Claim settlement costs can significantly impact your insurance expenses, encompassing legal fees, administrative charges, and payout amounts to claimants. Understanding how these costs are determined and managed helps you make informed decisions about your insurance policies. Explore the rest of this article to learn more about minimizing claim settlement costs effectively.

Table of Comparison

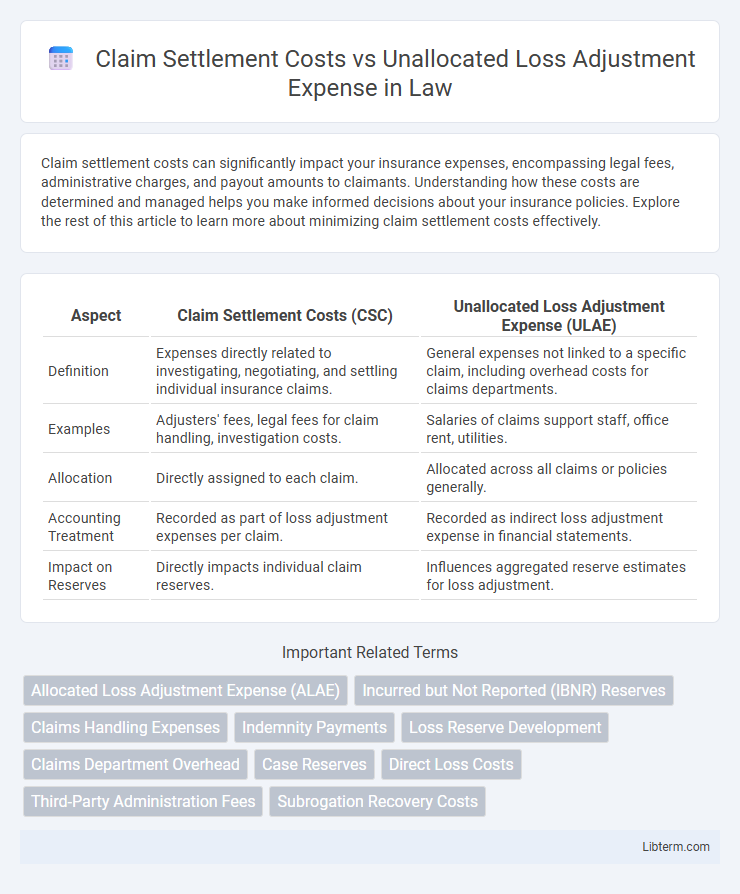

| Aspect | Claim Settlement Costs (CSC) | Unallocated Loss Adjustment Expense (ULAE) |

|---|---|---|

| Definition | Expenses directly related to investigating, negotiating, and settling individual insurance claims. | General expenses not linked to a specific claim, including overhead costs for claims departments. |

| Examples | Adjusters' fees, legal fees for claim handling, investigation costs. | Salaries of claims support staff, office rent, utilities. |

| Allocation | Directly assigned to each claim. | Allocated across all claims or policies generally. |

| Accounting Treatment | Recorded as part of loss adjustment expenses per claim. | Recorded as indirect loss adjustment expense in financial statements. |

| Impact on Reserves | Directly impacts individual claim reserves. | Influences aggregated reserve estimates for loss adjustment. |

Introduction to Claim Settlement Costs

Claim settlement costs represent the expenses directly associated with investigating, negotiating, and resolving insurance claims, including legal fees, adjuster salaries, and claim-related administrative costs. These costs are integral to assessing the financial impact of claims and are accounted for separately from unallocated loss adjustment expenses, which cover general claim management overhead not tied to individual claims. Accurately distinguishing claim settlement costs from unallocated expenses ensures precise financial reporting and effective risk management in the insurance industry.

Defining Unallocated Loss Adjustment Expenses (ULAE)

Unallocated Loss Adjustment Expenses (ULAE) refer to costs incurred by insurance companies that cannot be directly attributed to specific claim settlements. These expenses include administrative overhead, salaries of claims personnel, and general operational costs tied to the overall claims handling process. Unlike claim settlement costs, which are directly associated with individual claims, ULAE represents broader expenses essential for maintaining the claims adjustment infrastructure.

