A principal debtor is the primary party responsible for repaying a debt or fulfilling a financial obligation. Understanding your role as the principal debtor clarifies legal responsibilities and potential liabilities involved in loan agreements. Explore the rest of the article to learn more about your duties and protections as a principal debtor.

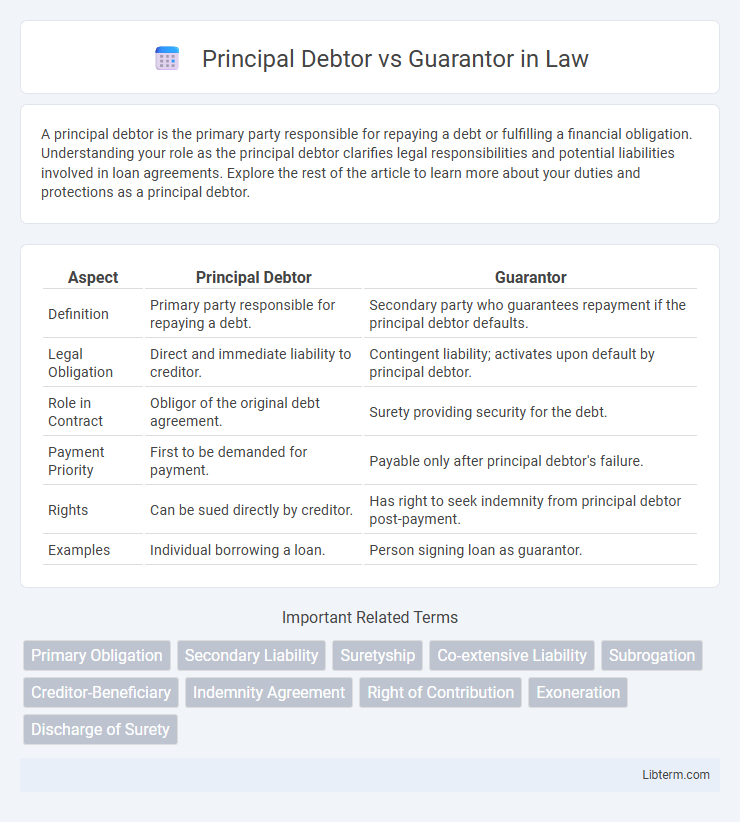

Table of Comparison

| Aspect | Principal Debtor | Guarantor |

|---|---|---|

| Definition | Primary party responsible for repaying a debt. | Secondary party who guarantees repayment if the principal debtor defaults. |

| Legal Obligation | Direct and immediate liability to creditor. | Contingent liability; activates upon default by principal debtor. |

| Role in Contract | Obligor of the original debt agreement. | Surety providing security for the debt. |

| Payment Priority | First to be demanded for payment. | Payable only after principal debtor's failure. |

| Rights | Can be sued directly by creditor. | Has right to seek indemnity from principal debtor post-payment. |

| Examples | Individual borrowing a loan. | Person signing loan as guarantor. |

Understanding the Roles: Principal Debtor vs Guarantor

The principal debtor is the primary party responsible for repaying a debt and fulfilling contractual obligations directly with the creditor. The guarantor, in contrast, provides a secondary assurance by agreeing to pay the debt only if the principal debtor defaults, acting as a backup source of repayment. Distinguishing these roles is crucial in credit agreements to understand liability and risk allocation between the parties involved.

Legal Definitions of Principal Debtor and Guarantor

The principal debtor is the primary party legally obligated to fulfill a debt or contractual obligation under the terms of the agreement. A guarantor, by contrast, is a secondary party who promises to satisfy the debt or obligation if the principal debtor defaults, creating a contingent liability. Legal definitions emphasize the principal debtor's primary liability, while the guarantor holds a secondary, supportive role enforceable only upon default by the principal debtor.

Core Responsibilities of a Principal Debtor

The principal debtor holds the primary obligation to repay the debt or fulfill the contractual terms directly with the creditor, ensuring timely payment and adherence to agreed conditions. They are legally responsible for the entire debt amount, with their creditworthiness and financial stability crucial to the creditor's risk assessment. The guarantor only assumes responsibility if the principal debtor defaults, making the principal debtor's role central in managing and executing debt repayment.

Key Obligations of a Guarantor

A guarantor's key obligations include assuming responsibility for the debt if the principal debtor defaults, ensuring timely payment to the creditor, and adhering to the terms stipulated in the guarantee agreement. Unlike the principal debtor, the guarantor's liability is secondary and contingent upon the principal debtor's failure to fulfill their obligations. Guarantors must also provide collateral or security if required, and they have the right to seek reimbursement from the principal debtor after settling the debt.

Differences in Liability: Principal Debtor vs Guarantor

The principal debtor holds primary liability for repaying the debt directly to the creditor, while the guarantor's liability is secondary and activates only if the principal debtor defaults. The guarantor serves as a backup assurance, ensuring the creditor recovers the loan amount in case of non-payment by the principal debtor. Unlike the principal debtor, the guarantor cannot be pursued for repayment until the creditor has exhausted all remedies against the principal debtor.

Rights and Protections for Guarantors

Guarantors possess key rights that protect them from undue liability, including the right to be informed about the principal debtor's default and the right to demand a copy of the underlying debt agreement. Legal protections ensure guarantors cannot be held liable for amounts exceeding the agreed-upon guarantee unless explicitly stated in the contract. Courts may offer relief to guarantors in cases of misrepresentation, coercion, or when the creditor fails to take reasonable steps to recover from the principal debtor first.

Legal Enforcement Against Principal Debtors and Guarantors

Legal enforcement against principal debtors involves direct claims for repayment of the debt, with the creditor having the right to seize assets and initiate bankruptcy proceedings if the debtor defaults. Guarantors face enforcement only after the principal debtor's default, where the creditor must first pursue the principal before holding the guarantor liable under the guarantee agreement. Courts typically require clear evidence of the guarantee and proper notice to the guarantor before enforcement actions can proceed against them.

Termination of Liability: How Obligations End

The principal debtor's liability terminates when the debt is fully repaid or legally discharged, releasing them from further obligations. The guarantor's liability ends only after the principal debtor fails to fulfill the obligation and the guarantor satisfies the creditor or the guarantee contract is lawfully terminated. Courts typically require clear evidence of debt settlement or formal release to confirm the end of a guarantor's responsibility.

Common Scenarios: Principal Debtor and Guarantor in Practice

In common scenarios, the principal debtor is the primary party responsible for repaying a loan or fulfilling a contractual obligation, whereas the guarantor provides a secondary assurance to creditors by promising to pay if the principal debtor defaults. Banks often require guarantors in personal loans or business credit to mitigate risks associated with borrower insolvency. In practice, guarantors serve as a financial safety net, enabling borrowers with limited credit history to access funds while protecting lenders from potential losses.

Frequently Asked Questions: Principal Debtor vs Guarantor

The principal debtor is the primary party responsible for repaying a loan or debt, whereas the guarantor agrees to fulfill the obligation only if the principal debtor defaults. Frequently asked questions often clarify that the guarantor's liability is secondary and contingent, and they are legally obligated to pay only after the lender exhausts all means to recover from the principal debtor. Understanding this distinction helps in assessing credit risk and the legal implications of debt agreements.

Principal Debtor Infographic

libterm.com

libterm.com