Distribution by sale involves allocating products to different markets or retail channels based on sales performance and demand analysis. Strategic distribution ensures maximum product availability, improving customer satisfaction and boosting revenue streams. Explore the rest of the article to understand how optimizing your distribution by sale can enhance your business growth.

Table of Comparison

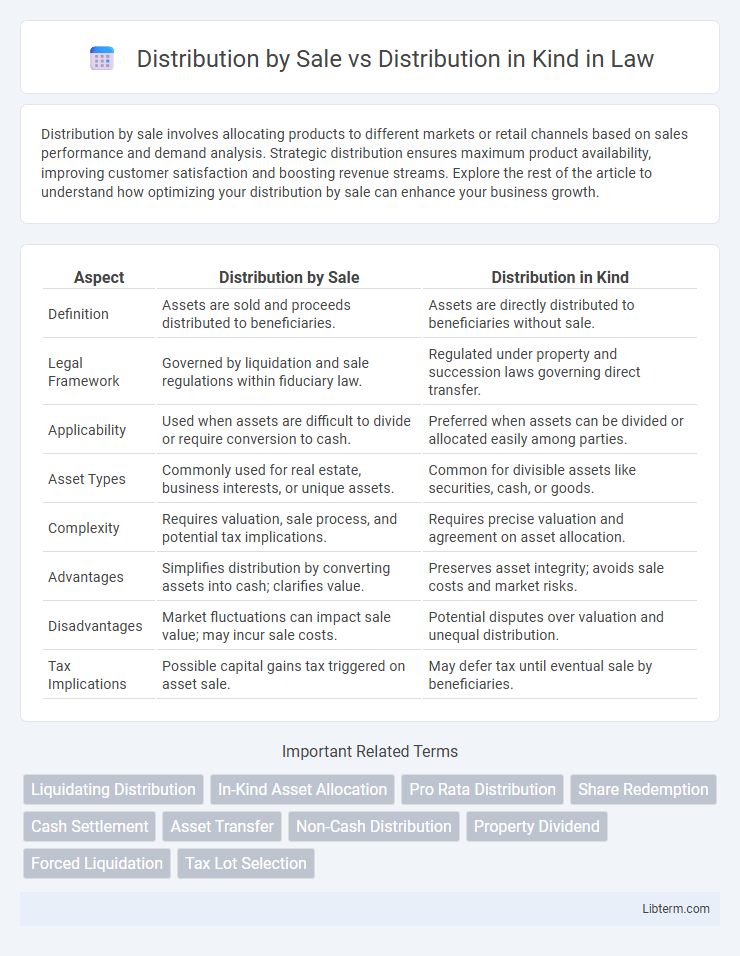

| Aspect | Distribution by Sale | Distribution in Kind |

|---|---|---|

| Definition | Assets are sold and proceeds distributed to beneficiaries. | Assets are directly distributed to beneficiaries without sale. |

| Legal Framework | Governed by liquidation and sale regulations within fiduciary law. | Regulated under property and succession laws governing direct transfer. |

| Applicability | Used when assets are difficult to divide or require conversion to cash. | Preferred when assets can be divided or allocated easily among parties. |

| Asset Types | Commonly used for real estate, business interests, or unique assets. | Common for divisible assets like securities, cash, or goods. |

| Complexity | Requires valuation, sale process, and potential tax implications. | Requires precise valuation and agreement on asset allocation. |

| Advantages | Simplifies distribution by converting assets into cash; clarifies value. | Preserves asset integrity; avoids sale costs and market risks. |

| Disadvantages | Market fluctuations can impact sale value; may incur sale costs. | Potential disputes over valuation and unequal distribution. |

| Tax Implications | Possible capital gains tax triggered on asset sale. | May defer tax until eventual sale by beneficiaries. |

Introduction to Distribution by Sale and Distribution in Kind

Distribution by sale involves converting assets or goods into cash before dispersing proceeds to stakeholders, optimizing liquidity and simplifying valuation processes. Distribution in kind transfers assets directly to beneficiaries without conversion, often used in scenarios involving non-liquid or unique property that requires preservation of value or entity structure. Understanding these methods is critical for effective asset management and compliance in corporate finance and estate settlements.

