The Presentment Clause outlines the constitutional procedure for how a bill becomes law by requiring that any legislation passed by Congress be presented to the President for approval or veto. This process ensures a system of checks and balances between the legislative and executive branches, preventing unilateral lawmaking. Explore the rest of the article to understand how the Presentment Clause shapes the legislative process and your role within the US government framework.

Table of Comparison

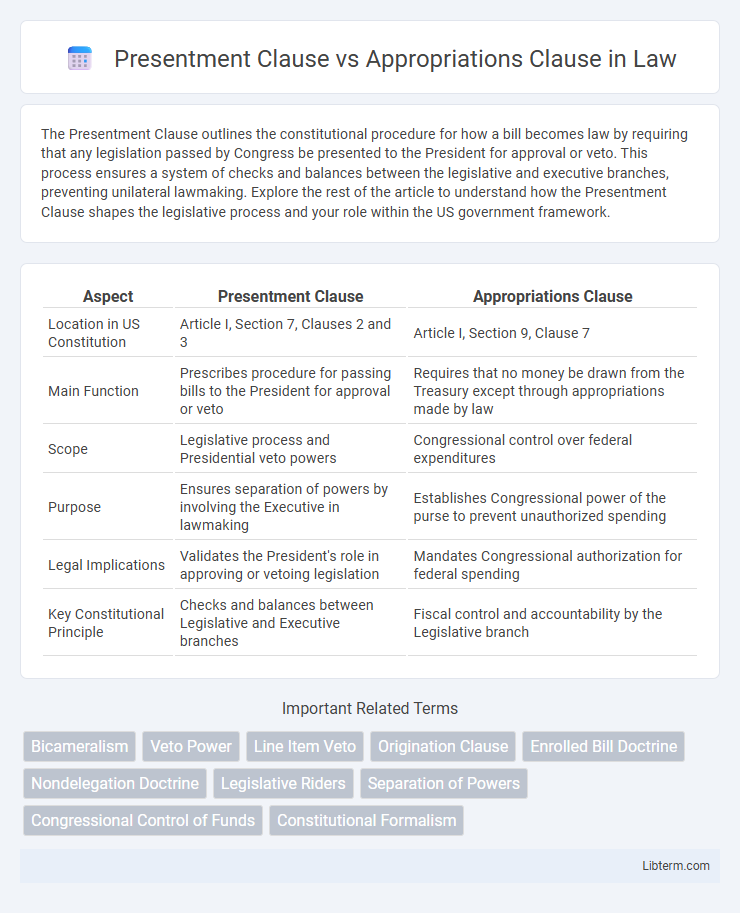

| Aspect | Presentment Clause | Appropriations Clause |

|---|---|---|

| Location in US Constitution | Article I, Section 7, Clauses 2 and 3 | Article I, Section 9, Clause 7 |

| Main Function | Prescribes procedure for passing bills to the President for approval or veto | Requires that no money be drawn from the Treasury except through appropriations made by law |

| Scope | Legislative process and Presidential veto powers | Congressional control over federal expenditures |

| Purpose | Ensures separation of powers by involving the Executive in lawmaking | Establishes Congressional power of the purse to prevent unauthorized spending |

| Legal Implications | Validates the President's role in approving or vetoing legislation | Mandates Congressional authorization for federal spending |

| Key Constitutional Principle | Checks and balances between Legislative and Executive branches | Fiscal control and accountability by the Legislative branch |

Introduction to Constitutional Clauses

The Presentment Clause, found in Article I, Section 7 of the U.S. Constitution, outlines the process by which Congress must present bills to the President for approval or veto, ensuring a check on legislative power. The Appropriations Clause, located in Article I, Section 9, mandates that no money can be drawn from the Treasury except through appropriations made by law, emphasizing Congressional control over government spending. Together, these clauses establish foundational principles for the separation of powers and fiscal responsibility within the federal government.

Understanding the Presentment Clause

The Presentment Clause, found in Article I, Section 7 of the U.S. Constitution, mandates that every bill passed by Congress must be presented to the President for approval or veto, ensuring executive review of legislative acts. This clause functions as a crucial check on legislative power by requiring presidential assent or rejection before a bill becomes law, distinct from the Appropriations Clause which specifically governs the allocation and authorization of federal spending. Understanding the Presentment Clause highlights the balance of power designed to prevent unilateral lawmaking and to maintain separation of powers between the legislative and executive branches.

