Trust forms the foundation of all successful relationships, whether personal or professional, by fostering reliability and openness. Building trust requires consistent honesty, transparency, and respect, which encourage mutual understanding and cooperation. Discover how cultivating trust can transform your interactions and lead to lasting connections by reading the full article.

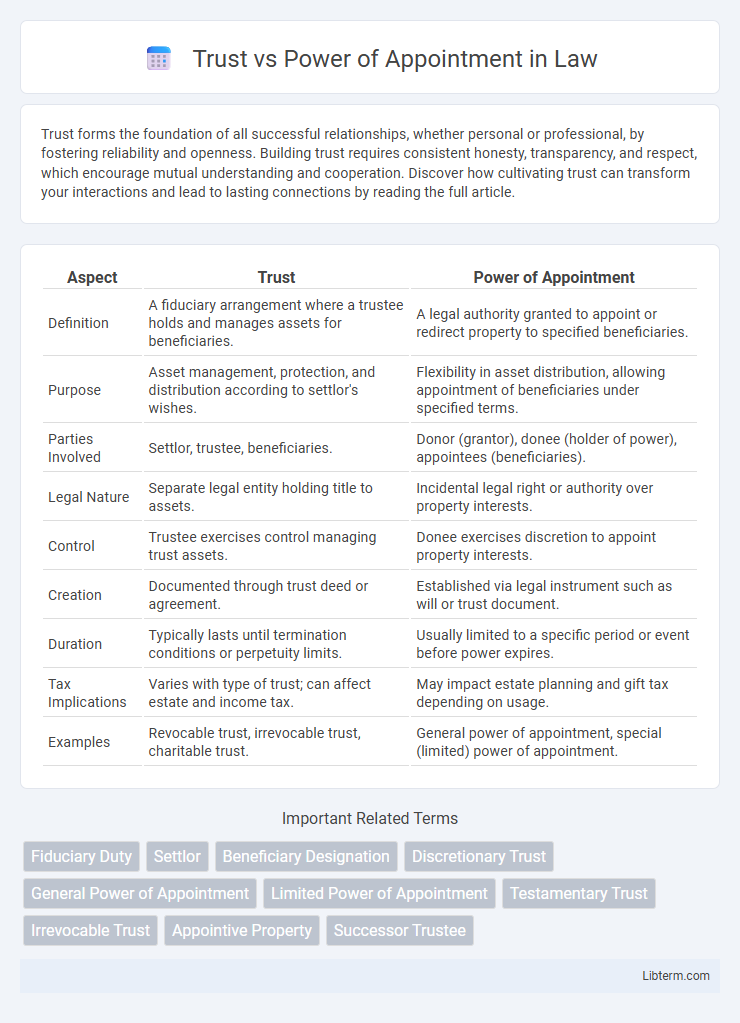

Table of Comparison

| Aspect | Trust | Power of Appointment |

|---|---|---|

| Definition | A fiduciary arrangement where a trustee holds and manages assets for beneficiaries. | A legal authority granted to appoint or redirect property to specified beneficiaries. |

| Purpose | Asset management, protection, and distribution according to settlor's wishes. | Flexibility in asset distribution, allowing appointment of beneficiaries under specified terms. |

| Parties Involved | Settlor, trustee, beneficiaries. | Donor (grantor), donee (holder of power), appointees (beneficiaries). |

| Legal Nature | Separate legal entity holding title to assets. | Incidental legal right or authority over property interests. |

| Control | Trustee exercises control managing trust assets. | Donee exercises discretion to appoint property interests. |

| Creation | Documented through trust deed or agreement. | Established via legal instrument such as will or trust document. |

| Duration | Typically lasts until termination conditions or perpetuity limits. | Usually limited to a specific period or event before power expires. |

| Tax Implications | Varies with type of trust; can affect estate and income tax. | May impact estate planning and gift tax depending on usage. |

| Examples | Revocable trust, irrevocable trust, charitable trust. | General power of appointment, special (limited) power of appointment. |

Introduction to Trusts and Powers of Appointment

Trusts are legal arrangements where a grantor transfers assets to a trustee to manage for the benefit of designated beneficiaries, providing control over asset distribution and potential tax advantages. Powers of appointment enable a person, known as the powerholder, to direct the disposition of trust property under specified terms, allowing flexibility and control in estate planning. Understanding the differences between trusts and powers of appointment is essential for effective asset management and estate tax optimization.

