A trustee is an individual or entity appointed to manage assets or property on behalf of a beneficiary, ensuring fiduciary duties are upheld with loyalty and care. Understanding the roles, responsibilities, and legal implications of trusteeship is essential to safeguard your interests effectively. Explore the article to learn how trustees operate and how they can protect your assets.

Table of Comparison

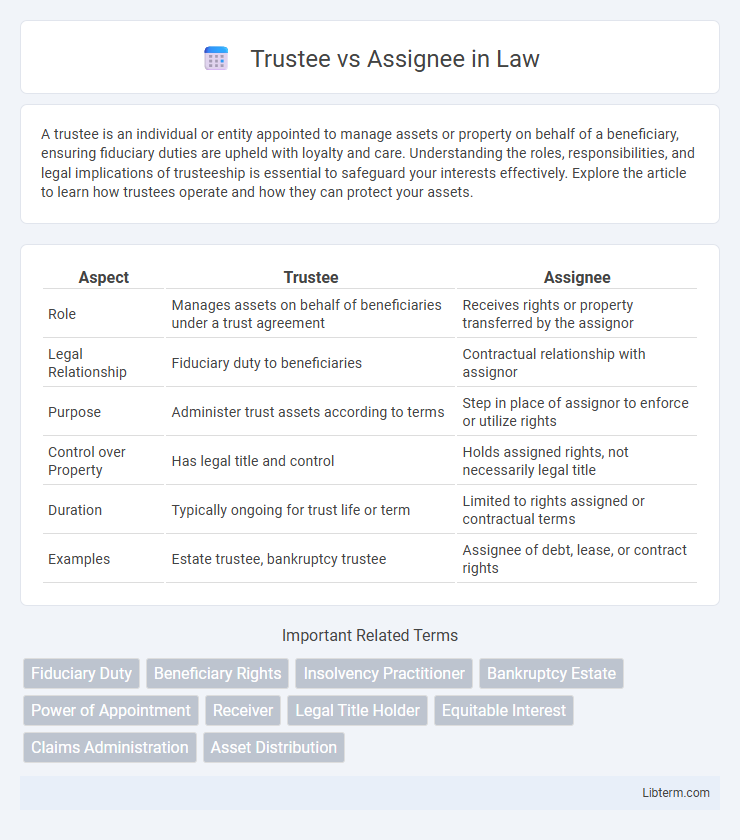

| Aspect | Trustee | Assignee |

|---|---|---|

| Role | Manages assets on behalf of beneficiaries under a trust agreement | Receives rights or property transferred by the assignor |

| Legal Relationship | Fiduciary duty to beneficiaries | Contractual relationship with assignor |

| Purpose | Administer trust assets according to terms | Step in place of assignor to enforce or utilize rights |

| Control over Property | Has legal title and control | Holds assigned rights, not necessarily legal title |

| Duration | Typically ongoing for trust life or term | Limited to rights assigned or contractual terms |

| Examples | Estate trustee, bankruptcy trustee | Assignee of debt, lease, or contract rights |

Understanding the Roles: Trustee vs Assignee

A trustee is an individual or entity appointed to manage assets or property on behalf of another, often within the context of a trust, ensuring fiduciary duties are met according to the trust agreement. An assignee is a party who receives rights or property through assignment, typically acquiring legal title or interest transferred from the assignor, often without ongoing management responsibilities. Distinguishing these roles hinges on the trustee's fiduciary duty and active asset management versus the assignee's role as a recipient of rights or interests without inherent fiduciary obligations.

Key Legal Definitions

A trustee is a person or entity legally appointed to manage assets or property on behalf of a beneficiary, holding fiduciary duties to act in the best interest of the beneficiary according to the terms of a trust. An assignee is an individual or entity that receives the rights or interests in a contract or property from the assignor, often without the same fiduciary obligations associated with trusteeship. Key legal definitions highlight that trustees have ongoing responsibilities and control over trust property, while assignees typically acquire specific rights or interests transferred through assignment agreements.

