Cooperative structures foster collaboration by enabling individuals or businesses to pool resources and share risks for mutual benefit. These organizations often emphasize democratic decision-making and equitable distribution of profits, making them attractive for community-driven projects. Explore the full article to discover how a cooperative model can enhance your ventures and support sustainable growth.

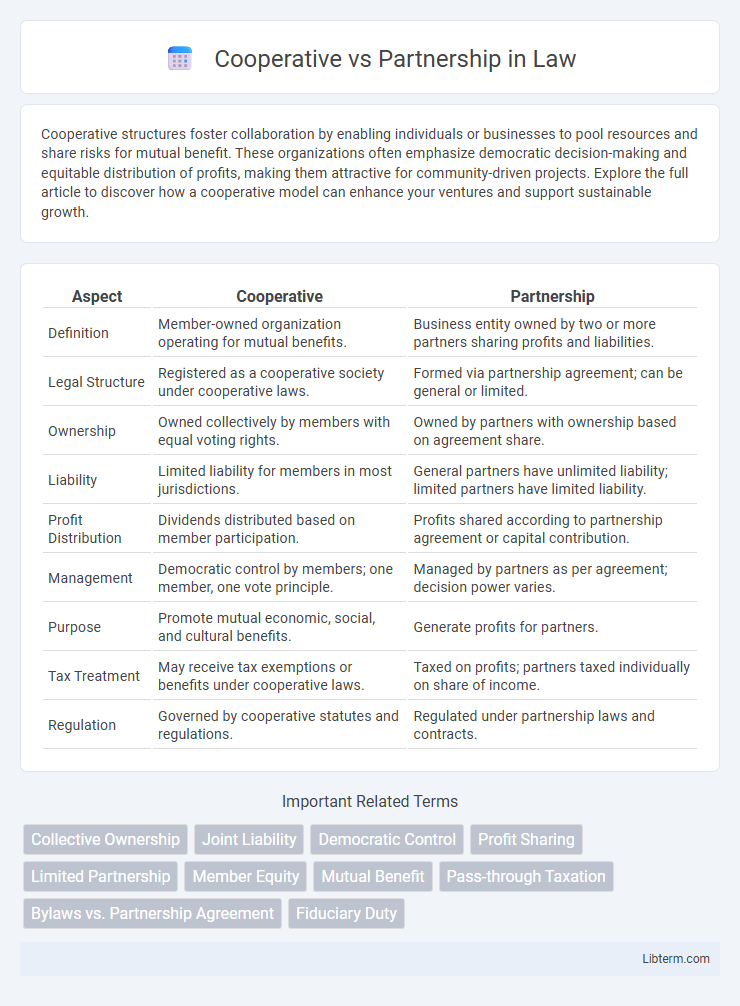

Table of Comparison

| Aspect | Cooperative | Partnership |

|---|---|---|

| Definition | Member-owned organization operating for mutual benefits. | Business entity owned by two or more partners sharing profits and liabilities. |

| Legal Structure | Registered as a cooperative society under cooperative laws. | Formed via partnership agreement; can be general or limited. |

| Ownership | Owned collectively by members with equal voting rights. | Owned by partners with ownership based on agreement share. |

| Liability | Limited liability for members in most jurisdictions. | General partners have unlimited liability; limited partners have limited liability. |

| Profit Distribution | Dividends distributed based on member participation. | Profits shared according to partnership agreement or capital contribution. |

| Management | Democratic control by members; one member, one vote principle. | Managed by partners as per agreement; decision power varies. |

| Purpose | Promote mutual economic, social, and cultural benefits. | Generate profits for partners. |

| Tax Treatment | May receive tax exemptions or benefits under cooperative laws. | Taxed on profits; partners taxed individually on share of income. |

| Regulation | Governed by cooperative statutes and regulations. | Regulated under partnership laws and contracts. |

Understanding Cooperatives: Definition and Key Features

A cooperative is a member-owned organization established to meet the common economic, social, and cultural needs of its members through a jointly owned and democratically controlled enterprise. Key features include voluntary and open membership, democratic member control based on one member one vote, and equitable distribution of surpluses among members. Cooperatives prioritize member benefits and community development over profit maximization, distinguishing them from traditional partnerships.

