Set-off allows creditors to reduce the amount owed by deducting any debts the creditor owes to the debtor, streamlining financial settlements and minimizing outstanding balances. This legal mechanism is commonly used in contracts and insolvency proceedings to ensure fair treatment of mutual debts. Explore the article to understand how set-off can impact your financial transactions and legal rights.

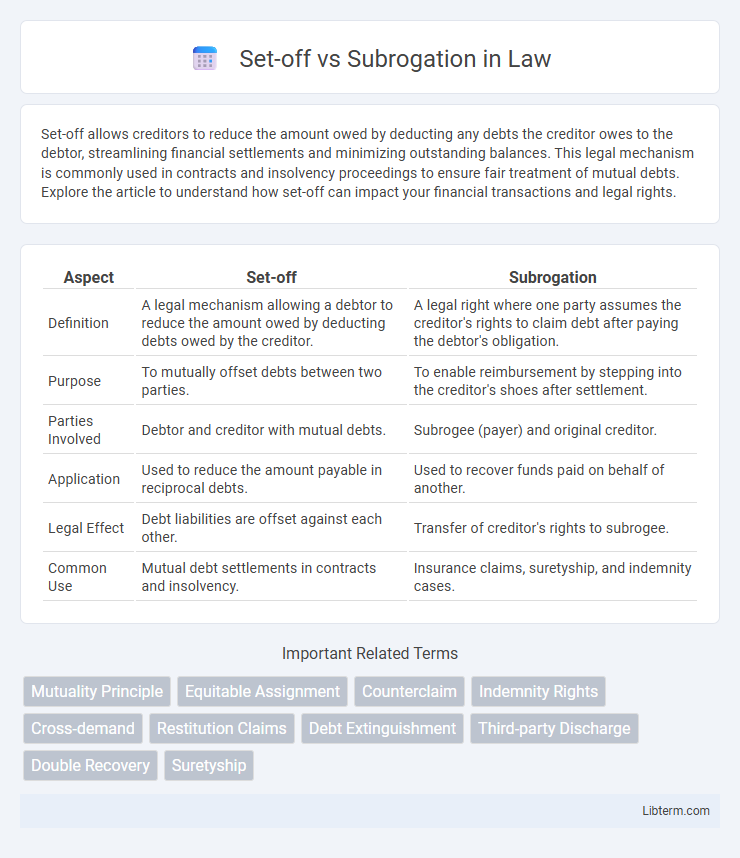

Table of Comparison

| Aspect | Set-off | Subrogation |

|---|---|---|

| Definition | A legal mechanism allowing a debtor to reduce the amount owed by deducting debts owed by the creditor. | A legal right where one party assumes the creditor's rights to claim debt after paying the debtor's obligation. |

| Purpose | To mutually offset debts between two parties. | To enable reimbursement by stepping into the creditor's shoes after settlement. |

| Parties Involved | Debtor and creditor with mutual debts. | Subrogee (payer) and original creditor. |

| Application | Used to reduce the amount payable in reciprocal debts. | Used to recover funds paid on behalf of another. |

| Legal Effect | Debt liabilities are offset against each other. | Transfer of creditor's rights to subrogee. |

| Common Use | Mutual debt settlements in contracts and insolvency. | Insurance claims, suretyship, and indemnity cases. |

Introduction to Set-off and Subrogation

Set-off is a legal mechanism allowing parties to balance mutual debts, reducing the amount owed between them to the net difference. Subrogation involves one party stepping into the shoes of another to enforce a claim or right, typically after settling a debt or obligation on behalf of the original party. Both doctrines play crucial roles in financial and legal transactions by enabling efficient debt recovery and creditor protection.

Defining Set-off in Legal Contexts

Set-off in legal contexts refers to the right of a debtor to reduce the amount of a debt by any sum the creditor owes them, effectively balancing mutual obligations between parties in a single transaction or related contracts. This principle prevents unjust enrichment and streamlines dispute resolution by offsetting debts without separate lawsuits. Legal statutes and case law often govern the precise application and limitations of set-off, ensuring fairness and efficiency in debt settlements.

Understanding Subrogation and Its Applications

Subrogation is a legal mechanism allowing an insurer to step into the shoes of the insured to recover costs from a third party responsible for a loss. It enables insurers to reclaim claim payments by pursuing reimbursement from at-fault parties, thereby preventing unjust enrichment. This process is common in insurance claims, particularly in property, health, and automobile insurance, facilitating cost recovery and maintaining fairness in liability distribution.

Key Differences Between Set-off and Subrogation

Set-off allows a debtor to reduce the amount owed to a creditor by any sum the creditor owes the debtor under a separate claim, directly balancing mutual debts. Subrogation involves one party stepping into the legal shoes of another to enforce third-party claims, typically after paying a debt owed by that party. Key differences include the nature of relationships, where set-off deals with mutual obligations between the same parties, while subrogation permits claim enforcement against a third party.

Legal Requirements for Set-off

Legal requirements for set-off typically include the existence of mutual debts between the parties and the enforceability of the claims at the time set-off is invoked. The claims must be liquidated or capable of being liquidated, and both debts should be due and payable to permit lawful set-off. Courts often require that the parties have reciprocal obligations arising from the same legal relationship or transaction to prevent unjust enrichment and ensure procedural fairness.

Essential Conditions for Subrogation

Essential conditions for subrogation include the existence of a valid debt or obligation between the original parties, where one party discharges the obligation on behalf of another, thereby acquiring the right to enforce the creditor's rights against the debtor. The subrogee must have made a payment or fulfilled a liability in good faith, without any fraud or collusion, and the subrogation must be expressly or impliedly agreed upon by the parties involved. Unlike set-off, which involves mutual debts between the same parties, subrogation transfers the creditor's rights to a third party who pays the debt.

Practical Examples of Set-off

Set-off occurs when a debtor reduces the amount owed to a creditor by any sum the creditor owes the debtor, such as a tenant deducting unpaid utility charges from rent payments. For example, if a supplier owes a company for returned defective goods, the company may deduct that amount from payments due on outstanding invoices. This practical mechanism helps streamline financial settlements without requiring separate transactions or litigation.

Common Scenarios Involving Subrogation

Subrogation commonly arises in insurance claims where an insurer seeks reimbursement from a third party responsible for the insured's loss, such as in auto accidents or property damage cases. It also occurs in creditor-debtor relationships when a guarantor pays off a debt and gains the right to pursue the original debtor for reimbursement. These situations highlight how subrogation enables recovery of costs by stepping into the rights of the party initially compensated.

Impact of Set-off and Subrogation in Debt Recovery

Set-off enables a debtor to reduce the amount owed by asserting mutual debts, expediting debt recovery while minimizing litigation costs and improving cash flow management. Subrogation allows a party who has paid a debt on behalf of another to step into the creditor's shoes, facilitating the recovery of amounts paid and protecting the party's financial interests. Both mechanisms enhance creditor rights and provide efficient solutions in insolvency and debt enforcement scenarios.

Conclusion: Choosing Between Set-off and Subrogation

Choosing between set-off and subrogation depends on the nature of the debt and the legal relationship between parties. Set-off is preferable when mutual debts exist between the same parties, allowing for netting amounts owed, while subrogation applies when a third party satisfies a debt and seeks to step into the creditor's rights. Selecting the appropriate remedy ensures effective debt resolution by aligning with the specific circumstances of liability and payment.

Set-off Infographic

libterm.com

libterm.com