Interpretation involves analyzing and assigning meaning to information, texts, or data to gain deeper understanding and insight. It requires critical thinking and context awareness to accurately convey the intended message or significance. Discover how mastering interpretation can enhance your comprehension and decision-making by reading the rest of this article.

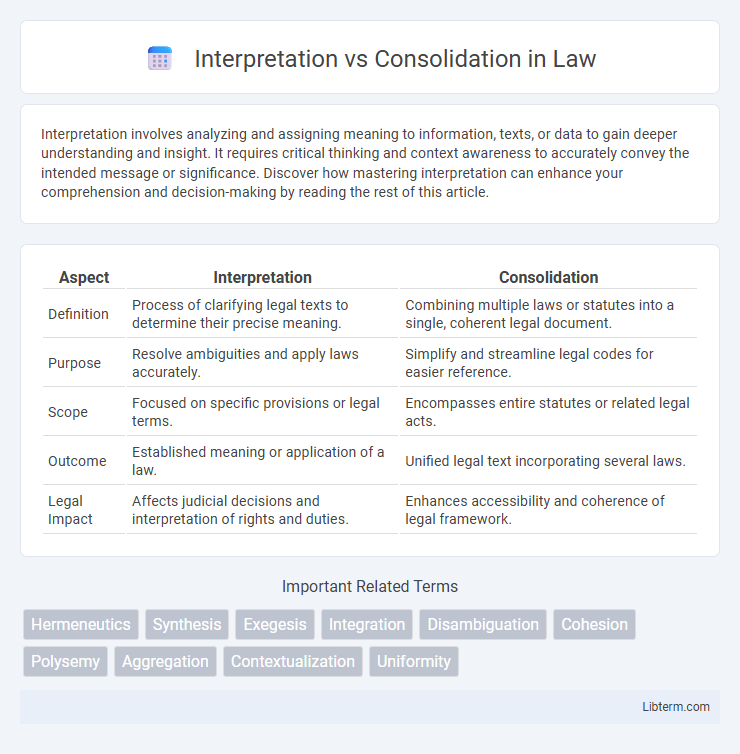

Table of Comparison

| Aspect | Interpretation | Consolidation |

|---|---|---|

| Definition | Process of clarifying legal texts to determine their precise meaning. | Combining multiple laws or statutes into a single, coherent legal document. |

| Purpose | Resolve ambiguities and apply laws accurately. | Simplify and streamline legal codes for easier reference. |

| Scope | Focused on specific provisions or legal terms. | Encompasses entire statutes or related legal acts. |

| Outcome | Established meaning or application of a law. | Unified legal text incorporating several laws. |

| Legal Impact | Affects judicial decisions and interpretation of rights and duties. | Enhances accessibility and coherence of legal framework. |

Understanding Interpretation and Consolidation

Understanding interpretation involves analyzing financial statements to extract meaningful insights about a company's performance, risk, and value, emphasizing ratios, trends, and comparative analysis. Consolidation refers to the process of combining financial data from multiple subsidiaries into a single set of financial statements, ensuring alignment with accounting standards like IFRS or GAAP. Mastery of both interpretation and consolidation aids stakeholders in evaluating overall corporate health and facilitating accurate financial reporting.

Key Differences Between Interpretation and Consolidation

Interpretation involves explaining the meaning of financial data or accounting principles, while consolidation refers to combining the financial statements of multiple entities into one comprehensive report. Key differences include that interpretation focuses on analysis and understanding, whereas consolidation emphasizes aggregation and eliminating intercompany transactions. Interpretation aids decision-making through insight, while consolidation ensures accurate representation of group financial performance.

Importance of Interpretation in Data Analysis

Interpretation in data analysis is crucial for transforming raw data into meaningful insights that drive informed decision-making and strategic planning. It allows analysts to identify patterns, trends, and correlations that consolidation alone cannot reveal, enabling a deeper understanding of complex datasets. Effective interpretation bridges the gap between aggregated data and actionable intelligence, ensuring that business objectives are met with precision.

The Role of Consolidation in Information Management

Consolidation plays a critical role in information management by integrating diverse data sources into a unified system, enabling more efficient access and analysis. It reduces data redundancy and enhances data quality, supporting accurate reporting and decision-making. Effective consolidation ensures that organizations maintain a single source of truth, streamlining workflows and improving overall operational efficiency.

Common Applications of Interpretation

Interpretation commonly applies in sectors such as legal, medical, and conference settings where real-time language translation is critical for effective communication. It facilitates instantaneous understanding between parties speaking different languages, ensuring seamless interaction at international meetings, courtrooms, and healthcare consultations. Unlike consolidation, which merges financial data for comprehensive reporting, interpretation focuses on verbal or sign language translation to bridge language barriers in diverse professional environments.

Use Cases for Consolidation in Practice

Consolidation is crucial in financial reporting for organizations managing multiple subsidiaries or business units, enabling the aggregation of financial statements into a single, unified report that reflects the overall economic condition. Use cases include multinational corporations needing to comply with regulatory requirements like IFRS or GAAP, streamlining performance analysis across divisions, and facilitating mergers and acquisitions by providing a clear financial overview. Consolidation also supports accurate intercompany transaction elimination, risk assessment, and strategic decision-making by delivering comprehensive, consolidated financial data.

Challenges in Interpreting Complex Data

Interpreting complex data involves challenges such as managing data heterogeneity, ensuring data quality, and overcoming cognitive biases that can skew analysis. Effective interpretation demands advanced analytical tools and domain expertise to accurately extract meaningful patterns from diverse datasets. Unlike consolidation, which combines data for unified reporting, interpretation requires contextual understanding to provide actionable insights from raw information.

Limitations of Consolidating Diverse Sources

Consolidation of diverse sources often encounters limitations due to variations in data formats, quality, and context, which can lead to loss of nuanced information during aggregation. Interpretation allows for deeper understanding by analyzing inconsistencies, cultural differences, and source-specific meanings that consolidation might overlook. Complex datasets demand interpretive approaches to uncover insights that a purely consolidated view cannot provide.

Best Practices for Balancing Interpretation and Consolidation

Effective financial reporting requires a balanced approach between interpretation and consolidation to ensure accuracy and clarity. Best practices involve integrating detailed financial analysis with consolidated data to provide comprehensive insights while maintaining compliance with accounting standards like IFRS or GAAP. Employing advanced software tools for automated consolidation and continuous cross-functional communication helps align interpretations with consolidated results, enhancing decision-making and stakeholder trust.

Future Trends in Interpretation vs Consolidation

Future trends in interpretation and consolidation highlight a growing reliance on artificial intelligence and machine learning to enhance accuracy and efficiency. Advances in cloud-based platforms enable real-time data integration, supporting dynamic consolidation processes and seamless interpretation across complex financial structures. Enhanced automation tools are expected to reduce manual errors, accelerate reporting cycles, and facilitate compliance with evolving regulatory standards.

Interpretation Infographic

libterm.com

libterm.com