A receiver is a crucial component in communication systems that captures and decodes transmitted signals for further processing. It ensures the accurate retrieval of information by filtering out noise and handling signal distortions. Discover how a receiver works and why it plays an essential role in your communication devices by reading the full article.

Table of Comparison

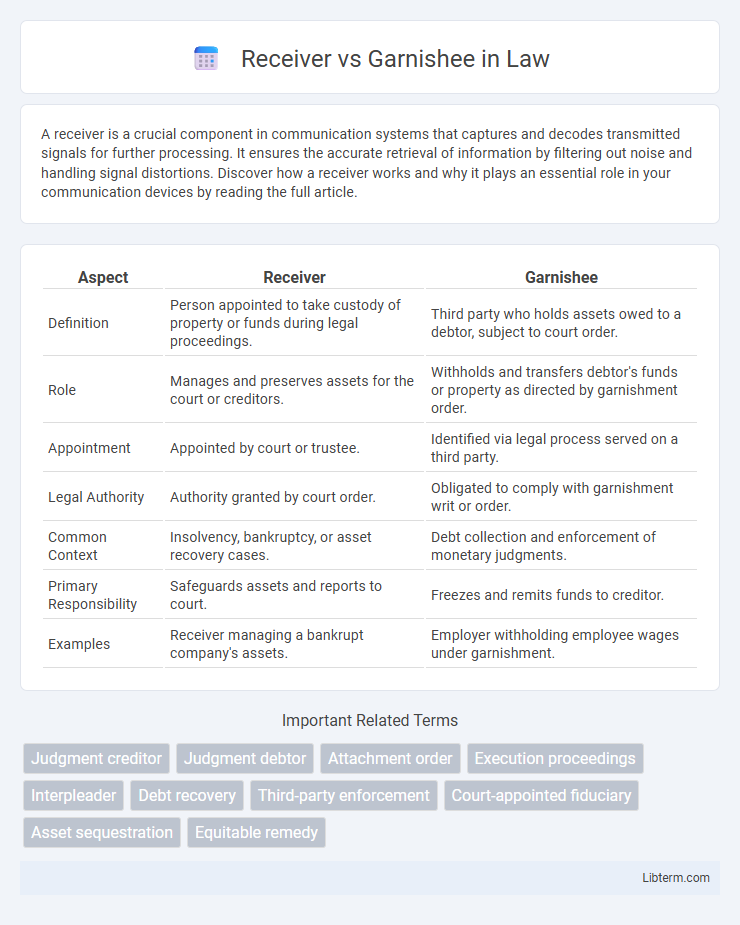

| Aspect | Receiver | Garnishee |

|---|---|---|

| Definition | Person appointed to take custody of property or funds during legal proceedings. | Third party who holds assets owed to a debtor, subject to court order. |

| Role | Manages and preserves assets for the court or creditors. | Withholds and transfers debtor's funds or property as directed by garnishment order. |

| Appointment | Appointed by court or trustee. | Identified via legal process served on a third party. |

| Legal Authority | Authority granted by court order. | Obligated to comply with garnishment writ or order. |

| Common Context | Insolvency, bankruptcy, or asset recovery cases. | Debt collection and enforcement of monetary judgments. |

| Primary Responsibility | Safeguards assets and reports to court. | Freezes and remits funds to creditor. |

| Examples | Receiver managing a bankrupt company's assets. | Employer withholding employee wages under garnishment. |

Introduction to Receivers and Garnishees

Receivers are court-appointed individuals managing and protecting assets during legal disputes or insolvency, ensuring proper administration of property under court control. Garnishees, typically third parties such as employers or banks, are legally obligated to withhold funds from a debtor's assets to satisfy a creditor's claim. Both roles are essential in enforcing court orders but differ in function: receivers control assets directly, while garnishees facilitate debt repayment through asset withholding.

