Rescission is a legal remedy that cancels a contract, restoring the parties to their original positions as if the agreement never existed. This process is often used when contracts are formed under fraud, misrepresentation, undue influence, or mutual mistake. Discover how rescission could protect your rights and when it might be the best course of action by reading the full article.

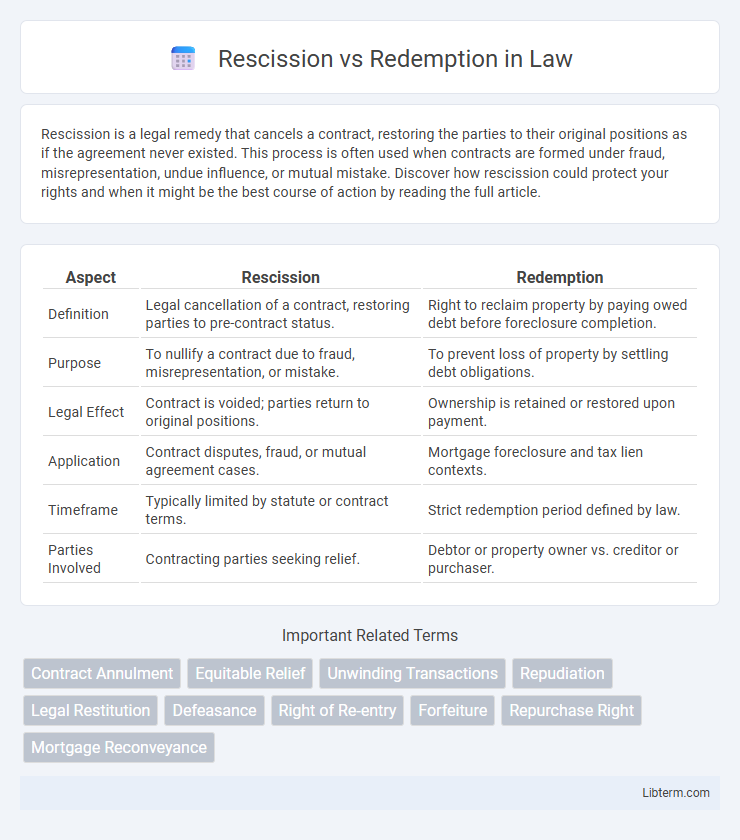

Table of Comparison

| Aspect | Rescission | Redemption |

|---|---|---|

| Definition | Legal cancellation of a contract, restoring parties to pre-contract status. | Right to reclaim property by paying owed debt before foreclosure completion. |

| Purpose | To nullify a contract due to fraud, misrepresentation, or mistake. | To prevent loss of property by settling debt obligations. |

| Legal Effect | Contract is voided; parties return to original positions. | Ownership is retained or restored upon payment. |

| Application | Contract disputes, fraud, or mutual agreement cases. | Mortgage foreclosure and tax lien contexts. |

| Timeframe | Typically limited by statute or contract terms. | Strict redemption period defined by law. |

| Parties Involved | Contracting parties seeking relief. | Debtor or property owner vs. creditor or purchaser. |

Understanding Rescission: Definition and Context

Rescission refers to the legal cancellation of a contract, effectively nullifying the agreement as if it never existed, often due to mutual mistake, fraud, or misrepresentation. It allows parties to return to their pre-contractual positions by undoing all contractual obligations and restoring any exchanged benefits. This remedy is commonly applied in cases where continuing the contract would be unfair or inequitable, ensuring fairness in contractual relationships.

What is Redemption? Key Concepts Explained

Redemption refers to the act of reclaiming an asset, property, or financial instrument by paying off an outstanding debt or fulfilling specific conditions, often seen in mortgage, bond, or foreclosure contexts. Key concepts include the borrower's right to redeem within a stipulated period, preventing permanent loss of the asset, and restoring full ownership by settling arrears or obligations. Redemption ensures protection against involuntary loss by allowing the property or bondholder to reinstate legal title through financial restitution.

Legal Foundations of Rescission and Redemption

Rescission is grounded in contract law principles allowing parties to nullify agreements due to factors like misrepresentation, fraud, or mutual mistake, restoring them to their pre-contractual positions. Redemption, rooted in property and mortgage law, permits borrowers to reclaim foreclosed property by fulfilling payment obligations before a specified deadline, effectively reversing the foreclosure process. Both remedies rely on statutory provisions and judicial interpretations that define eligibility criteria, procedural requirements, and the scope of rights preserved or restored during the rescission or redemption process.

Key Differences Between Rescission and Redemption

Rescission involves the cancellation of a contract, returning both parties to their pre-contractual positions, primarily used when there is a fundamental breach or misrepresentation. Redemption refers to the repayment of a debt or reclaiming property by paying off the owed amount, often seen in mortgage or lien contexts. The key difference lies in rescission nullifying the contract itself, while redemption fulfills the contract's obligations by settling outstanding debts.

Situations Where Rescission Applies

Rescission applies primarily in situations involving contracts tainted by fraud, misrepresentation, undue influence, or mutual mistake, allowing the parties to void the agreement and restore their original positions. It is also relevant when a contract's essential terms have been fundamentally breached, making performance unfair or impossible. Unlike redemption, rescission aims to cancel the contractual obligations entirely rather than recover a civil debt or reclaim possession of property.

Common Scenarios for Redemption

Common scenarios for redemption typically involve mortgage loans, where a borrower pays off the outstanding debt to reclaim foreclosed property. In tax lien cases, redemption allows property owners to clear tax debts within a specified period to avoid permanent loss of ownership. Redemption periods and conditions vary by jurisdiction, directly impacting the rights of both creditors and debtors during property recovery processes.

Implications for Contracts and Agreements

Rescission terminates a contract, nullifying all obligations and restoring parties to their pre-contractual positions, often used in cases of fraud, misrepresentation, or mutual mistake. Redemption involves the right to reclaim property or rights by fulfilling specific conditions, commonly seen in mortgage agreements where borrowers repay owed amounts to regain title. Understanding the distinct legal effects of rescission versus redemption is crucial for drafting enforceable contracts and resolving disputes effectively.

Rescission vs Redemption: Pros and Cons

Rescission allows parties to cancel a contract and restore original positions, offering a clean break but may lead to disputes over restitution and delays. Redemption enables a defaulted borrower to recover property by paying owed amounts, providing a clear recovery path but often requires immediate full payment and can be costly. Choosing between rescission and redemption depends on factors like legal costs, timing flexibility, and financial capacity of the parties involved.

Real-World Examples of Rescission and Redemption

Rescission occurs when a contract is canceled due to misrepresentation, fraud, or mutual mistake, such as in real estate transactions where a buyer discovers undisclosed property defects and the sale is undone. Redemption commonly appears in mortgage foreclosures, exemplified when a homeowner repays the outstanding loan balance plus interest to reclaim their property after default. Both legal remedies restore parties to their original positions but apply in distinct contexts: rescission nullifies agreements, while redemption reinstates rights after default.

Choosing the Right Remedy: Factors to Consider

Choosing between rescission and redemption hinges on factors such as the nature of the contract breach, timing of the claim, and the parties' intentions. Rescission voids the contract and restores parties to their pre-contract positions, best suited for cases involving fraud or misrepresentation, while redemption allows recovery of property through payment, commonly applied in mortgage or foreclosure contexts. Evaluating legal requirements, financial implications, and potential impact on relationships ensures the selection of the appropriate remedy aligns with the specific dispute circumstances.

Rescission Infographic

libterm.com

libterm.com