An indemnity clause is a contractual provision that shifts responsibility for certain damages or losses from one party to another, ensuring protection against potential liabilities. This clause commonly appears in commercial agreements to allocate risk and safeguard your interests in legal disputes. Explore the rest of the article to understand how an indemnity clause can impact your contracts and negotiations.

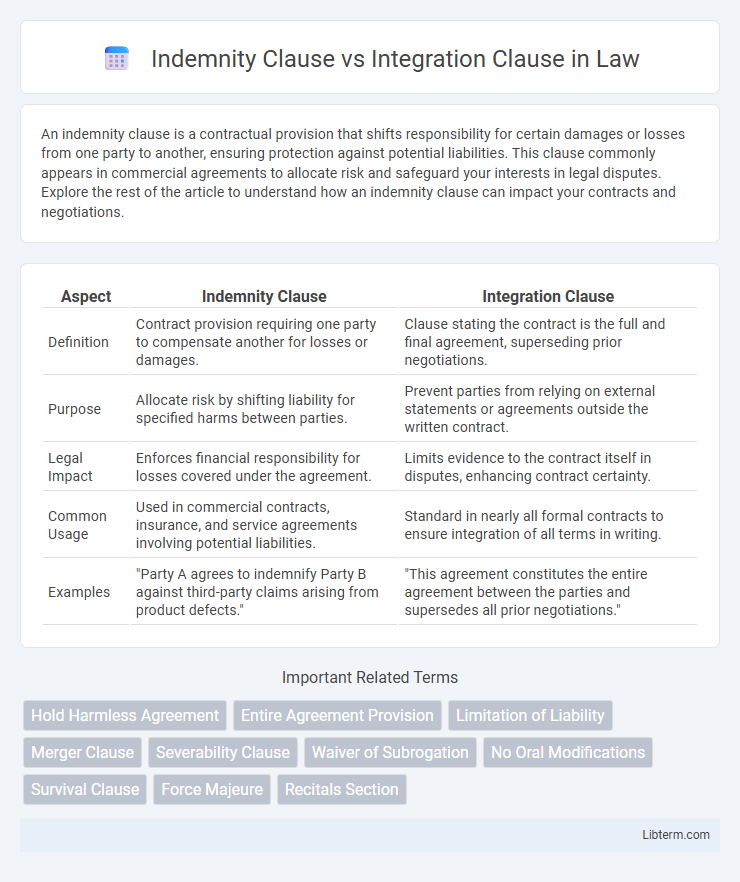

Table of Comparison

| Aspect | Indemnity Clause | Integration Clause |

|---|---|---|

| Definition | Contract provision requiring one party to compensate another for losses or damages. | Clause stating the contract is the full and final agreement, superseding prior negotiations. |

| Purpose | Allocate risk by shifting liability for specified harms between parties. | Prevent parties from relying on external statements or agreements outside the written contract. |

| Legal Impact | Enforces financial responsibility for losses covered under the agreement. | Limits evidence to the contract itself in disputes, enhancing contract certainty. |

| Common Usage | Used in commercial contracts, insurance, and service agreements involving potential liabilities. | Standard in nearly all formal contracts to ensure integration of all terms in writing. |

| Examples | "Party A agrees to indemnify Party B against third-party claims arising from product defects." | "This agreement constitutes the entire agreement between the parties and supersedes all prior negotiations." |

Understanding Indemnity Clauses

Indemnity clauses allocate risk by requiring one party to compensate the other for specific damages or losses, ensuring financial protection during contractual disputes or unforeseen events. These clauses clearly define the scope of indemnification, including covered liabilities, timeframes, and any limitations to prevent ambiguity in enforcement. Understanding indemnity clauses is critical for mitigating potential legal exposure and negotiating balanced contract terms.

Defining Integration Clauses

Integration clauses, often called entire agreement clauses, define the contract as the complete and final agreement between parties, preventing prior negotiations or agreements from influencing contract interpretation. These clauses ensure that only the written document and any explicitly referenced attachments govern the parties' obligations, reducing ambiguity and disputes over external statements. Indemnity clauses, by contrast, allocate risk by requiring one party to compensate the other for certain damages or losses, operating independently within the framework established by the integration clause.

