The National Securities Markets Improvement Act (NSMIA) streamlines regulations by preempting state securities laws for certain securities, fostering a more efficient national market. This act reduces regulatory overlap and promotes capital formation by creating uniform federal standards while preserving investor protection. Explore the rest of the article to understand how NSMIA may impact your investments and compliance strategies.

Table of Comparison

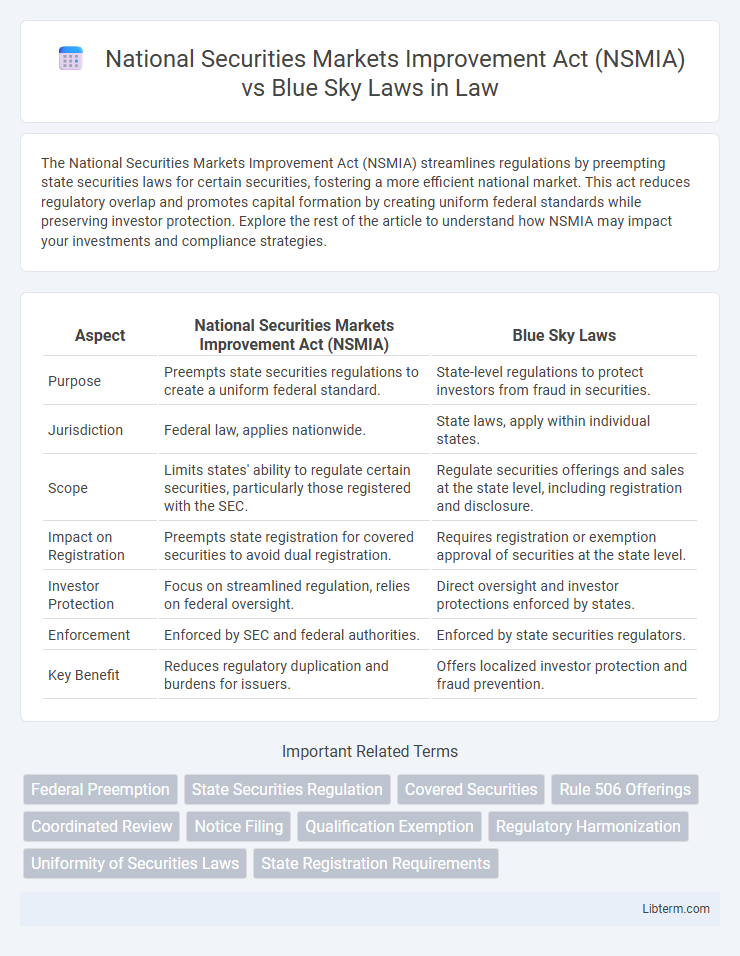

| Aspect | National Securities Markets Improvement Act (NSMIA) | Blue Sky Laws |

|---|---|---|

| Purpose | Preempts state securities regulations to create a uniform federal standard. | State-level regulations to protect investors from fraud in securities. |

| Jurisdiction | Federal law, applies nationwide. | State laws, apply within individual states. |

| Scope | Limits states' ability to regulate certain securities, particularly those registered with the SEC. | Regulate securities offerings and sales at the state level, including registration and disclosure. |

| Impact on Registration | Preempts state registration for covered securities to avoid dual registration. | Requires registration or exemption approval of securities at the state level. |

| Investor Protection | Focus on streamlined regulation, relies on federal oversight. | Direct oversight and investor protections enforced by states. |

| Enforcement | Enforced by SEC and federal authorities. | Enforced by state securities regulators. |

| Key Benefit | Reduces regulatory duplication and burdens for issuers. | Offers localized investor protection and fraud prevention. |

Introduction to NSMIA and Blue Sky Laws

The National Securities Markets Improvement Act (NSMIA) of 1996 established federal preemption over state securities regulations, streamlining securities offerings by reducing duplicative state registration requirements. Blue Sky Laws refer to state-level securities regulations designed to protect investors from fraud by requiring registration of securities, brokers, and investment advisors within each state. NSMIA limits the enforceability of Blue Sky Laws on certain securities by preempting state oversight to foster a more uniform national securities market.

Historical Background of Securities Regulation

The National Securities Markets Improvement Act (NSMIA) of 1996 was enacted to streamline federal and state securities regulations by preempting certain state Blue Sky Laws, which historically varied and posed compliance challenges for issuers. Blue Sky Laws, established in the early 20th century following securities fraud scandals, aimed to protect investors through state-level registration and disclosure requirements. NSMIA's historical significance lies in its role to modernize and harmonize securities regulation, enhancing capital formation while reducing regulatory fragmentation between federal and state jurisdictions.

