A trustee manages assets or property on behalf of beneficiaries according to a trust agreement, ensuring legal and financial responsibilities are met with fiduciary duty and transparency. Effective trusteeship requires understanding legal obligations, financial management, and communication skills to protect the interests of all parties involved. Explore the full article to learn how your role as a trustee can impact trust administration and beneficiary outcomes.

Table of Comparison

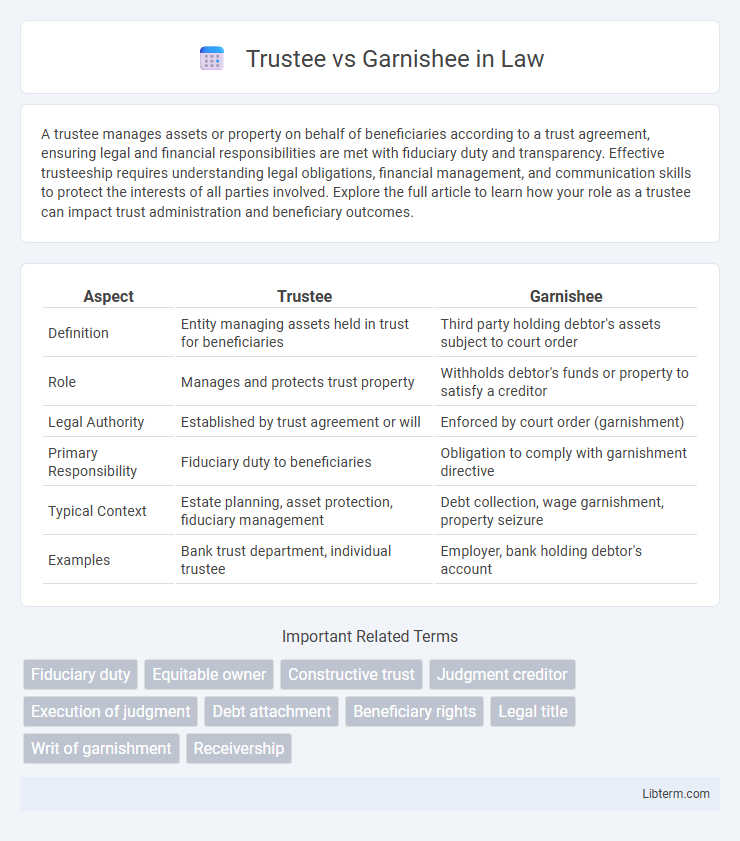

| Aspect | Trustee | Garnishee |

|---|---|---|

| Definition | Entity managing assets held in trust for beneficiaries | Third party holding debtor's assets subject to court order |

| Role | Manages and protects trust property | Withholds debtor's funds or property to satisfy a creditor |

| Legal Authority | Established by trust agreement or will | Enforced by court order (garnishment) |

| Primary Responsibility | Fiduciary duty to beneficiaries | Obligation to comply with garnishment directive |

| Typical Context | Estate planning, asset protection, fiduciary management | Debt collection, wage garnishment, property seizure |

| Examples | Bank trust department, individual trustee | Employer, bank holding debtor's account |

Understanding the Roles: Trustee vs Garnishee

A trustee manages and holds assets on behalf of beneficiaries under a trust agreement, maintaining fiduciary duties and ensuring proper administration of the trust. A garnishee is a third party, often an employer or financial institution, legally obligated to withhold funds from a debtor's account or wages to satisfy a creditor's judgment. Understanding these distinct roles highlights the trustee's responsibility for asset management and the garnishee's function in enforcing debt collection through court orders.

Legal Definitions of Trustee and Garnishee

A trustee is a legal entity or individual appointed to manage assets or property on behalf of a beneficiary, holding fiduciary duties to act in the beneficiary's best interest according to the terms of a trust agreement. A garnishee, on the other hand, is a third party, often an employer or bank, ordered by a court to withhold funds or assets from a debtor's account or wages to satisfy a creditor's judgment. The trustee's role involves asset management and protection, while the garnishee's role is to execute a court-mandated withholding to fulfill debt obligations.

