A short sale occurs when a homeowner sells their property for less than the outstanding mortgage balance, typically to avoid foreclosure. This process requires lender approval and can significantly impact your credit score, but it offers a way to mitigate financial loss. Explore the rest of this article to understand the benefits, risks, and steps involved in a short sale.

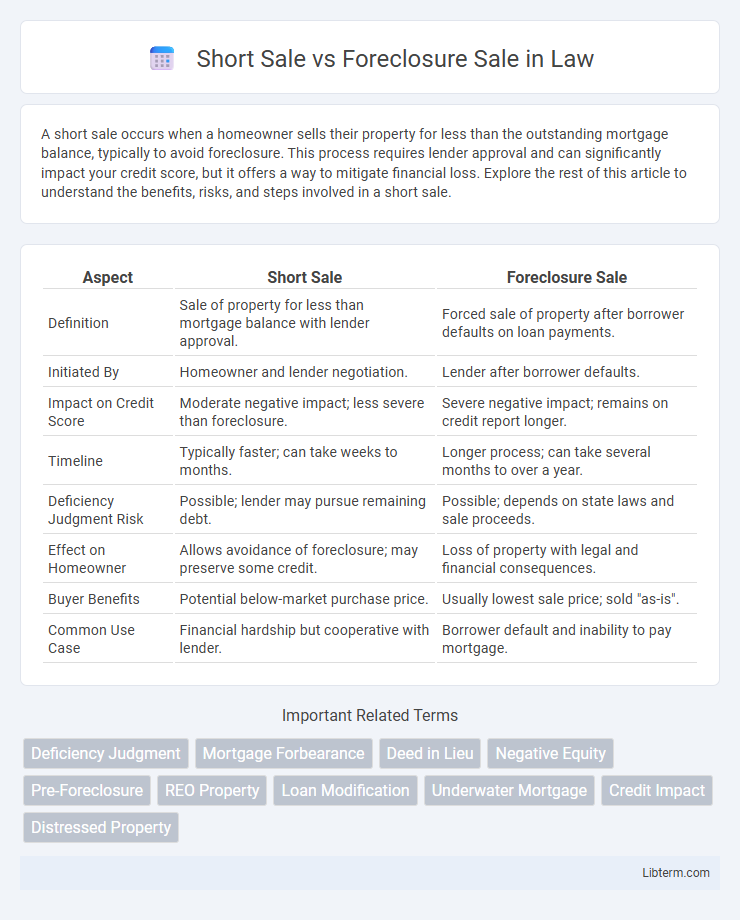

Table of Comparison

| Aspect | Short Sale | Foreclosure Sale |

|---|---|---|

| Definition | Sale of property for less than mortgage balance with lender approval. | Forced sale of property after borrower defaults on loan payments. |

| Initiated By | Homeowner and lender negotiation. | Lender after borrower defaults. |

| Impact on Credit Score | Moderate negative impact; less severe than foreclosure. | Severe negative impact; remains on credit report longer. |

| Timeline | Typically faster; can take weeks to months. | Longer process; can take several months to over a year. |

| Deficiency Judgment Risk | Possible; lender may pursue remaining debt. | Possible; depends on state laws and sale proceeds. |

| Effect on Homeowner | Allows avoidance of foreclosure; may preserve some credit. | Loss of property with legal and financial consequences. |

| Buyer Benefits | Potential below-market purchase price. | Usually lowest sale price; sold "as-is". |

| Common Use Case | Financial hardship but cooperative with lender. | Borrower default and inability to pay mortgage. |

Understanding Short Sale vs Foreclosure Sale

A short sale occurs when a homeowner sells their property for less than the owed mortgage balance with lender approval, often minimizing credit damage compared to foreclosure. Foreclosure sale happens when the lender seizes and sells the property after the homeowner defaults on mortgage payments, typically resulting in more severe credit consequences. Understanding these processes is crucial for homeowners seeking alternatives to mitigate financial loss and protect credit health.

