Reimbursement alimony is financial support awarded to a spouse who contributed to the education, training, or career advancement of the other during the marriage. This form of support aims to balance the economic benefits gained and ensure fairness in asset division after divorce. Explore the rest of this article to understand how reimbursement alimony could affect your financial settlement.

Table of Comparison

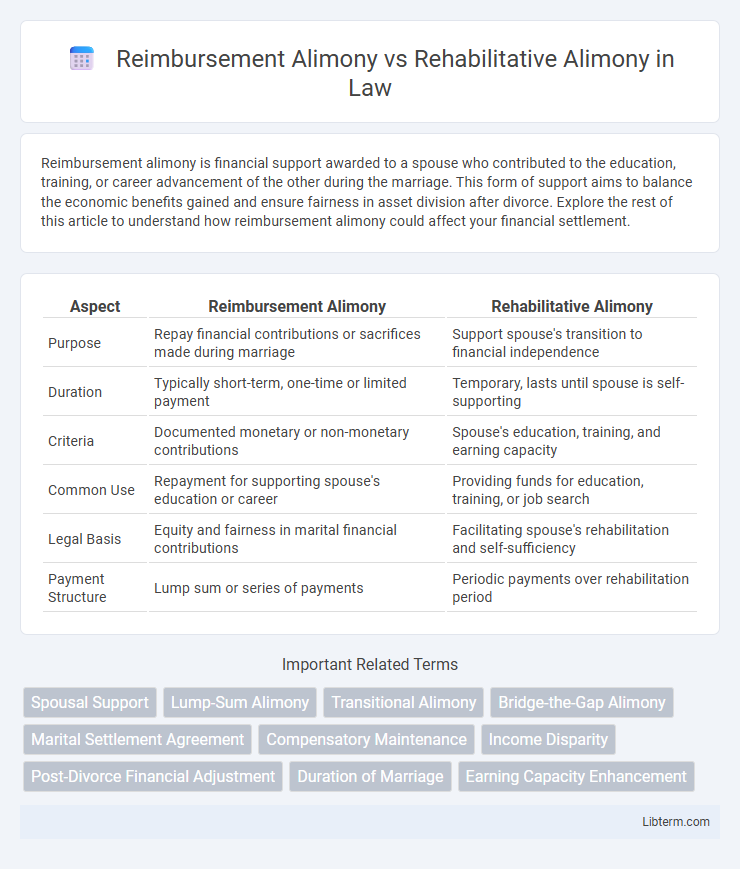

| Aspect | Reimbursement Alimony | Rehabilitative Alimony |

|---|---|---|

| Purpose | Repay financial contributions or sacrifices made during marriage | Support spouse's transition to financial independence |

| Duration | Typically short-term, one-time or limited payment | Temporary, lasts until spouse is self-supporting |

| Criteria | Documented monetary or non-monetary contributions | Spouse's education, training, and earning capacity |

| Common Use | Repayment for supporting spouse's education or career | Providing funds for education, training, or job search |

| Legal Basis | Equity and fairness in marital financial contributions | Facilitating spouse's rehabilitation and self-sufficiency |

| Payment Structure | Lump sum or series of payments | Periodic payments over rehabilitation period |

Understanding Alimony: An Overview

Reimbursement alimony reimburses a spouse for expenses incurred during the marriage, such as education or career advancement, that enhanced the other spouse's earning capacity. Rehabilitative alimony provides temporary financial support to help the recipient spouse gain independence by acquiring education, training, or work experience after divorce. Understanding these types of alimony clarifies how courts address different financial needs and contributions during and after marriage dissolution.

Defining Reimbursement Alimony

Reimbursement alimony is a court-ordered payment intended to compensate a spouse who financially supported the other spouse's education, training, or career advancement during the marriage. This type of alimony aims to balance the financial contributions by reimbursing the supporting spouse for expenses that enhanced the recipient's earning capacity. Unlike rehabilitative alimony, which provides temporary support to help a spouse regain financial independence, reimbursement alimony specifically addresses the repayment for past investments made in the other spouse's professional development.