Defining a Trust: Key Features and Structure

A trust is a fiduciary arrangement wherein a grantor transfers assets to a trustee, who manages these assets for the benefit of designated beneficiaries according to the terms outlined in the trust agreement. Key features include the trust property, the trustee's fiduciary duty, beneficiaries' equitable interests, and the legal framework that governs trust administration. The structure typically involves irrevocable or revocable provisions, specific instructions on asset distribution, and mechanisms for trust modification or termination.

Understanding the Power of Appointment

The Power of Appointment allows an individual, known as the appointor, to designate how trust property is distributed among beneficiaries, offering flexibility in estate planning. This power can be general or limited, with general powers enabling appointment to oneself or creditors, potentially impacting estate tax implications. Understanding the scope and restrictions of the Power of Appointment is crucial for effective trust management and aligning with the settlor's intent.

Legal Differences Between Trusts and Powers of Appointment

Trusts create a fiduciary relationship where a trustee holds and manages property for beneficiaries based on the trust agreement, while powers of appointment grant an individual the authority to direct property distribution without holding title. Legally, trusts impose ongoing duties and responsibilities on the trustee, including fiduciary obligations and formal administration requirements, whereas powers of appointment are typically exercised through specific instructions in a will or trust without creating such obligations. The enforceability and scope of trusts are defined by trust law statutes, whereas powers of appointment are governed primarily by the instrument granting the power and relevant property law principles.

Roles and Responsibilities: Trustees vs Appointees

Trustees manage and safeguard trust assets, ensuring fiduciary duties are met according to the trust document while making distributions to beneficiaries. Appointees, empowered by the power of appointment, hold the authority to designate who will receive specified trust property, exercising discretion within the limits set by the trust instrument. Trustees have ongoing administrative responsibilities, whereas appointees have typically a one-time or limited role in determining beneficiaries or asset allocation.

Flexibility and Control in Estate Planning

Trusts provide greater flexibility in estate planning by allowing grantors to specify detailed terms and conditions for asset distribution, including contingencies and protections against creditors. Power of Appointment grants beneficiaries or appointees the authority to designate who will receive trust assets, offering dynamic control but limited by the trust's original framework. Combining a trust with a power of appointment enhances control by enabling adaptable asset management while maintaining protective oversight.

Tax Implications: Trusts vs Powers of Appointment

Trusts are subject to specific income and estate tax rules, with irrevocable trusts often facing higher tax rates and potential grantor trust status impacting taxation. Powers of appointment can shift tax liability by allowing beneficiaries or others to control asset distribution, influencing inclusion in estate tax calculations and gift tax consequences. Understanding the interplay between trust structures and powers of appointment is crucial for effective tax planning and minimizing overall tax burdens.

Common Uses and Scenarios

Trusts are commonly used to manage and protect assets for beneficiaries, ensuring controlled distribution and tax efficiency, while power of appointment allows a designated individual to decide who receives certain property within a trust or estate plan. In estate planning scenarios, trusts provide structured asset management and protection from creditors, whereas powers of appointment offer flexibility for changing beneficiary designations based on future circumstances. Common uses of powers of appointment include enabling beneficiaries to tailor distributions after the grantor's death and accommodating changes in family dynamics or financial needs.

Advantages and Disadvantages of Each Approach

Trusts provide control over asset distribution with clear fiduciary duties, allowing for protection against creditors and estate taxes, but they can be costly to establish and administer. Power of appointment offers flexibility by permitting beneficiaries to decide asset allocation, enhancing adaptability to changing circumstances, though it may increase risks of mismanagement and complicate tax planning. Choosing between trust and power of appointment requires balancing control, flexibility, tax implications, and administrative complexity.

Choosing the Right Tool for Your Estate Plan

Selecting between a trust and a power of appointment depends on your estate goals and control preferences. Trusts offer structured asset management and protection, making them ideal for long-term wealth preservation and specific distribution terms. Powers of appointment provide flexibility, allowing beneficiaries or appointees to direct asset distribution, which is useful when adaptability or future decision-making is a priority.

Trust Infographic

libterm.com

libterm.com