A charitable trust is a legal arrangement where assets are dedicated to support nonprofit causes and benefit the public. These trusts enable donors to ensure their contributions are managed effectively for educational, religious, or humanitarian purposes, often providing tax advantages. Discover how setting up a charitable trust can serve your philanthropic goals and protect your legacy throughout the rest of this article.

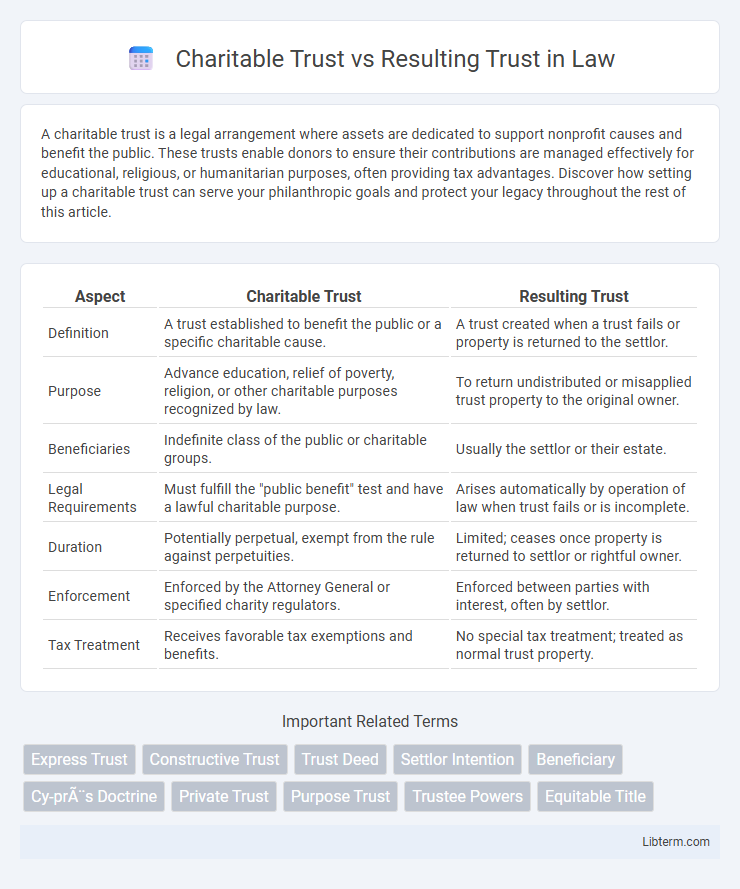

Table of Comparison

| Aspect | Charitable Trust | Resulting Trust |

|---|---|---|

| Definition | A trust established to benefit the public or a specific charitable cause. | A trust created when a trust fails or property is returned to the settlor. |

| Purpose | Advance education, relief of poverty, religion, or other charitable purposes recognized by law. | To return undistributed or misapplied trust property to the original owner. |

| Beneficiaries | Indefinite class of the public or charitable groups. | Usually the settlor or their estate. |

| Legal Requirements | Must fulfill the "public benefit" test and have a lawful charitable purpose. | Arises automatically by operation of law when trust fails or is incomplete. |

| Duration | Potentially perpetual, exempt from the rule against perpetuities. | Limited; ceases once property is returned to settlor or rightful owner. |

| Enforcement | Enforced by the Attorney General or specified charity regulators. | Enforced between parties with interest, often by settlor. |

| Tax Treatment | Receives favorable tax exemptions and benefits. | No special tax treatment; treated as normal trust property. |

Understanding Charitable Trusts: Definition and Key Features

Charitable trusts are legal arrangements established to manage assets for public benefit, typically supporting causes like education, health, or poverty relief. These trusts must have a clear charitable purpose, be for the public interest, and are exempt from certain taxes due to their philanthropic nature. Unlike resulting trusts, which arise from the intentions of parties or when trust purposes fail, charitable trusts are deliberately created to serve ongoing charitable objectives.

Defining Resulting Trusts: Purpose and Characteristics

Resulting trusts arise when property is transferred under circumstances indicating the transferee should not have full beneficial ownership, often to prevent unjust enrichment. They typically occur when an express trust fails or results from an implied intention that the transferor retains equitable interest. The purpose of resulting trusts is to restore property to the original owner or their estate, emphasizing the trust's automatic nature and reliance on presumed intent rather than explicit terms.

