mortgage perfection process centers on real estate recording systems, whereas security interests involve UCC filings or possession, reflecting distinct legal frameworks and procedures for establishing creditor rights.

Rights and Obligations of Parties Involved

A mortgage grants the lender a legal interest in the property used as collateral, allowing the lender rights to foreclose if the borrower defaults, while the borrower retains possession and usage rights. The borrower is obligated to repay the loan according to agreed terms, maintain the property, and insure it, whereas the lender must release the mortgage upon full repayment. In contrast, a security interest can cover various types of collateral beyond real estate, providing the secured party rights to seize or sell the collateral upon debtor default, with obligations including proper perfection of the interest and notification of enforcement actions.

Priority and Enforcement in Case of Default

In mortgage law, priority is determined by the chronological order of recording, with the first recorded mortgage holding superior priority over subsequent liens, ensuring the lender's claim is secured before others in case of borrower default. Enforcement involves the lender initiating a foreclosure process to sell the property and satisfy the outstanding debt, where foreclosure procedures vary by jurisdiction but generally give priority holders the right to recover their loan amount first. Security interests, governed by the Uniform Commercial Code (UCC) for personal property, prioritize based on the timing of filing a financing statement or possession of collateral, and enforcement typically involves repossession and sale of collateral, with secured parties holding the right to satisfy debts before unsecured creditors.

Practical Implications for Borrowers and Lenders

Mortgages legally transfer an interest in real property to secure a loan, providing lenders with prioritized claims and easier foreclosure processes, which benefits borrowers through lower interest rates and lenders through reduced risk. Security interests cover a broader range of collateral, including personal property, requiring proper attachment and perfection to protect lenders' rights, often leading to more complex enforcement procedures affecting both parties' bargaining positions. Borrowers must understand the type of collateral and associated rights, while lenders need to ensure compliance with relevant laws to maximize protection and recovery options.

Choosing the Right Option: Factors to Consider

When choosing between a mortgage and a security interest, key factors include the type of property involved, jurisdictional laws, and the parties' intended rights and obligations. Mortgages are typically used for real estate, providing lenders with rights to the property until the debt is paid, while security interests can cover personal property with broader applicability under the Uniform Commercial Code (UCC). Evaluating loan purpose, asset type, legal framework, and enforcement processes ensures the selected option aligns with both creditor protection and debtor flexibility.

Mortgage Infographic

libterm.com

libterm.com