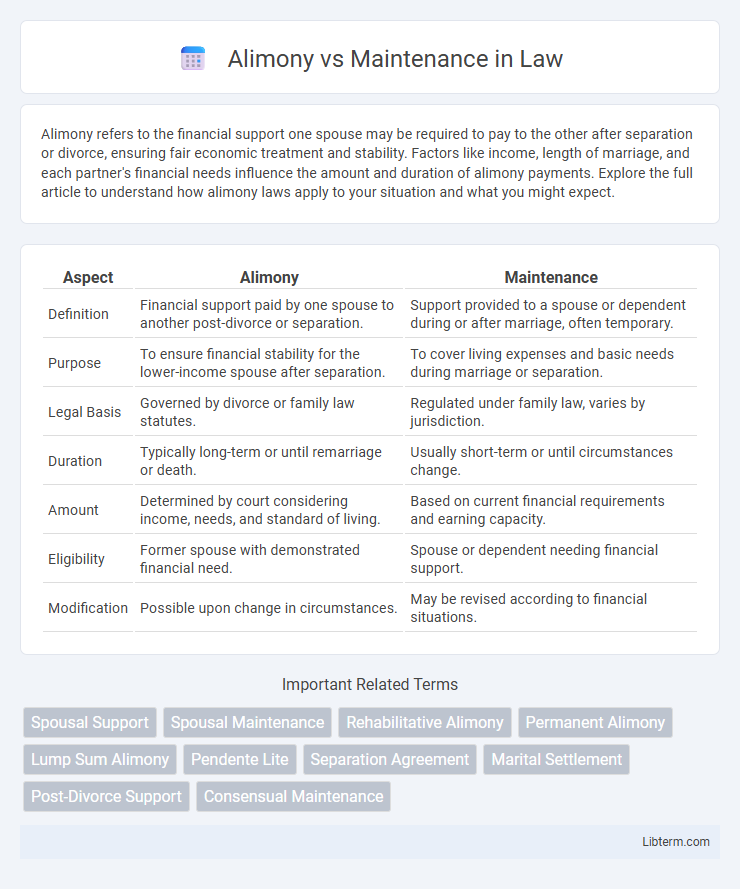

Alimony refers to the financial support one spouse may be required to pay to the other after separation or divorce, ensuring fair economic treatment and stability. Factors like income, length of marriage, and each partner's financial needs influence the amount and duration of alimony payments. Explore the full article to understand how alimony laws apply to your situation and what you might expect.

Table of Comparison

| Aspect | Alimony | Maintenance |

|---|---|---|

| Definition | Financial support paid by one spouse to another post-divorce or separation. | Support provided to a spouse or dependent during or after marriage, often temporary. |

| Purpose | To ensure financial stability for the lower-income spouse after separation. | To cover living expenses and basic needs during marriage or separation. |

| Legal Basis | Governed by divorce or family law statutes. | Regulated under family law, varies by jurisdiction. |

| Duration | Typically long-term or until remarriage or death. | Usually short-term or until circumstances change. |

| Amount | Determined by court considering income, needs, and standard of living. | Based on current financial requirements and earning capacity. |

| Eligibility | Former spouse with demonstrated financial need. | Spouse or dependent needing financial support. |

| Modification | Possible upon change in circumstances. | May be revised according to financial situations. |

Understanding Alimony and Maintenance

Alimony and maintenance both refer to financial support payments during or after a divorce, aimed at ensuring fair economic treatment between spouses. Alimony typically denotes spousal support ordered by a court to help the lower-earning partner maintain a similar standard of living, often based on factors like marriage duration, income disparity, and individual needs. Maintenance is a broader term used in some legal systems encompassing temporary or permanent financial support, which may include rehabilitative payments designed to help a spouse gain financial independence.

Key Differences Between Alimony and Maintenance

Alimony refers to the financial support paid by one spouse to another following a divorce, primarily intended to maintain the recipient's standard of living. Maintenance, often used interchangeably with alimony, varies by jurisdiction and may include short-term support during separation or post-divorce, covering necessities such as housing and living expenses. Key differences between alimony and maintenance lie in their duration, purpose, and eligibility criteria, where alimony typically involves long-term payments based on factors like income disparity, while maintenance can be temporary and focused on immediate financial needs.