Legal Framework: Charitable vs Resulting Trusts

Charitable trusts operate under statutory frameworks such as the Charities Act 2011 in the UK, emphasizing public benefit and regulatory oversight by charity commissions. Resulting trusts arise by operation of law, primarily to reflect the presumed intentions of parties when no explicit trust declaration exists, and are governed by common law principles without specific statutory regulation. The legal framework distinguishes charitable trusts with formal registration and tax benefits, while resulting trusts rely on judicial inference to address property title and equitable interests.

Formation Requirements: Charitable Trusts vs Resulting Trusts

Charitable trusts require a clear charitable purpose recognized by law, such as relief of poverty or advancement of education, and must comply with formalities like a written instrument and trustee appointment to ensure valid formation. Resulting trusts arise by operation of law when property is transferred under circumstances showing the transferor did not intend to benefit the transferee, often lacking explicit trust documentation but inferred from the parties' intent and conduct. Both trusts necessitate identifiable beneficiaries or purposes, yet charitable trusts emphasize public benefit and statutory compliance, whereas resulting trusts focus on preventing unjust enrichment based on equity principles.

Beneficiaries: Who Benefits from Each Type of Trust?

Charitable trusts benefit the public or a specific charitable purpose, such as education, health, or religion, with no individual beneficiaries entitled to the trust property. Resulting trusts arise when a trust fails or is incomplete, reverting the trust property to the original settlor or their estate, who are the primary beneficiaries. The key distinction lies in charitable trusts serving public or community interests, while resulting trusts protect the interests of private parties by restoring property rights.

Purpose and Intent: Comparing Trustees’ Duties

Charitable trusts are established to benefit the public or a specific charitable purpose, with trustees tasked to manage assets in strict compliance with legal and ethical standards to fulfill the trust's philanthropic intent. Resulting trusts arise when an express trust fails or when property is transferred without intent to gift, compelling trustees to return assets to the original owner or their heirs based on implied intentions. Trustees of charitable trusts must prioritize philanthropic goals and regulatory compliance, while trustees of resulting trusts primarily focus on honoring the original economic intent and ownership rights of the settlor.

Tax Implications: Charitable Trusts and Resulting Trusts

Charitable trusts benefit from significant tax advantages, including exemption from income and estate taxes, as long as the trust's purpose aligns with recognized charitable activities under tax laws. Resulting trusts do not qualify for these exemptions since they are typically established to return assets to the settlor or their heirs, leading to standard tax treatment on income or capital gains. Proper classification between charitable and resulting trusts directly impacts tax liabilities and compliance with regulatory requirements.

Duration and Termination: Lifespan of Each Trust

Charitable trusts typically have a perpetual duration, designed to last indefinitely to support ongoing charitable purposes, often exempt from the rule against perpetuities. Resulting trusts, conversely, arise automatically by operation of law and generally terminate once the underlying purpose or interest fails or the property is re-appropriated, usually within a limited timeframe. The key distinction lies in the intended lifespan: charitable trusts aim for long-term continuity, while resulting trusts are inherently temporary and contingent on the specific circumstances of the trust property.

Common Legal Challenges in Charitable and Resulting Trusts

Common legal challenges in charitable trusts often involve ensuring compliance with the specific charitable purposes defined in the trust deed and maintaining public benefit requirements under applicable charity laws. Resulting trusts frequently face disputes regarding the original intent of the settlor, especially when the expressed purpose fails or is unclear, leading to challenges over property ownership and equitable interests. Both types of trusts require careful legal scrutiny to resolve issues of fiduciary duty, enforcement mechanisms, and potential claimants' rights.

Choosing the Right Trust: Factors to Consider

Choosing the right trust involves evaluating the purpose, beneficiaries, and legal requirements of each type. Charitable trusts are established to benefit public causes and enjoy tax exemptions, while resulting trusts arise when property transfers fail or lack clear intent, returning assets to the original owner. Consider the goals of asset distribution, tax implications, and regulatory compliance when deciding between a charitable trust and a resulting trust.

Charitable Trust Infographic

libterm.com

libterm.com