What Is Rehabilitative Alimony?

Rehabilitative alimony is a form of spousal support awarded to help the recipient spouse gain financial independence through education or job training after divorce. It is typically granted for a limited duration, allowing the recipient time to improve employment prospects and become self-sufficient. Unlike reimbursement alimony, which compensates a spouse for expenses incurred during the marriage, rehabilitative alimony focuses on future earning capacity and skill development.

Key Differences Between Reimbursement and Rehabilitative Alimony

Reimbursement alimony compensates a spouse for financial contributions made to the other's education or career advancement, emphasizing repayment for past investments, while rehabilitative alimony supports a spouse's transition to financial independence, typically covering living expenses for a limited period. Key differences include the purpose, duration, and conditions: reimbursement alimony is often a lump sum or fixed amount linked to quantifiable costs, whereas rehabilitative alimony is period-specific and tied to a realistic plan for self-sufficiency. Courts evaluate factors such as financial contributions, earning capacity, and length of marriage to determine eligibility and amounts for each alimony type.

Eligibility Criteria for Each Alimony Type

Reimbursement alimony eligibility requires proof that one spouse incurred significant expenses or losses supporting the other's education or career advancement during the marriage, justifying compensation. Rehabilitative alimony eligibility focuses on the recipient spouse's demonstrated need for financial assistance to attain self-sufficiency through vocational training or education. Courts evaluate factors such as duration of marriage, financial resources, and the recipient's job skills to determine eligibility for either type of alimony.

Duration and Payment Structure

Reimbursement alimony typically involves a one-time lump sum or limited-duration payments designed to repay a spouse for financial contributions made during the marriage, such as education or career sacrifices. Rehabilitative alimony, on the other hand, provides periodic payments aimed at supporting a spouse's transition to financial independence over a specific time frame, often aligned with retraining or job search efforts. The duration of reimbursement alimony is generally fixed and short-term, while rehabilitative alimony duration varies, commonly adjusted based on the recipient's progress toward self-sufficiency.

Common Scenarios for Reimbursement Alimony

Reimbursement alimony commonly arises when one spouse has supported the other's education or training, anticipating a fair return after divorce. Typical scenarios include a spouse funding a partner's law school or advanced degree, leading to financial support that reimburses this investment. Courts often assess the direct financial contributions and the resulting increase in earning capacity to determine reimbursement alimony awards.

Typical Cases Involving Rehabilitative Alimony

Rehabilitative alimony typically applies in cases where one spouse requires financial support to gain education or job skills necessary for employment after divorce, such as a stay-at-home parent returning to the workforce. In contrast, reimbursement alimony often arises when one spouse has financially contributed to the other's education or career advancement during the marriage and seeks repayment. Courts frequently award rehabilitative alimony for a limited duration, aligning with the time needed for job training or education, unlike reimbursement alimony, which directly compensates for specific financial investments.

Legal Factors Affecting Alimony Determination

Reimbursement alimony compensates a spouse for expenses incurred during the marriage, such as education or career advancement, while rehabilitative alimony supports a spouse in becoming self-sufficient post-divorce. Legal factors affecting alimony determination include the duration of the marriage, each spouse's financial resources, standard of living during the marriage, and the recipient's ability to become self-supporting. Courts also examine the payer's capacity to pay, contributions to the marriage, and any misconduct impacting financial stability.

Choosing the Right Alimony Approach

Choosing the right alimony approach requires understanding the key differences between reimbursement alimony, which compensates a spouse for financial investments made during the marriage such as education or training, and rehabilitative alimony, designed to support a spouse temporarily while gaining employment skills or education post-divorce. Reimbursement alimony is typically awarded when one spouse has significantly contributed to the other's earning capacity, whereas rehabilitative alimony focuses on promoting financial independence through short-term support. Evaluating factors like the duration of marriage, the recipient's employability, and the purpose of financial support ensures a tailored and effective alimony arrangement.

Reimbursement Alimony Infographic

libterm.com

libterm.com