Key Differences Between Indemnity and Integration Clauses

Indemnity clauses allocate financial responsibility by requiring one party to compensate the other for specified losses or damages, often covering third-party claims and liabilities. Integration clauses, also known as merger clauses, establish that the contract represents the entire agreement between the parties, superseding all prior negotiations and external communications. The key difference lies in indemnity clauses addressing risk allocation and loss compensation, whereas integration clauses focus on contractual completeness and enforceability.

Purpose and Function of Indemnity Clauses

Indemnity clauses serve to allocate risk by requiring one party to compensate the other for specific losses or damages, protecting against potential liabilities arising from contractual breaches or third-party claims. Integration clauses, in contrast, affirm that the written contract represents the entire agreement between parties, preventing reliance on prior negotiations or external statements. The primary function of indemnity clauses is to provide financial security and legal protection by clearly defining responsibility for certain risks, thereby minimizing disputes related to unforeseen liabilities.

Role and Importance of Integration Clauses

Integration clauses establish the complete and exclusive agreement between parties, preventing any prior or external statements from altering contractual obligations; this ensures legal clarity and reduces disputes. Indemnity clauses allocate risk by requiring one party to compensate the other for certain damages or losses, playing a critical role in risk management. The integration clause's importance lies in safeguarding the contract's integrity, ensuring all indemnity provisions are enforceable as written without interference from outside agreements.

Legal Implications of Indemnity vs Integration Clauses

Indemnity clauses allocate financial responsibility for damages or losses between parties, often protecting one party from liabilities arising from breaches or third-party claims, thereby influencing risk management strategies in contracts. Integration clauses, also known as entire agreement clauses, legally establish that the written contract constitutes the complete and exclusive agreement, preventing parties from relying on prior negotiations or external agreements, which limits evidence in contract disputes. Understanding the legal implications of indemnity versus integration clauses is crucial for enforcing liability protections and ensuring clarity of contractual obligations during litigation.

Common Scenarios Involving Indemnity Clauses

Indemnity clauses are frequently included in contracts for construction projects, professional services, and product sales to allocate risk and protect parties from potential losses due to third-party claims. Common scenarios involve one party agreeing to indemnify and hold harmless the other for damages arising from negligence, breaches, or intellectual property infringement. Integration clauses, on the other hand, confirm that the written contract represents the entire agreement, preventing parties from relying on prior oral or written statements unrelated to indemnity or other terms.

Typical Uses for Integration Clauses in Contracts

Integration clauses are typically used in contracts to establish that the written agreement represents the complete and final understanding between the parties, preventing any prior or contemporaneous agreements from altering its terms. These clauses help avoid disputes by ensuring that all obligations, rights, and liabilities are confined to the contract itself, excluding external statements or negotiations. Commonly found in commercial, real estate, and employment contracts, integration clauses provide legal certainty and reduce the risk of contradictory claims.

Drafting Best Practices for Indemnity and Integration Clauses

Drafting indemnity clauses requires precise language to clearly define the scope, responsibilities, and limitations of indemnification, minimizing potential disputes and ensuring enforceability under applicable law. Integration clauses should explicitly state that the written agreement constitutes the entire contract, superseding prior negotiations or agreements, to prevent extrinsic evidence from altering contractual obligations. Combining explicit, unambiguous terms with consistent formatting and alignment with jurisdictional requirements enhances clarity and reduces litigation risks in both indemnity and integration clauses.

Choosing the Right Clause for Your Contract

Choosing the right clause for your contract depends on the specific risk allocation and protection needs of your agreement. An indemnity clause assigns financial responsibility for losses or damages, ensuring one party compensates the other for defined liabilities, while an integration clause (or merger clause) confirms that the written contract represents the entire agreement, preventing prior statements or agreements from altering its terms. Careful evaluation of contractual risks and enforcement goals helps determine whether an indemnity clause's liability coverage or an integration clause's clarity and finality is more appropriate for your legal protection.

Indemnity Clause Infographic

libterm.com

libterm.com