Key Differences Between Short Sale and Foreclosure

A short sale occurs when a homeowner sells their property for less than the outstanding mortgage balance with lender approval, often avoiding foreclosure and minimizing credit damage. Foreclosure sale happens after the borrower defaults, leading the lender to repossess and sell the property, which significantly impacts credit scores and involves a public auction. Key differences include the sale control, credit consequences, and the role of lender cooperation.

How a Short Sale Works

A short sale occurs when a homeowner sells their property for less than the outstanding mortgage balance, with lender approval, to avoid foreclosure. The lender agrees to accept the reduced sale price as full repayment of the loan, often requiring a detailed financial hardship analysis and extensive documentation from the seller. This process can mitigate credit damage compared to foreclosure and provides a faster resolution to delinquent mortgage situations.

How a Foreclosure Sale Works

A foreclosure sale occurs when a homeowner defaults on mortgage payments, leading the lender to repossess and sell the property at auction to recover the outstanding loan balance. This process bypasses the homeowner's consent and typically results in a lower sale price compared to market value. Foreclosure sales are governed by state laws and often involve a public auction where the highest bidder receives the deed, subject to any redemption period that may apply.

Pros and Cons of Short Sale

A short sale allows homeowners to sell their property for less than the outstanding mortgage balance, often resulting in less damage to their credit score compared to foreclosure. It provides a chance to avoid the lengthy and public foreclosure process, potentially preserving more equity and offering a quicker resolution. However, short sales require lender approval, can be time-consuming, and may involve significant negotiation, with the risk of tax implications or deficiency judgments depending on state laws.

Pros and Cons of Foreclosure

Foreclosure sales can offer properties at significantly reduced prices, attracting investors seeking below-market deals; however, buyers often face risks such as unclear property titles, potential liens, and the need for extensive repairs. Sellers undergoing foreclosure lose equity and face credit damage that can last for years, impacting future loan eligibility. Despite these drawbacks, foreclosure sales provide faster transactions compared to traditional sales but come with less negotiation flexibility and higher uncertainty for both buyers and sellers.

Impact on Credit Score: Short Sale vs Foreclosure

A short sale generally has a less severe impact on credit scores compared to a foreclosure, often resulting in a drop of 50 to 150 points versus a foreclosure's 85 to 160 points or more. Credit reporting agencies typically mark short sales as "settled for less than the full amount," which may allow faster credit recovery. Foreclosures remain on credit reports for up to seven years, potentially leading to higher interest rates and longer-term credit challenges than short sales.

Financial Implications for Homeowners

Short sales typically result in less severe credit damage than foreclosure sales, allowing homeowners to rebuild credit faster and qualify for future loans more easily. Foreclosure sales often lead to a significant drop in credit scores, increased difficulty securing new mortgages, and potential tax liabilities on forgiven debt. Homeowners facing financial distress should weigh the long-term credit impacts and consult financial advisors to choose the option that minimizes economic losses.

Buying Opportunities: Short Sale vs Foreclosure Properties

Short sale properties often present buying opportunities with less competition and the potential for negotiating better terms due to seller motivation to avoid foreclosure. Foreclosure sales typically involve properties sold as-is, offering discounted prices but with higher risks of damage and liens. Buyers benefit from researching both options thoroughly to capitalize on lower purchase prices while navigating the differences in condition and negotiation processes.

Which Option Is Better for Struggling Homeowners?

Short sales often allow struggling homeowners to avoid the severe credit score impact associated with foreclosure sales, typically resulting in a less damaging effect on credit reports and faster financial recovery. Foreclosure sales can lead to lengthy legal processes, higher costs, and potential deficiency judgments, making short sales a preferable option for minimizing financial and emotional strain. Homeowners should weigh factors such as current market conditions, lender willingness, and their long-term financial goals when deciding between short sale and foreclosure sale options.

Short Sale Infographic

libterm.com

libterm.com