Key Differences: Claim Settlement Costs vs ULAE

Claim Settlement Costs (CSC) refer to direct expenses incurred during the investigation, negotiation, and payment of insurance claims, including legal fees, adjuster salaries, and related costs. Unallocated Loss Adjustment Expense (ULAE) encompasses overhead costs that cannot be directly attributed to specific claims, such as administrative salaries, office rent, and support services involved in the overall claims handling process. The key difference lies in CSC being directly linked to individual claims' resolution, while ULAE represents indirect expenses supporting the entire claims operation without direct allocation to a single claim.

Components of Claim Settlement Costs

Claim settlement costs encompass all expenses directly related to processing and resolving claims, including adjusters' fees, investigation costs, legal fees, and payment of claims to policyholders. These costs are a subset of total claims expenses and are distinct from unallocated loss adjustment expenses (ULAE), which refer to overhead costs such as salaries of claims department staff and office expenses not tied to individual claims. Understanding the components of claim settlement costs aids insurers in accurately pricing policies and managing claim reserves.

Typical Items Included in ULAE

Typical items included in Unallocated Loss Adjustment Expense (ULAE) cover the overhead costs directly related to claims handling but not assignable to specific claims, such as salaries for claims adjusters, office rent, utilities, and administrative expenses. ULAE differs from Claim Settlement Costs, which encompass direct costs like payments to claimants, legal fees, investigation costs, and expert witness fees. Understanding these distinctions is critical for accurate reserving and financial reporting within insurance operations.

Impact on Insurance Financial Statements

Claim settlement costs directly affect the insurer's profit and loss statement by increasing incurred losses and reducing net income, while unallocated loss adjustment expenses (ULAE) are overhead costs not tied to specific claims but are necessary for claims handling, influencing underwriting expenses. Both claim settlement costs and ULAE impact the balance sheet through reserves and liabilities, as insurers must estimate and report these expenses to comply with accounting standards. Accurate measurement and allocation of these costs are critical for insurers to maintain solvency, set appropriate premiums, and ensure transparent financial reporting.

Methods for Calculating Claim Settlement Costs

Methods for calculating claim settlement costs typically involve analyzing direct expenses associated with claims processing, including investigation, legal fees, and payment disbursement. Actuarial techniques such as the case reserve method and paid-incurred (P-I) chain ladder method are commonly used to estimate these costs by projecting future payments based on historical claim data. Accurate differentiation between claim settlement costs and unallocated loss adjustment expenses (ULAE) ensures precise financial reporting and effective reserving strategies in insurance operations.

Approaches to Estimating ULAE

Estimating Unallocated Loss Adjustment Expense (ULAE) typically involves the use of the incurred claims method, which allocates expenses based on the volume of claims processed, or the paid loss method, which ties expenses directly to claims paid over a period. Actuarial approaches like the trend method incorporate historical expense data to project future ULAE more accurately, adjusting for inflation and operational changes. Advanced models may also utilize regression analysis and claim frequency to refine estimates, ensuring costs reflect the underlying claims settlement process rather than direct claim reimbursements.

Strategies to Minimize Both Expenses

Implementing advanced data analytics enhances accuracy in claim assessments, reducing Claim Settlement Costs by pinpointing fraudulent or inflated claims early. Streamlining administrative processes and investing in automation minimizes Unallocated Loss Adjustment Expense through improved efficiency and reduced overhead. Training claims personnel in effective negotiation techniques helps control payout amounts while maintaining customer satisfaction, thereby lowering overall claim-related expenditures.

Implications for Insurers and Policyholders

Claim settlement costs directly impact an insurer's financial stability by affecting loss reserves and underwriting profitability, while unallocated loss adjustment expenses (ULAE) represent administrative costs that cannot be traced to specific claims, influencing overall expense management. For insurers, accurate allocation between claim settlement costs and ULAE is critical for regulatory compliance and pricing strategies, with improper classification potentially leading to misleading financial statements. Policyholders may experience variations in premium rates and claim service quality, as insurers adjust reserves and expense assumptions based on these cost distinctions.

Claim Settlement Costs Infographic

libterm.com

libterm.com