Strict liability holds parties accountable for damages or injuries caused by their actions or products, regardless of intent or negligence. This legal principle is especially significant in cases involving inherently dangerous activities or defective products, ensuring victims receive compensation without the burden of proving fault. Discover how strict liability may impact your legal rights and responsibilities by reading the rest of this article.

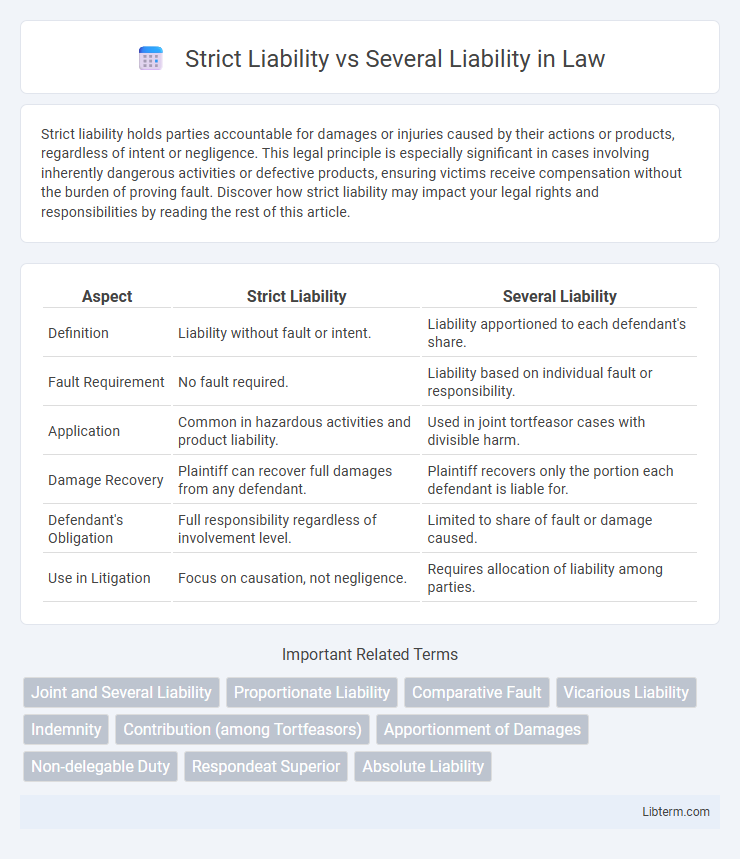

Table of Comparison

| Aspect | Strict Liability | Several Liability |

|---|---|---|

| Definition | Liability without fault or intent. | Liability apportioned to each defendant's share. |

| Fault Requirement | No fault required. | Liability based on individual fault or responsibility. |

| Application | Common in hazardous activities and product liability. | Used in joint tortfeasor cases with divisible harm. |

| Damage Recovery | Plaintiff can recover full damages from any defendant. | Plaintiff recovers only the portion each defendant is liable for. |

| Defendant's Obligation | Full responsibility regardless of involvement level. | Limited to share of fault or damage caused. |

| Use in Litigation | Focus on causation, not negligence. | Requires allocation of liability among parties. |

Introduction to Liability Concepts

Strict liability imposes responsibility on a party regardless of fault or intent, primarily in cases involving inherently hazardous activities or defective products. Several liability allocates financial responsibility among parties proportionate to their individual share of fault or involvement in causing harm. Understanding these liability frameworks is crucial for assessing legal obligations and potential damages in tort and contract law cases.

Definition of Strict Liability

Strict liability refers to a legal doctrine holding a party responsible for damages or injuries caused by their actions or products regardless of fault or intent. Unlike several liability, which assigns financial responsibility proportionate to each defendant's degree of fault, strict liability imposes accountability even if all reasonable precautions were taken. This principle commonly applies in cases involving inherently hazardous activities or defective product liability.

Definition of Several Liability

Several liability refers to a legal concept where each defendant is responsible only for their specific portion of the damages or debt, rather than the entire amount owed. Unlike strict liability, which imposes responsibility regardless of fault, several liability limits financial responsibility to the defendant's individual share. This distinction plays a critical role in tort cases and contractual disputes where multiple parties are involved.

Key Differences between Strict and Several Liability

Strict liability holds a party responsible for damages regardless of fault or intent, often applied in cases involving inherently dangerous activities or defective products. Several liability assigns responsibility proportionally to each defendant based on their specific share of fault in causing harm. The key difference lies in strict liability's focus on faultless accountability versus several liability's emphasis on dividing damages according to individual negligence.

Legal Scenarios Involving Strict Liability

Strict liability applies in legal scenarios where a party is held responsible for damages without the need to prove negligence or fault, such as in cases involving abnormally dangerous activities or defective products. Several liability, in contrast, assigns each defendant responsibility only for their proportional share of the total damages. In strict liability cases, the injured party benefits from a simplified burden of proof, particularly in toxic torts, animal attacks, and ultrahazardous material disputes.

Legal Scenarios Involving Several Liability

In legal scenarios involving several liability, each defendant is responsible only for their respective share of the damages, allowing for distributed financial accountability based on individual fault or contribution to the harm. This contrasts with strict liability cases, where responsibility is assigned irrespective of fault, often applied in inherently dangerous activities or defective product claims. Understanding the nuances between strict and several liability is crucial for determining the extent of each party's legal and financial obligations in multi-defendant lawsuits.

Advantages and Disadvantages of Each Liability Type

Strict liability ensures accountability without proving fault, simplifying plaintiff recovery in cases like product defects or hazardous activities, but it may burden defendants unfairly by holding them liable regardless of negligence. Several liability limits a defendant's financial responsibility to their proportionate share of fault, promoting fairness and preventing excessive loss allocation; however, it can complicate litigation by requiring detailed fault assessments and may leave plaintiffs undercompensated if some defendants are insolvent. Both liability types impact risk management strategies, influencing insurance policies and litigation costs for businesses and individuals involved in tort claims.

Case Studies Illustrating Strict vs. Several Liability

Case studies such as the landmark Sindell v. Abbott Laboratories illustrate strict liability by holding manufacturers liable for a plaintiff's injury without proving negligence, emphasizing the protection of consumers from defective products. In contrast, the case of Summers v. Tice exemplifies several liability, where multiple defendants are held liable only for their individual share of harm, allocating fault proportionally among parties. These cases highlight the practical application of strict liability in product defects and several liability in apportioning damages in multi-defendant tort claims.

Impact on Plaintiffs and Defendants

Strict liability holds defendants fully responsible for damages regardless of fault, providing plaintiffs with a straightforward path to recovery, especially in product liability and abnormally dangerous activities. Several liability limits each defendant's financial responsibility to their proportionate share of fault, potentially reducing the amount recoverable by plaintiffs but protecting defendants from absorbing excessive costs. This distinction significantly influences litigation strategies, settlement negotiations, and the ultimate distribution of financial burdens among multiple defendants and injured parties.

Conclusion: Choosing the Appropriate Liability Framework

Choosing the appropriate liability framework depends on the case specifics and desired fairness in damage allocation. Strict liability ensures accountability regardless of fault, often used in hazardous activities, while several liability limits each party's responsibility to their proportionate fault, promoting equitable compensation but potentially leaving plaintiffs partially unpaid. Legal practitioners must assess factors such as risk levels, the number of defendants, and public policy to decide between strict and several liability for optimal justice outcomes.

Strict Liability Infographic

libterm.com

libterm.com