Embezzlement involves the fraudulent appropriation of funds or property entrusted to one's care, often occurring in workplace or organizational settings. Understanding the legal consequences and prevention strategies is crucial to protect your assets and maintain ethical standards. Explore the rest of the article to learn how to identify, prevent, and respond to embezzlement effectively.

Table of Comparison

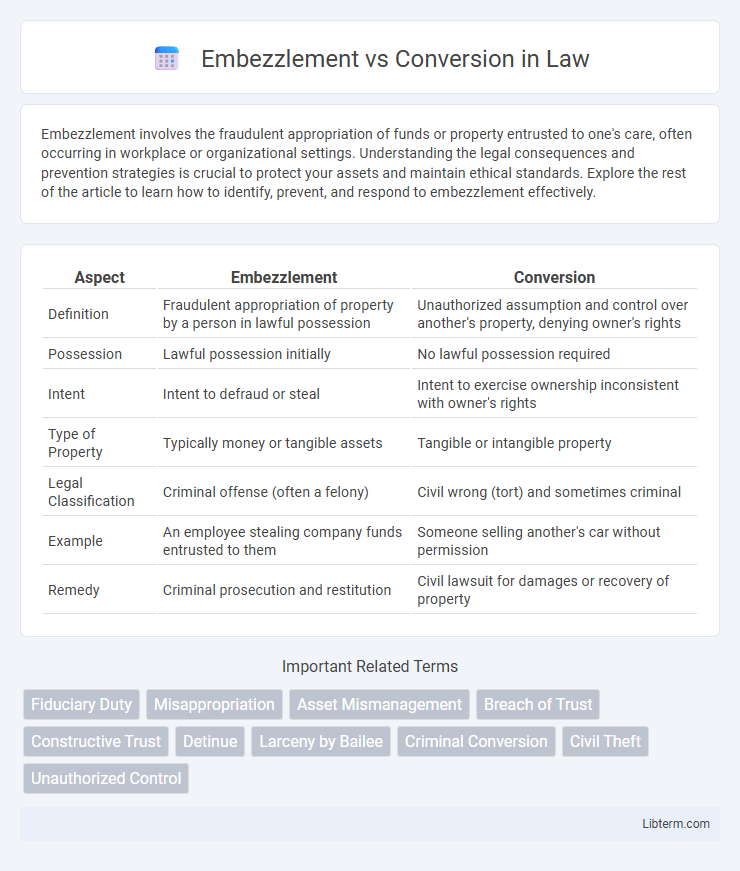

| Aspect | Embezzlement | Conversion |

|---|---|---|

| Definition | Fraudulent appropriation of property by a person in lawful possession | Unauthorized assumption and control over another's property, denying owner's rights |

| Possession | Lawful possession initially | No lawful possession required |

| Intent | Intent to defraud or steal | Intent to exercise ownership inconsistent with owner's rights |

| Type of Property | Typically money or tangible assets | Tangible or intangible property |

| Legal Classification | Criminal offense (often a felony) | Civil wrong (tort) and sometimes criminal |

| Example | An employee stealing company funds entrusted to them | Someone selling another's car without permission |

| Remedy | Criminal prosecution and restitution | Civil lawsuit for damages or recovery of property |

Introduction to Embezzlement and Conversion

Embezzlement involves the unlawful taking or misappropriation of funds or property entrusted to an individual, often occurring in fiduciary relationships such as between an employee and employer. Conversion refers to the unauthorized assumption and exercise of ownership rights over someone else's property, resulting in the deprivation of the rightful owner's control. Both legal concepts address wrongful control over property but differ in the nature of the initial possession and intent.

Defining Embezzlement

Embezzlement involves the fraudulent appropriation of property or funds entrusted to an individual, typically in a fiduciary or employment relationship, with the intent to deprive the rightful owner permanently. Unlike conversion, which is the unauthorized exercise of control over someone else's property without lawful justification, embezzlement specifically requires a breach of trust. Legal definitions emphasize the initial lawful possession of the property, distinguishing embezzlement from other forms of theft.

Understanding Conversion in Law

Conversion in law refers to an unauthorized act that deprives an owner of their property rights, treating the property as if it belongs to the wrongdoer. Unlike embezzlement, which involves wrongful appropriation of property entrusted to someone, conversion can occur without any initial trust relationship. Legal elements of conversion include interference with possession, intent to exercise control, and significant deprivation of the owner's rights.

Key Differences Between Embezzlement and Conversion

Embezzlement involves the fraudulent appropriation of property by a person in a position of trust or responsibility, typically an employee or fiduciary, whereas conversion refers to the unauthorized assumption and exercise of ownership rights over someone else's property without consent. Embezzlement requires a breach of trust and intent to deprive the owner permanently, while conversion centers on the wrongful possession or use of property regardless of a fiduciary relationship. Legal distinctions also include embezzlement being a criminal offense involving misappropriation, while conversion often manifests in civil claims seeking damages for loss or deprivation of property.

Legal Elements of Embezzlement

Embezzlement requires the legal elements of lawful possession of property, fraudulent appropriation, and intent to deprive the rightful owner permanently. Unlike conversion, which involves unauthorized control over someone else's property without initial permission, embezzlement involves a breach of trust by someone already entrusted with the property. Proof of intent and breach of fiduciary duty are crucial in establishing embezzlement under criminal statutes.

Essential Elements of Conversion

Conversion involves the unauthorized assumption and exercise of ownership rights over another's personal property, depriving the true owner of its possession or use. The essential elements include the plaintiff's ownership or right to possession of the property, the defendant's unauthorized act or dominion over the property, and resulting deprivation or interference with the plaintiff's rights. Unlike embezzlement, which requires a fiduciary relationship and fraudulent intent, conversion centers on the wrongful appropriation or control of property without consent.

Common Examples and Case Studies

Embezzlement commonly involves employees misappropriating funds from their employer, such as diverting company money into personal accounts, while conversion typically centers on unauthorized use or control over someone else's property, like taking a vehicle without permission. Case studies reveal embezzlement scenarios in corporate fraud cases involving falsified bookkeeping, whereas conversion is often highlighted in legal disputes over stolen goods or intangible assets like intellectual property. Both crimes emphasize the unauthorized control of assets but differ in the legal elements of ownership infringement and fraudulent intent.

Penalties and Legal Consequences

Embezzlement carries severe penalties including fines, restitution, and imprisonment ranging from one to twenty years depending on the amount stolen and jurisdiction. Conversion, often treated as a civil matter, may result in compensatory damages and sometimes punitive damages if proven intentional, with possible criminal charges less common but still applicable. Legal consequences for embezzlement typically involve criminal prosecution with potential felony charges, while conversion usually involves civil lawsuits seeking recovery of property or its value.

Defenses to Embezzlement and Conversion Charges

Defenses to embezzlement charges often include proving lack of fraudulent intent or demonstrating that the accused had lawful possession or authorization over the property. In conversion cases, common defenses involve showing that the alleged conduct did not deprive the owner of possession or that there was a valid legal right to the property. Both defenses hinge on distinguishing unauthorized control from lawful use or rightful ownership to negate the elements of the offenses.

Preventative Measures and Best Practices

Implementing strict internal controls and regularly conducting financial audits are essential preventative measures against embezzlement and conversion. Segregation of duties limits the opportunity for misappropriation of assets by ensuring no single individual has complete control over financial transactions. Employee training on ethical standards and establishing clear reporting mechanisms encourage transparency and early detection of suspicious activities.

Embezzlement Infographic

libterm.com

libterm.com