Conditional estate refers to a property interest that depends on the occurrence of a specific event or condition, which determines whether the estate will continue or end. This type of estate limits your ownership rights, making future interests contingent upon particular circumstances set forth in the deed or will. Explore the rest of the article to understand how conditional estates impact property rights and inheritance.

Table of Comparison

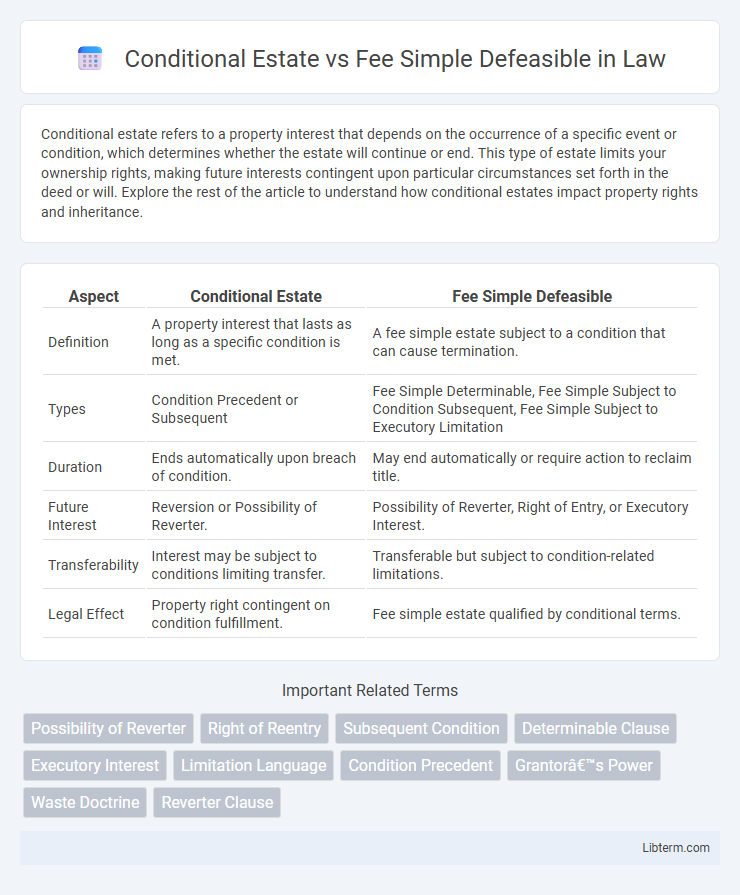

| Aspect | Conditional Estate | Fee Simple Defeasible |

|---|---|---|

| Definition | A property interest that lasts as long as a specific condition is met. | A fee simple estate subject to a condition that can cause termination. |

| Types | Condition Precedent or Subsequent | Fee Simple Determinable, Fee Simple Subject to Condition Subsequent, Fee Simple Subject to Executory Limitation |

| Duration | Ends automatically upon breach of condition. | May end automatically or require action to reclaim title. |

| Future Interest | Reversion or Possibility of Reverter. | Possibility of Reverter, Right of Entry, or Executory Interest. |

| Transferability | Interest may be subject to conditions limiting transfer. | Transferable but subject to condition-related limitations. |

| Legal Effect | Property right contingent on condition fulfillment. | Fee simple estate qualified by conditional terms. |

Introduction to Property Ownership Types

Conditional estates impose specific conditions on property ownership that, if violated, can lead to termination or reversion of the estate, unlike fee simple defeasible estates which grant ownership subject to conditions but allow reversion upon breach. Fee simple defeasible includes determinable and subject-to-condition subsequent types, both creating defeasible fees where the estate might end automatically or require legal action to revert ownership. Understanding these property ownership types is essential for real estate transactions and estate planning, as they determine the rights, restrictions, and future interests tied to real property.

Defining Conditional Estate

A Conditional Estate is a type of real property ownership that persists only as long as a specific condition or event occurs or fails to occur, causing the estate to terminate if the condition is breached. Unlike Fee Simple Defeasible, which includes determinable and subject-to-condition subsequent estates automatically reverting or giving the grantor a right of entry, a Conditional Estate specifically emphasizes the conditional nature of ownership subject to future events. This estate type is commonly used to restrict land use or ensure property dedication to particular purposes, with ownership rights contingent upon compliance with imposed conditions.

