A pledge represents a solemn promise or commitment often used to guarantee performance or fulfillment of an obligation. It is a powerful tool in legal and financial contexts, ensuring security for parties involved. Explore the full article to understand how a pledge can safeguard your interests effectively.

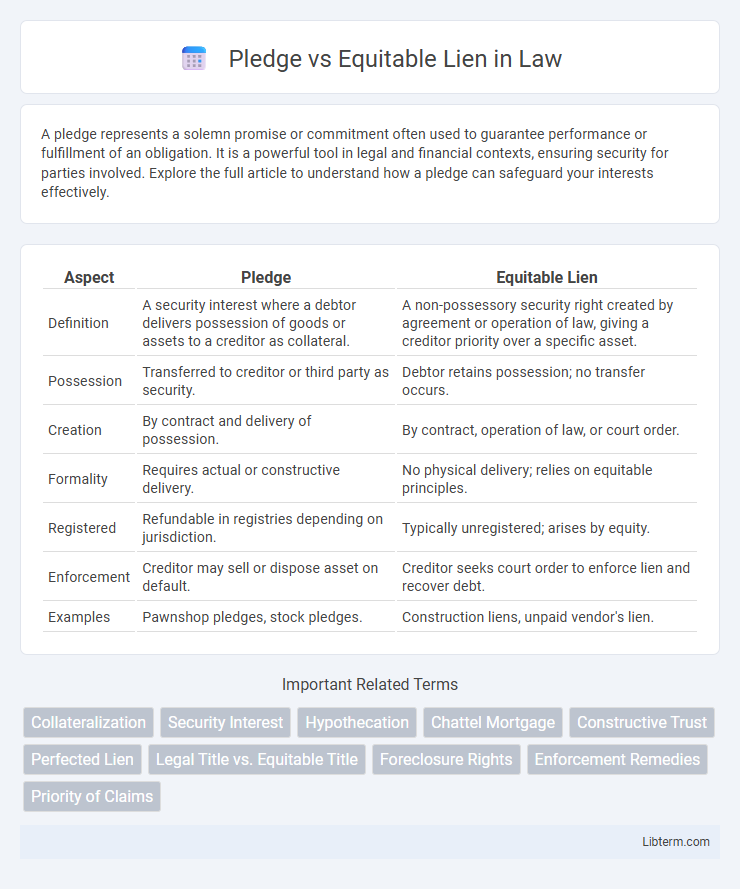

Table of Comparison

| Aspect | Pledge | Equitable Lien |

|---|---|---|

| Definition | A security interest where a debtor delivers possession of goods or assets to a creditor as collateral. | A non-possessory security right created by agreement or operation of law, giving a creditor priority over a specific asset. |

| Possession | Transferred to creditor or third party as security. | Debtor retains possession; no transfer occurs. |

| Creation | By contract and delivery of possession. | By contract, operation of law, or court order. |

| Formality | Requires actual or constructive delivery. | No physical delivery; relies on equitable principles. |

| Registered | Refundable in registries depending on jurisdiction. | Typically unregistered; arises by equity. |

| Enforcement | Creditor may sell or dispose asset on default. | Creditor seeks court order to enforce lien and recover debt. |

| Examples | Pawnshop pledges, stock pledges. | Construction liens, unpaid vendor's lien. |

Introduction to Pledge and Equitable Lien

A pledge is a security interest where a debtor delivers possession of personal property to a creditor as collateral for a loan, allowing the creditor to retain possession until the debt is satisfied. An equitable lien is a non-possessory security interest imposed by a court to prevent unjust enrichment, granting the creditor a right to have specific property applied toward the debt. Both mechanisms protect creditors' interests but differ in possession and enforcement methods.

Definition of Pledge

A pledge is a specific type of security interest where a debtor delivers possession of personal property to a creditor as collateral for a debt, ensuring the creditor's right to sell the property if the debt is unpaid. Unlike an equitable lien, which grants a non-possessory security interest based on fairness, a pledge requires actual transfer of possession. The pledge's primary function is to provide the creditor with immediate control over the collateral to secure repayment.