Defining Distribution by Sale

Distribution by sale involves transferring assets or proceeds from a business or estate to beneficiaries through a monetary transaction, where the assets are sold and the cash distributed. This method allows for liquidity and ease of division, particularly when assets are difficult to divide physically. It contrasts with distribution in kind, where beneficiaries receive specific physical assets rather than their monetary equivalent.

What is Distribution in Kind?

Distribution in Kind refers to the allocation of assets or resources in their tangible or physical form rather than converting them into cash. This method is commonly used in corporate contexts, such as dividend payouts where shareholders receive shares or physical goods instead of monetary payments. Distribution in Kind can preserve asset value and offer more direct benefits to recipients compared to distribution by sale, which involves selling assets and distributing the proceeds.

Key Differences Between the Two Methods

Distribution by sale involves converting assets into cash and then distributing the proceeds to beneficiaries, providing liquidity and flexibility in allocation. Distribution in kind consists of transferring actual assets, such as property or securities, directly to beneficiaries without liquidation, preserving asset integrity and potentially avoiding transaction costs. Key differences include liquidity impact, tax implications, and the complexity of equalizing shares among beneficiaries.

Legal Considerations and Compliance

Distribution by Sale involves transferring assets through monetary transactions, requiring strict adherence to contractual agreements, tax regulations, and securities laws to ensure legal compliance. Distribution in Kind entails allocating non-cash assets directly to beneficiaries, necessitating precise valuation, documentation, and compliance with asset-specific regulations to avoid legal disputes. Both distribution methods demand transparency, accurate reporting, and alignment with fiduciary duties to uphold regulatory standards and protect stakeholder interests.

Tax Implications for Each Distribution Method

Distribution by sale triggers taxable events as assets are sold, often realizing capital gains subject to income tax, while distributing proceeds may result in immediate tax liabilities for recipients. Distribution in kind involves transferring assets directly to beneficiaries, potentially deferring capital gains taxes until the assets are eventually sold by the recipients. Understanding IRS regulations and specific trust or entity structures is crucial for optimizing tax outcomes in both distribution methods.

Pros and Cons of Distribution by Sale

Distribution by Sale converts assets into cash before allocation, providing recipients with liquid funds that offer flexibility in usage. This method streamlines the division process and reduces disputes over asset valuation but may incur transaction costs and potential tax liabilities from the sale. However, recipients might lose sentimental value associated with physical assets and face delays if the sale process is prolonged.

Pros and Cons of Distribution in Kind

Distribution in kind involves allocating assets or goods directly rather than converting them to cash, preserving the original form of the asset, which can be advantageous for maintaining value and minimizing transaction costs. However, this method may lead to challenges such as difficulty in valuing and dividing assets fairly among recipients, potential liquidity issues, and complexities in managing physical properties or goods. While distribution in kind supports asset retention and avoids market volatility, it requires careful assessment to ensure equitable division and to handle possible administrative burdens.

Factors to Consider When Choosing Distribution Method

Choosing between distribution by sale and distribution in kind involves assessing factors such as the target audience's needs, the nature of the goods or services, and logistical capabilities. Distribution by sale is ideal for converting products directly into revenue, making it suitable for commercial enterprises with efficient sales channels, while distribution in kind often benefits social programs or situations requiring equitable resource allocation without monetary transactions. Evaluating costs, recipient preferences, and regulatory compliance is essential to optimize the effectiveness and sustainability of the chosen distribution method.

Practical Examples and Case Studies

Distribution by sale involves converting assets into cash and distributing proceeds to beneficiaries, commonly seen in trust wind-ups where estate properties are sold to provide liquid funds. Distribution in kind refers to transferring assets directly to beneficiaries without sale, such as allocating shares of stock or real estate in family estate planning to preserve asset value and minimize tax impacts. Case studies illustrate a family trust distributing rental properties in kind to beneficiaries to avoid capital gains tax triggered by sale, while another example shows a charitable foundation selling donated artworks to fund grants, exemplifying distribution by sale.

Distribution by Sale Infographic

libterm.com

libterm.com