Exploring the Appropriations Clause

The Appropriations Clause, found in Article I, Section 9, Clause 7 of the U.S. Constitution, grants Congress the exclusive power to control federal spending by requiring that no money be drawn from the Treasury unless appropriated by law. This clause serves as a crucial check on executive power by ensuring that all public funds are allocated through legislation, thereby promoting fiscal accountability and transparency. Its interpretation often contrasts with the Presentment Clause, which outlines the process for presidential approval of legislation, highlighting the distinct roles of Congress in funding and the President in executing laws.

Historical Context and Origins

The Presentment Clause, found in Article I, Section 7 of the U.S. Constitution, originated from the Founding Fathers' desire to create a clear legislative process for enacting laws, ensuring presidential review to maintain checks and balances on Congressional power. The Appropriations Clause, located in Article I, Section 9, was rooted in colonial practices aimed at controlling the expenditure of public funds by requiring explicit legislative approval for government spending. Both clauses reflect the framers' intent to balance authority between branches, prevent unchecked government actions, and safeguard taxpayer resources through carefully defined constitutional mechanisms.

Key Differences Between Presentment and Appropriations Clauses

The Presentment Clause, found in Article I, Section 7 of the U.S. Constitution, requires that all bills passed by Congress be presented to the President for approval or veto, serving as a key part of the legislative process. The Appropriations Clause, located in Article I, Section 9, mandates that no money shall be drawn from the Treasury except through appropriations made by law, ensuring Congressional control over government spending. The key difference lies in the Presentment Clause governing how bills become law through Presidential review, while the Appropriations Clause restricts funds' disbursement, reflecting separate but complementary roles in budgetary authorization and legislative enactment.

Role in Legislative Process

The Presentment Clause mandates that all bills passed by both houses of Congress be presented to the President for approval or veto, ensuring executive oversight in lawmaking. The Appropriations Clause grants Congress the exclusive power to allocate federal funds, authorizing the expenditure of government resources according to enacted legislation. Together, these clauses balance legislative authority by controlling both the passage of laws and the disbursement of public money through constitutional checks.

Impact on the Balance of Powers

The Presentment Clause mandates that all bills passed by Congress must be presented to the President for approval or veto, reinforcing the executive's role in legislative enactment and providing a direct check on Congressional power. The Appropriations Clause grants Congress the exclusive authority to allocate federal funds, ensuring legislative control over government spending and limiting executive discretion in budgetary matters. Together, these clauses establish a dynamic equilibrium where the executive can influence lawmaking through veto power while Congress retains fiscal control, maintaining a robust balance of powers within the federal government.

Landmark Supreme Court Cases

The Presentment Clause, established in Article I, Section 7 of the U.S. Constitution, mandates that all bills passed by Congress must be presented to the President for approval or veto, as reinforced in the 1911 Supreme Court case *The Pocket Veto Case* (Okanogan, Newport & Northern Railway Co. v. United States). The Appropriations Clause, found in Article I, Section 9, requires that no money be drawn from the Treasury except through appropriations made by law, underscored by the 2016 decision in *United States v. MacCollom*, which affirmed Congress's exclusive power over federal spending. These clauses delineate the separation of powers, with landmark cases such as *Marbury v. Madison* (1803) emphasizing the boundaries of legislative versus executive authority in the budgetary and lawmaking process.

Modern Applications and Debates

The Presentment Clause, outlined in Article I, Section 7 of the U.S. Constitution, governs the process by which Congress passes laws and presents them to the President for approval or veto, ensuring a structured legislative procedure. The Appropriations Clause, found in Article I, Section 9, mandates that no money can be drawn from the Treasury without an appropriation made by law, securing congressional control over federal spending. Modern debates focus on the balance of power between the legislative and executive branches, especially regarding emergency spending, budget impasses, and executive actions bypassing traditional appropriations, raising questions about constitutional limits and accountability.

Conclusion: Significance in American Governance

The Presentment Clause establishes the formal process for the President to review and either approve or veto legislation passed by Congress, ensuring executive check on legislative power. The Appropriations Clause mandates that no money can be drawn from the Treasury without a specific law passed by Congress, securing legislative control over federal expenditures. Together, these clauses balance authority between branches, reinforcing constitutional checks and safeguards vital to American governance.

Presentment Clause Infographic

libterm.com

libterm.com