Definition of Equitable Lien

An equitable lien is a non-possessory security interest that arises by operation of equity, giving the creditor a right to have specific property applied to satisfy a debt or obligation. Unlike a pledge, which involves the creditor taking possession of the debtor's property as security, an equitable lien attaches to property without transfer of possession. This legal remedy ensures priority over other claims by creating a charge on the debtor's asset, enforceable through the courts when monetary debt remains unpaid.

Legal Basis and Principles

A pledge is a possessory security interest where the debtor delivers physical possession of collateral to the creditor, grounded in contract and property law principles emphasizing transfer of custody without ownership change. An equitable lien arises by operation of equity, providing a non-possessory security interest to satisfy a debt from specific property, based on principles of fairness and justice to prevent unjust enrichment. While a pledge requires actual possession, an equitable lien relies on the court's equitable jurisdiction to impose security rights where no formal agreement or possession exists.

Key Differences Between Pledge and Equitable Lien

Pledge involves the delivery of goods or securities as collateral for a debt, granting the pledgee possession and a right to sell if the debtor defaults, while an equitable lien arises by operation of law, giving the lienholder a charge on property without transfer of possession. Pledges are typically consensual, requiring explicit agreement and actual control, whereas equitable liens emerge to prevent unjust enrichment and are enforceable in equity without formal possession or contract. The enforceability and remedies differ: pledge allows for immediate sale of the pledged asset upon default, while equitable lien requires court intervention to establish and enforce the charge on the property.

Creation and Formalities

A pledge is created through the delivery of possession of a movable asset to the creditor as security for a debt, requiring physical transfer or control without ownership transfer, while an equitable lien arises by operation of law to secure a debt when no formal charge exists. Formalities for a pledge include a written agreement and actual or constructive delivery of the pledged property, ensuring enforceability against third parties. Equitable liens do not require possession or formal registration but depend on equitable principles, typically imposed by courts to prevent unjust enrichment.

Rights and Obligations of Parties

In a pledge, the pledgor transfers possession of movable property to the pledgee as security for a debt, granting the pledgee the right to retain and sell the property upon default to recover the owed amount, while the pledgor retains ownership and the obligation to repay the debt. An equitable lien arises by operation of law, giving the lienholder a charge over specific property as security without transferring possession, enabling the lienholder to enforce payment by claiming proceeds from the sale, while the property owner bears the duty to satisfy the secured debt. Both mechanisms protect creditors' interests but differ in possession transfer and enforcement procedures, with pledges involving actual delivery and equitable liens depending on court recognition of security rights.

Enforcement and Remedies

Enforcement of a pledge involves the secured party taking possession of the pledged asset and selling it to satisfy the debt, with strict adherence to contractual terms and statutory procedures. An equitable lien, lacking possession or title transfer, permits the creditor to seek judicial enforcement through a court order directing the sale of the charged asset to recover the debt. Remedies for breach in a pledge primarily include sale of the pledged property and deficiency claims, whereas equitable lien remedies focus on equitable relief such as specific performance or injunctions to prevent unjust enrichment.

Practical Applications and Examples

A pledge involves transferring possession of personal property to a creditor as security for a debt, allowing the creditor to sell the asset if the debtor defaults; for example, pawning a watch to obtain a loan. An equitable lien is a non-possessory security interest imposed by courts to prevent unjust enrichment, such as when funds from a property sale must secure a contractor's payment despite no formal agreement. Practical applications of pledges are common in pawnshops and secured lending, while equitable liens frequently arise in construction disputes and trust law scenarios where direct possession is absent.

Conclusion: Choosing Between Pledge and Equitable Lien

Choosing between a pledge and an equitable lien depends primarily on the nature of the asset and the level of control desired by the secured party. A pledge involves the transfer of possession of the collateral to the creditor, offering stronger security and easier enforcement, while an equitable lien creates a charge on the property without transferring possession, providing more flexibility for the debtor. Opt for a pledge when physical control and priority enforcement are essential, but select an equitable lien if the debtor needs to retain possession and use of the asset during the loan term.

Pledge Infographic

libterm.com

libterm.com