Appointment and Selection Process

Trustees are appointed through a formal legal process often outlined in a trust deed or by court order, ensuring fiduciary responsibility and oversight in managing trust assets. Assignees are usually selected via contractual agreements or bankruptcy proceedings, with their primary role being the transfer or management of assigned property or claims. The trustee selection emphasizes fiduciary duties and long-term asset management, while assignee appointment focuses on claim administration and debt resolution.

Duties and Responsibilities

A trustee holds legal title to property or assets with a fiduciary duty to manage and protect them in the best interest of the beneficiaries, ensuring compliance with the trust terms and applicable laws. An assignee acquires rights or interests transferred from the assignor but typically does not have fiduciary responsibilities or obligations beyond enforcing contractual rights or obligations. Trustees must exercise loyalty, prudence, and impartiality, while assignees focus on the enforcement and administration of assigned rights or claims.

Fiduciary Obligations Compared

Trustees hold fiduciary obligations requiring them to act in the best interests of beneficiaries by managing assets with prudence, loyalty, and impartiality. Assignees, while responsible for managing assigned assets or claims, typically owe limited fiduciary duties primarily focused on maximizing value for the assignor or creditors. The scope of fiduciary responsibility is broader and more legally enforceable for trustees compared to assignees, who function more as custodians or agents rather than fiduciaries.

Powers in Asset Management

Trustees hold fiduciary responsibilities to manage assets on behalf of beneficiaries, possessing broad powers including controlling, investing, and distributing trust property according to the trust deed. Assignees primarily gain control over the assigned assets for debt recovery or liquidation purposes, with powers limited to managing and disposing of those assets to satisfy creditors. The trustee's powers are governed by trust law and fiduciary duties, whereas the assignee's powers are defined by assignment contracts and relevant insolvency statutes.

Legal Rights and Limitations

Trustees possess fiduciary duties to manage and protect assets on behalf of beneficiaries, with legal rights encompassing asset control, duty of loyalty, and obligations to act in the best interest of the trust. Assignees receive legal rights to enforce or collect assigned claims or property interests but lack fiduciary responsibilities and operate under limitations defined by the assignment agreement and applicable laws. Unlike trustees, assignees cannot manage broader estate matters and their powers are confined to the scope of the assigned rights, highlighting key legal differences in authority and liability.

Trustee vs Assignee in Bankruptcy Proceedings

In bankruptcy proceedings, a trustee is an appointed official responsible for managing the debtor's estate, liquidating assets, and distributing proceeds to creditors according to bankruptcy laws. An assignee, historically used under older bankruptcy laws, is a private party who receives title to the debtor's assets for similar purposes but lacks the formal authority and oversight granted to a trustee. The trustee acts under court supervision to ensure equitable treatment of creditors, while the assignee's role is more limited and less regulated in modern bankruptcy cases.

Termination and Removal Procedures

Trustee termination typically occurs upon completion of the trust's purpose or by court order, with removal provisions often outlined in the trust document allowing for resignation or replacement due to incapacity or breach of duty. Assignee termination involves the transfer or completion of assigned rights, with removal procedures dependent on the underlying contract terms and often require notice to assignor or involved parties. Both roles require formal documentation and may involve legal proceedings to ensure proper transition and protection of beneficiary or creditor interests.

Key Differences Summarized

A trustee holds legal title to trust property and manages it for the benefit of beneficiaries, whereas an assignee receives rights or property transferred from another party, often for debt repayment or contractual obligations. Trustees have fiduciary duties to act in the best interests of beneficiaries, while assignees primarily enforce or collect assigned rights without fiduciary responsibilities. The key difference lies in the scope of authority: trustees manage assets within a trust framework, while assignees operate under assignment agreements transferring specific rights.

Trustee Infographic

libterm.com

libterm.com