Key Differences Between Trustees and Garnishees

Trustees manage assets or property held in a trust for beneficiaries, exercising fiduciary duties and decision-making authority to protect and distribute these assets according to the trust's terms. Garnishees, by contrast, are third parties, such as employers or banks, legally compelled to withhold a portion of a debtor's wages or funds to satisfy a creditor's claim under a court order. While trustees have control over trust property and a duty of loyalty and care, garnishees act as neutral parties with no ownership interest, merely executing a court-mandated financial obligation.

Functions and Responsibilities of a Trustee

A trustee manages and protects assets on behalf of beneficiaries, ensuring fiduciary duties are upheld by prudently investing and distributing trust property according to the trust document. Trustees maintain accurate records, file necessary tax returns, and communicate regularly with beneficiaries to provide transparency. Unlike a garnishee, who is a third party compelled to withhold and remit funds, a trustee actively administers the trust with discretionary control over trust assets.

Duties and Obligations of a Garnishee

A garnishee is legally obligated to withhold funds or property belonging to a debtor upon receiving a court order or writ of garnishment, ensuring these assets are preserved for creditor claims. The duties of a garnishee include promptly notifying the debtor of the garnishment, accurately accounting for the withheld amounts, and remitting the funds to the court or creditor within the specified timeframe. Failure to comply with these obligations can result in legal liability for the garnishee, including contempt of court or damages for improper withholding or failure to disclose assets.

When Is a Trustee Appointed?

A trustee is appointed when a court oversees the administration of a trust or bankruptcy estate, ensuring assets are managed according to legal or fiduciary obligations. In bankruptcy cases, trustees are assigned immediately after a petition is filed to protect creditors' interests and distribute assets fairly. Their appointment differs from garnishees, who are third parties ordered to withhold funds owed to debtors.

Situations Involving a Garnishee Order

A garnishee order involves a court directing a third party, often an employer or bank, to withhold funds or property owed to a debtor to satisfy a creditor's claim. Unlike a trustee who manages assets in bankruptcy or trust administration, a garnishee temporarily holds assets for repayment purposes without ownership rights. Garnishee orders frequently arise in wage garnishment cases or bank account levies where immediate debt recovery is necessary.

Legal Processes Involving Trustees and Garnishees

Trustees manage assets held in trust and are legally obligated to distribute them according to the trust agreement, while garnishees are third parties who hold assets or wages of a debtor subject to court-ordered garnishment. Legal processes involving trustees often include fiduciary duties under trust law and court supervision to ensure proper administration, whereas garnishee processes involve issuance of a garnishment order or writ by a creditor to intercept funds owed to the debtor. Courts enforce these processes differently, with trustees liable for breach of trust and garnishees liable for noncompliance with garnishment directives under applicable state or federal laws.

Trustee vs Garnishee: Impact on Creditors and Debtors

Trustees manage assets in bankruptcy cases, prioritizing creditor claims and ensuring equitable distribution, which protects creditors' interests by consolidating and liquidating debtor assets. Garnishees, typically third parties withholding debtor wages or funds, directly affect debtors by reducing their available income while simultaneously providing creditors with a mechanism for debt recovery without full asset liquidation. The distinction impacts creditors as trustees offer comprehensive debt resolution, whereas garnishees provide targeted repayment, influencing the speed and extent of creditor satisfaction and debtor financial flexibility.

Choosing the Right Legal Action: Trustee or Garnishee

Selecting the appropriate legal action between a trustee and a garnishee depends on the type of debt recovery and asset control involved. A trustee manages assets held in trust and distributes them according to legal or fiduciary obligations, making this option suitable for structured debt settlements or bankruptcy cases. Garnishee proceedings directly involve third parties holding the debtor's funds or properties, allowing creditors to seize assets like wages or bank accounts to satisfy outstanding debts.

Trustee Infographic

libterm.com

libterm.com