Legal Definitions: Receiver vs Garnishee

A receiver is a court-appointed official assigned to manage and preserve property or assets during litigation or insolvency, acting as a neutral custodian to protect creditor interests. A garnishee is a third party, typically an employer or bank, legally required to withhold funds or property belonging to a debtor to satisfy a creditor's judgment. The receiver controls and operates the asset under court supervision, whereas the garnishee's role is limited to complying with a court order to divert debtor assets.

Roles and Responsibilities

A receiver is appointed by the court or creditors to take control of a company's assets, manage its operations, and protect creditor interests during insolvency or disputes. A garnishee is a third party, often an employer or bank, legally required to withhold funds from a debtor's wages or accounts and redirect them to satisfy a creditor's judgment. The receiver's responsibilities include asset preservation and financial oversight, while the garnishee's role centers on compliance with court orders for debt recovery.

Appointment Process

The appointment process for a receiver involves a court order directing an individual or entity to manage and preserve assets during litigation or insolvency, often initiated by creditors or the court itself. A garnishee is appointed through a garnishment order, where the court compels a third party holding the debtor's assets, such as wages or bank funds, to remit those assets directly to the creditor. Both appointment mechanisms require judicial authorization, but receivership typically addresses broader asset control, while garnishment targets specific funds or property.

Situations Requiring a Receiver

Situations requiring a receiver typically involve complex financial disputes, insolvency cases, or when a court appoints a neutral third party to manage assets during litigation to protect creditor interests. A receiver takes custody and control of specific property or business operations to preserve value, unlike a garnishee who merely withholds funds owed to a debtor to satisfy a judgment. Courts often appoint receivers in cases of mismanagement, fraud allegations, or to prevent dissipation of assets pending resolution.

Circumstances for Garnishee Orders

Garnishee orders are typically issued when a creditor seeks to recover debts directly from a debtor's third-party, such as an employer or bank holding the debtor's funds, under legal authority. They are enforced in circumstances where a debtor owes money, and the creditor obtains a court order to attach funds or assets held by a garnishee to satisfy the debt. This legal mechanism is distinct from receivership, which usually involves appointing a receiver to manage or liquidate a debtor's property in insolvency or enforcement scenarios.

Impact on Debtors and Creditors

Receivers prioritize recovering secured creditors' debts by managing or selling debtor assets, often limiting debtor control and focusing on satisfying creditor claims. Garnishees act as third parties compelled to withhold debtor funds, directly diverting payments to creditors without transferring asset control from debtors. The receiver's involvement typically results in significant debtor disruption, whereas garnishment imposes a financial burden without altering asset ownership, affecting creditor recovery strategies differently.

Legal Procedures and Court Involvement

A Receiver is appointed by the court to manage or preserve property during legal disputes, often in complex cases involving insolvency or corporate control, and operates under court supervision to protect assets. A Garnishee, on the other hand, is typically a third party ordered by the court to withhold assets or wages owed to a debtor and transfer them to the creditor after a judgment is obtained. Legal procedures for appointing a Receiver involve detailed court hearings and specific criteria related to asset protection, while garnishment requires a judicial order post-judgment, emphasizing the garnishee's role as a conduit rather than a property manager.

Key Differences Between Receiver and Garnishee

The key differences between a receiver and a garnishee lie in their roles and responsibilities during asset management and debt collection. A receiver is a court-appointed individual who takes control of a debtor's property to manage and protect assets, often during insolvency or disputes, while a garnishee is typically a third party, such as an employer or bank, ordered by the court to withhold funds or property belonging to the debtor to satisfy a creditor's claim. Unlike a garnishee, the receiver actively administers and disposes of assets, whereas the garnishee acts as a passive intermediary in the debt recovery process.

Conclusion: Choosing the Right Legal Remedy

Selecting between a receiver and a garnishee hinges on the specific circumstances of asset control and debt recovery. A receiver offers comprehensive management of a debtor's property, ideal for preserving value and overseeing complex assets. Garnishee orders target third-party-held funds or wages, providing a direct, often faster route to debt collection without assuming property control.

Receiver Infographic

libterm.com

libterm.com