An executor is a person appointed to administer the estate of a deceased individual, ensuring that assets are distributed according to the will and debts are settled. Understanding the executor's duties and legal responsibilities can protect your interests and prevent probate delays. Discover everything you need to know about the role of an executor in the following article.

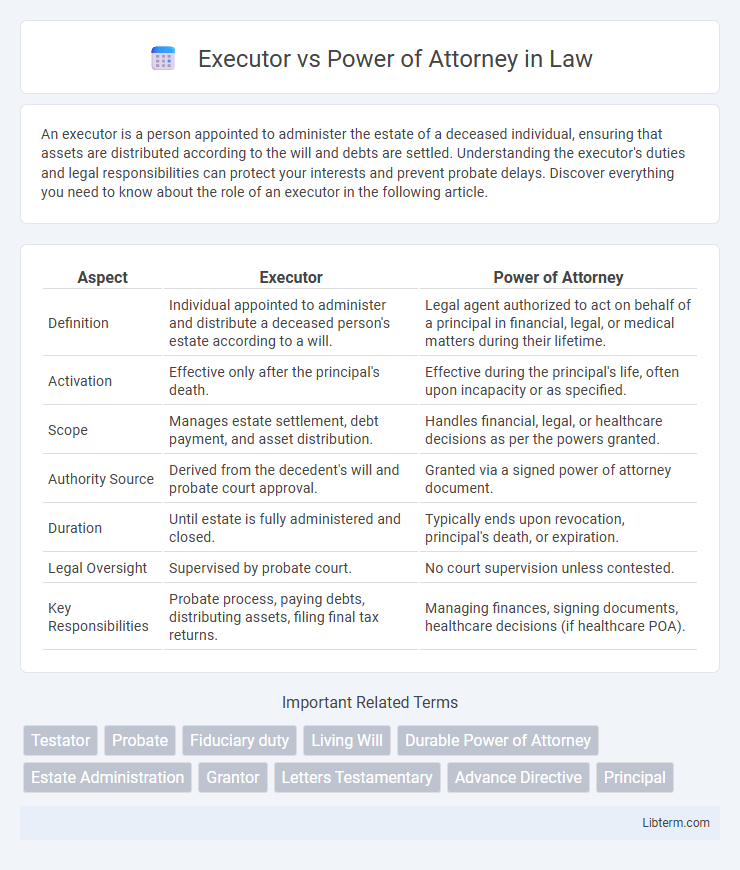

Table of Comparison

| Aspect | Executor | Power of Attorney |

|---|---|---|

| Definition | Individual appointed to administer and distribute a deceased person's estate according to a will. | Legal agent authorized to act on behalf of a principal in financial, legal, or medical matters during their lifetime. |

| Activation | Effective only after the principal's death. | Effective during the principal's life, often upon incapacity or as specified. |

| Scope | Manages estate settlement, debt payment, and asset distribution. | Handles financial, legal, or healthcare decisions as per the powers granted. |

| Authority Source | Derived from the decedent's will and probate court approval. | Granted via a signed power of attorney document. |

| Duration | Until estate is fully administered and closed. | Typically ends upon revocation, principal's death, or expiration. |

| Legal Oversight | Supervised by probate court. | No court supervision unless contested. |

| Key Responsibilities | Probate process, paying debts, distributing assets, filing final tax returns. | Managing finances, signing documents, healthcare decisions (if healthcare POA). |

Understanding the Roles: Executor vs Power of Attorney

An executor is a legally appointed individual responsible for managing and distributing a deceased person's estate according to their will, while a power of attorney grants a designated person authority to make financial or medical decisions on behalf of someone still living. Executors act after death, overseeing probate and ensuring debts and taxes are paid, whereas power of attorney agents operate during the principal's lifetime, often in cases of incapacity. Understanding the distinction between these roles is crucial for effective estate planning and safeguarding personal interests.

Key Legal Definitions and Distinctions

An executor is a person appointed in a will to manage and distribute the deceased's estate according to the will's terms, holding authority only after death. A power of attorney (POA) is a legal document granting an individual the authority to act on another's behalf during their lifetime, often for financial or medical decisions. Key distinctions include the executor's post-mortem role versus the POA agent's authority limited to the grantor's lifetime, with the POA becoming void upon death.

When Is an Executor Appointed?

An executor is appointed when a person creates a valid will and designates an individual to manage their estate after death. This appointment becomes effective only upon the testator's passing, allowing the executor to probate the will, settle debts, and distribute assets according to the deceased's wishes. Unlike a power of attorney, which grants authority during the principal's lifetime, an executor's authority arises solely post-mortem.

The Scope of Power of Attorney

The scope of Power of Attorney (POA) defines the legal authority granted to an agent to act on behalf of the principal in specific or broad matters, ranging from financial decisions to healthcare directives. Unlike an executor who is appointed through a will to manage and distribute the deceased's estate, a Power of Attorney is effective during the principal's lifetime and can be tailored to include limited or general powers. Understanding the precise powers delineated in the POA document is crucial for ensuring appropriate and lawful actions by the agent.

Duties and Responsibilities: Executor’s Role

The executor manages the deceased's estate by collecting assets, paying debts, and distributing property according to the will. They must file probate court documents, handle tax filings, and ensure all legal obligations are met. Executor responsibilities require fiduciary duty, demanding transparency, accuracy, and adherence to state laws throughout the estate administration process.

Authority and Limitations of Power of Attorney

Power of attorney grants an appointed agent the authority to make decisions on behalf of the principal, including financial, legal, or healthcare matters, depending on the scope defined in the document. Limitations of power of attorney include its revocability by the principal at any time, and it typically terminates upon the principal's death or incapacitation unless specified as durable. Unlike an executor who manages estate distribution post-mortem through probate, a power of attorney's authority ends before the principal's death and does not authorize control over estate assets after death.

When Does Each Role End?

The role of an executor ends once the probate process is complete and all estate assets are distributed according to the will or state law. A power of attorney terminates upon the principal's death, revocation, or incapacity, unless a durable power of attorney specifies otherwise. Executors handle post-mortem estate administration, while powers of attorney enable decision-making during the principal's lifetime.

Choosing the Right Person for Each Role

Selecting the right executor involves choosing an individual with strong organizational skills and trustworthiness to manage estate distribution according to a will. A power of attorney requires a person capable of making financial or medical decisions under pressure, often needing prompt judgment and understanding of legal responsibilities. Matching each role to a person whose strengths align with the duties ensures efficient estate management and protection of the principal's interests.

Legal Implications and Common Mistakes

Executors hold legal authority to administer and settle a deceased person's estate, following probate court directives, while powers of attorney grant agents authority to make decisions on behalf of a living person, limited by the scope and duration stipulated in the document. Common legal mistakes include confusing these roles, leading to unauthorized actions, and failing to update or revoke powers of attorney, which can cause disputes or financial loss. Clear distinctions between executor duties and power of attorney authority are critical to avoid probate delays, contested estates, and potential liability issues.

Executor vs Power of Attorney: Frequently Asked Questions

Executors are legally appointed to administer a deceased person's estate, while a Power of Attorney grants someone authority to act on behalf of another during their lifetime. An Executor's duties begin only after death and involve distributing assets according to the will, whereas a Power of Attorney's authority ceases at death. Common questions focus on the distinctions in responsibilities, timing, and legal powers between these roles in estate and financial management.

Executor Infographic

libterm.com

libterm.com