Legal Definitions: Alimony vs Maintenance

Alimony refers to court-ordered financial support paid by one spouse to another following a divorce or separation, primarily intended to help the lower-earning spouse maintain a comparable standard of living. Maintenance, often used interchangeably with alimony but varying by jurisdiction, typically encompasses spousal support payments that may be temporary or permanent based on factors like marriage duration and each party's income. Legal definitions distinguish alimony as more focused on long-term support, while maintenance can include rehabilitative support aimed at helping the recipient become self-sufficient.

Eligibility Criteria for Alimony and Maintenance

Eligibility criteria for alimony typically require the spouse seeking support to demonstrate financial need and the other spouse's capacity to pay, often considering marriage duration, income disparity, and standard of living during the marriage. Maintenance eligibility varies by jurisdiction but generally involves factors such as the length of the marriage, earning potential of both parties, and any agreements made during divorce settlements. Courts assess these criteria to ensure fair financial assistance and support based on individual circumstances and legal standards.

Types of Alimony and Maintenance

Types of alimony include temporary, rehabilitative, permanent, and lump-sum payments, each serving different financial support needs during or after divorce proceedings. Maintenance, often used interchangeably with alimony, encompasses spousal support but may also include child maintenance, covering expenses for child upbringing beyond regular custody agreements. Understanding the distinction between these types--particularly temporary versus permanent--is crucial for determining financial responsibilities post-separation.

Factors Influencing the Court’s Decision

Courts consider factors such as the duration of the marriage, the income and earning capacity of each spouse, and contributions made during the marriage when deciding on alimony versus maintenance. The financial needs and ability to pay, along with the standard of living established during the marriage, heavily influence the court's judgment. Health, age, and the presence of children requiring support are also critical elements affecting the determination of spousal support.

Duration and Modification of Payments

Alimony, often referred to as spousal support, typically has a predefined duration based on factors such as the length of the marriage and the recipient's financial dependence, while maintenance can be more flexible, sometimes awarded on a temporary basis. The modification of alimony payments usually requires a significant change in circumstances, such as income alteration or remarriage, whereas maintenance payments can be adjusted more readily to reflect current needs and earning capacities. Courts evaluate factors like the payer's ability to pay and the recipient's financial status when considering modifications for both alimony and maintenance.

Tax Implications of Alimony and Maintenance

Alimony payments are often tax-deductible for the payer and taxable income for the recipient under U.S. tax law for agreements finalized before 2019, while maintenance payments may have varying tax treatments depending on jurisdiction and specific legal definitions. The Tax Cuts and Jobs Act of 2017 eliminated the tax deduction for alimony payments in divorce agreements executed after December 31, 2018, shifting the tax burden exclusively to the payer in many cases. Understanding the distinctions between alimony and maintenance in the applicable state or country is crucial for accurate tax reporting and financial planning during divorce settlements.

Rights and Obligations of Spouses

Alimony and maintenance both involve financial support between spouses, but alimony typically refers to post-divorce payments while maintenance can include ongoing support during separation or marriage. The rights of spouses to receive alimony depend on factors such as duration of marriage, income disparity, and contributions made during the marriage. Obligations include the payer's duty to provide reasonable financial assistance to ensure the recipient spouse's ability to meet basic living expenses and maintain a standard of living comparable to that during the marriage.

Common Myths About Alimony and Maintenance

Alimony and maintenance are often misunderstood, with common myths suggesting alimony is automatically granted or permanent, while maintenance is only for temporary support; in reality, alimony depends on various factors like income disparity, duration of marriage, and individual needs. Many believe only women receive alimony, but courts award payments based on financial necessity, regardless of gender. Another misconception is that alimony and maintenance mean the same, whereas alimony typically refers to spousal support after divorce, and maintenance can include broader financial assistance during separation or legal proceedings.

Alimony Infographic

libterm.com

libterm.com