Key Provisions of the National Securities Markets Improvement Act

The National Securities Markets Improvement Act (NSMIA) of 1996 preempts state Blue Sky Laws to create a streamlined, uniform regulatory framework for securities offerings by exempting certain securities from state registration and review. NSMIA establishes federal authority over national securities exchanges and investment advisers, reducing duplicative state registration requirements and promoting capital formation across state lines. Key provisions include federal preemption of state laws on covered securities, uniform standards for investment adviser registration, and enhanced protections for investors through federal oversight.

Overview of Blue Sky Laws and Their Purpose

Blue Sky Laws are state-level regulations designed to protect investors from securities fraud by requiring registration and disclosure for securities offerings within the state. These laws aim to ensure transparency, prevent deceptive practices, and promote investor confidence in local markets. While the National Securities Markets Improvement Act (NSMIA) preempts certain state regulations to streamline securities registration, Blue Sky Laws remain crucial for addressing fraud and investor protection at the state level.

Preemption of State Laws: NSMIA’s Impact

The National Securities Markets Improvement Act (NSMIA) of 1996 significantly preempted state Blue Sky Laws by establishing a federal framework for securities regulation, particularly for nationally traded securities. NSMIA preemption limits states from imposing duplicative or conflicting registration requirements on certain securities and investment advisers already registered with the SEC. This federal preemption enhances uniformity in securities regulation, reducing compliance burdens and promoting capital formation across state lines.

Registration Requirements: NSMIA vs Blue Sky Laws

The National Securities Markets Improvement Act (NSMIA) preempts state securities registration requirements for certain securities, particularly those registered with the SEC, streamlining the federal regulatory framework to avoid duplicative state filings. In contrast, Blue Sky Laws mandate state-level registration and disclosure for securities offerings, requiring issuers to comply with varied and often complex state-specific requirements. NSMIA's federal preemption ensures uniformity and reduces regulatory burdens for nationally traded securities, while Blue Sky Laws maintain state oversight for securities not covered by NSMIA, focusing on investor protection at the state level.

Exemptions and Limitations Under Both Regimes

The National Securities Markets Improvement Act (NSMIA) of 1996 preempts state Blue Sky laws by providing federal exemptions that reduce duplicative securities regulation, particularly for nationally traded securities and investment advisers managing over $100 million. Under NSMIA, certain securities are federally covered, limiting state regulation primarily to antifraud provisions, while Blue Sky laws still apply to non-exempt securities and smaller issuers not meeting NSMIA thresholds. This delineation creates a dual-layer framework where NSMIA streamlines market regulation federally, and Blue Sky laws offer residual protections at the state level, focusing mainly on intrastate offerings and sales.

Regulatory Authority: SEC vs State Securities Regulators

The National Securities Markets Improvement Act (NSMIA) centralizes regulatory authority under the Securities and Exchange Commission (SEC), preempting state securities regulations for certain securities to promote uniformity in the market. Blue Sky Laws, enforced by state securities regulators, retain authority over securities not covered by NSMIA, focusing on investor protection within individual states. This division creates a dual system where NSMIA streamlines federal oversight while Blue Sky Laws ensure localized regulatory control.

Benefits and Challenges of NSMIA Preemption

The National Securities Markets Improvement Act (NSMIA) preempts state Blue Sky Laws for certain securities, streamlining federal and state regulatory frameworks and reducing compliance costs for issuers operating across multiple states. This federal preemption benefits capital formation by creating a more uniform regulatory environment but challenges arise as states lose control over investor protections and enforcement tailored to local market conditions. The balance between enhanced market efficiency under NSMIA and the diminished role of state oversight highlights the ongoing tension in securities regulation.

Future Trends in Federal and State Securities Law

The National Securities Markets Improvement Act (NSMIA) preempts state Blue Sky Laws by streamlining federal regulatory oversight of securities offerings, promoting uniformity and reducing duplication in securities registration requirements. Future trends indicate continued federal expansion in regulating emerging investment products like cryptocurrencies, while states are likely to enhance investor protection through targeted regulations addressing technological advancements and fraud prevention. Harmonization efforts between federal and state laws are expected to increase, balancing efficient capital formation with robust investor safeguards in an evolving securities landscape.

National Securities Markets Improvement Act (NSMIA) Infographic

libterm.com

libterm.com