What is a Partnership? An Overview

A partnership is a legally recognized business structure where two or more individuals share ownership, responsibilities, profits, and liabilities according to a partnership agreement. It allows for combined resources, skills, and capital to operate a business collaboratively while maintaining flexibility in management and decision-making. Partnerships differ from cooperatives by focusing on profit distribution among partners rather than member-based democratic control.

Legal Structure: Cooperative vs Partnership

Cooperatives operate as member-owned entities with a legal structure emphasizing democratic control and limited liability for members, often governed by cooperative laws specific to jurisdictions. Partnerships are formed by two or more individuals or entities sharing profits, losses, and responsibilities, usually under general or limited partnership statutes, with partners personally liable for obligations unless structured as limited partnerships. The legal frameworks of cooperatives provide statutory protections promoting collective benefit, whereas partnerships focus on mutual agency and fiduciary duties among partners.

Ownership and Membership: Who’s in Control?

Cooperatives are collectively owned and democratically controlled by their members, who typically have equal voting rights regardless of their investment size, ensuring a one-member, one-vote principle. Partnerships, in contrast, are owned by individual partners whose control and decision-making power usually correspond to their capital contributions or agreed terms in the partnership agreement. This fundamental difference means cooperatives prioritize member participation and collective benefit, while partnerships focus on shared profit and control proportional to ownership stakes.

Decision-Making Processes Compared

Cooperatives typically employ democratic decision-making models, where each member has an equal vote regardless of investment size, ensuring collective control aligned with shared values. Partnerships often rely on agreements specifying decision authority, which may prioritize partners based on capital contribution or expertise, allowing for more centralized or negotiated control. The cooperative structure fosters inclusive, consensus-driven decisions, while partnerships provide flexibility for customized governance tailored to specific business goals.

Profit Distribution: Shared Benefits and Liabilities

Cooperatives distribute profits based on member participation, ensuring equitable sharing of benefits and liabilities aligned with individual contributions, while partnerships allocate profits and losses according to predetermined ownership percentages or agreements among partners. In cooperatives, surplus earnings are often reinvested or returned as patronage dividends, reinforcing member control and mutual support. Partnerships face joint liability for debts, whereas cooperatives limit individual liability, protecting members financially beyond their investment.

Formation and Registration: Steps and Requirements

Cooperatives require a collective of at least five members coming together with a shared vision, followed by drafting bylaws and registering with the state's cooperative regulatory authority, often necessitating a feasibility study and member education. Partnerships form through an agreement between two or more individuals or entities, which may be written or oral, and must register the business name with local or state agencies, obtaining necessary licenses depending on the industry and jurisdiction. Both structures demand compliance with specific documentation, tax registrations, and adherence to local or state laws, but cooperatives typically face more stringent formation requirements due to their democratic governance and member-focused principles.

Taxation Differences: Cooperative vs Partnership

Cooperatives are generally taxed as pass-through entities where profits are returned to members who then report income on their personal tax returns, often benefiting from deductions on patronage dividends. Partnerships also operate as pass-through entities, but income, losses, and credits flow directly to partners based on their share, requiring detailed allocation on Schedule K-1 and individual tax returns. Unlike partnerships, cooperatives may receive specific tax advantages under Subchapter T of the Internal Revenue Code, reducing taxable income through patronage refund distributions.

Pros and Cons of Cooperatives

Cooperatives offer democratic control, limited liability, and profit distribution based on member participation, promoting community and shared benefits. However, they may face challenges like slower decision-making processes, limited access to capital, and potential conflicts among members due to diverse interests. Unlike partnerships, cooperatives emphasize collective ownership and equal voting rights, which can impact efficiency and scalability.

Pros and Cons of Partnerships

Partnerships offer the advantage of shared decision-making and resource pooling, which can lead to increased capital and diverse expertise, enhancing business growth potential. However, partnerships also carry the risk of unlimited liability for general partners, potential conflicts among partners, and profit-sharing that may reduce individual financial rewards. Unlike cooperatives, partnerships typically lack the democratic control and member benefit distribution that foster collective ownership and community focus.

Cooperative Infographic

libterm.com

libterm.com