Understanding Fee Simple Defeasible

Fee simple defeasible is a type of freehold estate in real property that grants ownership with specific conditions or limitations, which, if violated, can lead to the termination of the estate. Unlike conditional estates that require an event to occur to either continue or terminate the ownership, fee simple defeasible automatically reverts to the grantor or a third party upon breach of the stipulated condition. This estate provides more flexibility while protecting the grantor's interests by ensuring the property use adheres to the original terms of ownership.

Key Differences Between Conditional Estate and Fee Simple Defeasible

Conditional estates require the property holder to meet specific conditions, and failure to do so results in automatic termination of ownership in favor of the grantor or their heirs. Fee simple defeasible grants ownership with the possibility of losing the estate if a stipulated event occurs, but it can be either a fee simple determinable, which ends automatically, or a fee simple subject to condition subsequent, which requires action to reclaim the property. The key difference lies in how the estate ends: conditional estates terminate automatically upon breach, while fee simple defeasible variations depend on the nature of the condition and reentry rights.

Types of Fee Simple Defeasible Estates

Fee simple defeasible estates include two primary types: fee simple determinable and fee simple subject to a condition subsequent. A fee simple determinable automatically ends and reverts to the grantor when a specified condition is violated, indicated by language such as "so long as" or "while." Fee simple subject to a condition subsequent requires the grantor to take action to reclaim the property after a breach of condition, typically using phrases like "on condition that" or "but if.

Legal Implications of Each Ownership Type

Conditional estates impose legal obligations requiring specific conditions to be met; failure to comply results in automatic forfeiture of ownership rights. Fee simple defeasible grants ownership that can be voided if stipulated conditions are violated, allowing previous owners or heirs to reclaim the property through legal action. Both ownership types create enforceable encumbrances that impact transferability, inheritance, and potential litigation in real estate transactions.

Common Use Cases in Real Estate

Conditional estate grants ownership that endures only as long as a specific condition is met, commonly used in family trusts or charitable land donations to ensure purpose compliance. Fee simple defeasible offers full ownership subject to potential termination upon breach of a stipulated condition, often applied in commercial real estate leases or development agreements with zoning restrictions. Both instruments protect interests by enforcing conditions, but fee simple defeasible provides stronger ownership rights with built-in contingencies for reversion.

Transferring Conditional Estate vs Fee Simple Defeasible

Transferring a conditional estate involves granting property with a specific condition that, if violated, results in the automatic termination of the estate and reversion to the grantor or a third party. In contrast, transferring a fee simple defeasible allows the grantee to hold the property indefinitely unless a stated event occurs, which can trigger a possibility of reverter or a right of entry. The key distinction lies in the automatic termination in conditional estates versus the future interest retained by the grantor in fee simple defeasible transfers.

Reversion and Termination Scenarios

A Conditional Estate grants ownership subject to a specific condition, terminating automatically upon violation and often resulting in reversion to the grantor. A Fee Simple Defeasible estate includes conditions that, if breached, can lead to termination and either reversion or shifting of ownership, depending on whether it is fee simple determinable or fee simple subject to condition subsequent. Reversion scenarios in conditional estates occur immediately upon condition failure, whereas fee simple defeasible estates may require legal action for termination and possession recovery.

Choosing the Right Estate for Property Transactions

Choosing the right estate in property transactions hinges on understanding the distinctions between a Conditional Estate and a Fee Simple Defeasible; the former grants ownership subject to specific conditions, while the latter involves ownership that can be voided if certain events occur. Fee Simple Defeasible estates often include determinable or subject-to-condition subsequent clauses, providing automatic reversion or grantor rights of re-entry, which affects long-term control and marketability. Selecting the appropriate estate type ensures clarity in ownership rights, risk management, and aligns with the parties' intentions regarding property use and future interests.

Conditional Estate Infographic

libterm.com

libterm.com