A life estate grants an individual the right to use and control a property for the duration of their lifetime, after which the property passes to another designated party. This legal arrangement offers a way to manage estate planning, ensuring your property benefits loved ones while you retain use during your lifetime. Explore the rest of the article to understand how a life estate can impact your estate strategy and property rights.

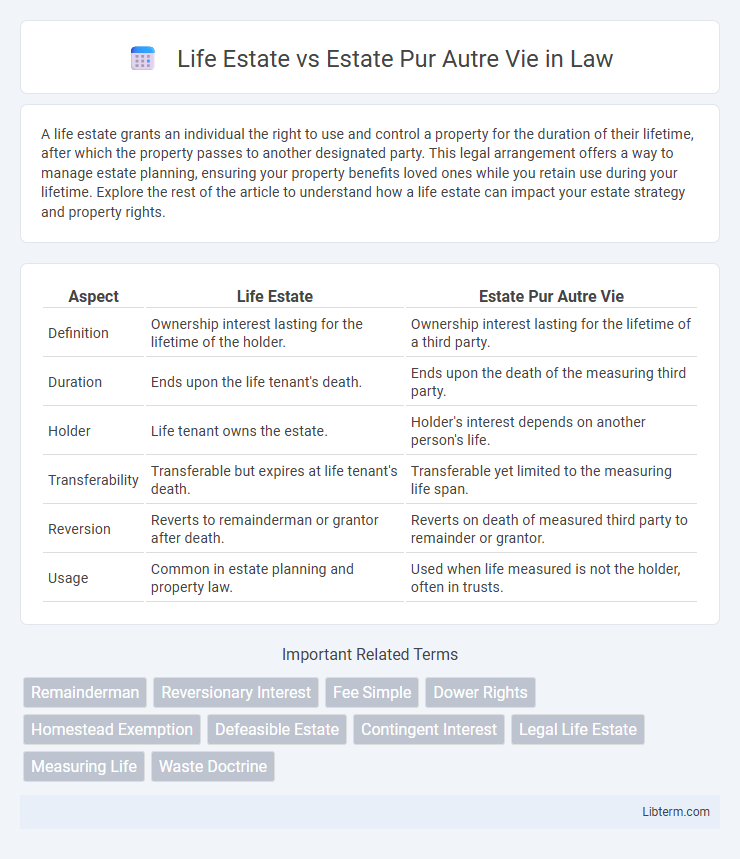

Table of Comparison

| Aspect | Life Estate | Estate Pur Autre Vie |

|---|---|---|

| Definition | Ownership interest lasting for the lifetime of the holder. | Ownership interest lasting for the lifetime of a third party. |

| Duration | Ends upon the life tenant's death. | Ends upon the death of the measuring third party. |

| Holder | Life tenant owns the estate. | Holder's interest depends on another person's life. |

| Transferability | Transferable but expires at life tenant's death. | Transferable yet limited to the measuring life span. |

| Reversion | Reverts to remainderman or grantor after death. | Reverts on death of measured third party to remainder or grantor. |

| Usage | Common in estate planning and property law. | Used when life measured is not the holder, often in trusts. |

Introduction to Life Estate and Estate Pur Autre Vie

A Life Estate grants ownership of property for the duration of a person's lifetime, typically the life tenant, after which the estate passes to a designated remainderman. Estate Pur Autre Vie differs by basing the property's tenure on the life of a third party, not the life tenant, allowing possession to continue until that third party's death. Both convey limited ownership interests but hinge on differing life spans that determine estate duration.

Defining a Life Estate

A life estate grants ownership of property for the duration of a person's lifetime, known as the life tenant, who has the right to use and benefit from the property until their death. Estate pur autre vie differs by measuring the ownership term based on the life of a third party rather than the life tenant. Both structures create future interests, with the property reverting to the original owner or a remainderman after the measuring life ends.

Understanding Estate Pur Autre Vie

Estate pur autre vie is a type of life estate measured by the life of a person other than the grantee, often referred to as the measuring life. This legal arrangement grants possession and use of property for the duration of the measuring life, after which the estate reverts to the original grantor or a remainder beneficiary. Understanding estate pur autre vie is crucial for estate planning and property interests, especially when the measuring life is someone other than the property holder.

Key Differences Between Life Estate and Estate Pur Autre Vie

A Life Estate grants property ownership to an individual for the duration of their own lifetime, after which the property passes to a remainderman. An Estate Pur Autre Vie, however, lasts for the lifetime of a third party, meaning the holder's interest ends when that specified person dies. The key difference lies in the measuring life: Life Estate is measured by the grantee's life, while Estate Pur Autre Vie depends on the lifespan of another individual.

Legal Implications of Each Estate Type

Life estate grants a person ownership and rights to use property for their lifetime, with the legal implication that the property reverts to the remainderman upon their death, limiting the life tenant's ability to sell or encumber the property permanently. Estate pur autre vie is tied to the life of a third party, meaning the grantee's interest lasts until that third party's death, creating complexities in property transfer and potential disputes in identifying the measuring life. Both estate types impact estate planning, taxation, and creditor claims, requiring careful legal drafting to ensure clarity of rights and succession.

Rights and Responsibilities of Life Tenants

Life tenants in a Life Estate hold the right to possess, use, and derive benefits from the property during their lifetime, with the responsibility to maintain it without causing waste. In an Estate Pur Autre Vie, the life tenant's rights and duties are similarly tied to the duration of another person's life, requiring them to preserve the property's value until that measuring life ends. Both types of estates impose fiduciary duties on life tenants, ensuring the property remains intact for remaindermen or reversioners after the life interest concludes.

Transferability and Termination Explained

A Life Estate grants property ownership for the duration of the life tenant's lifetime, terminating upon their death and transferring full ownership to the remainderman without requiring probate. Estate Pur Autre Vie lasts for the lifetime of a third party, known as the measuring life, and its transferability depends on the specific terms set by the grantor, often limiting alienation or transfer rights. Both estates terminate upon the relevant life's death, but the distinct measuring life in Estate Pur Autre Vie affects the timing and conditions under which the property interest ends and passes to successors.

Benefits and Drawbacks of Life Estates

Life estates provide property owners the ability to use and control real estate during their lifetime, ensuring the property passes directly to the remainderman without probate, which offers clear transfer and potential tax benefits; however, life tenants must maintain the property and cannot sell or encumber it beyond the life estate's term. Estate pur autre vie, where the life estate is measured by another person's life, allows flexible duration tied to a third party but introduces uncertainty in property interest length, complicating financial and estate planning. Life estates limit the owner's control and can affect eligibility for certain benefits, while their irrevocable nature benefits heirs by protecting future interests.

Common Uses and Scenarios for Estate Pur Autre Vie

Estate Pur Autre Vie commonly arises in situations where property is granted to one person for the duration of another's life, such as when a life tenant holds an interest measured by a third party's lifespan. This estate type frequently appears in trust arrangements, guardianship estates, or familial property settlements to provide tailored possession and use rights while preserving remainder interests for heirs. It ensures flexible management of property during the designated life term, often used to protect interests of minors or dependents until a specified person's death.

Choosing the Right Estate Structure for Your Needs

Choosing between a life estate and an estate pur autre vie depends on the specific parties involved and the intended duration of property interests. A life estate grants ownership rights to the life tenant for their own lifetime, while an estate pur autre vie extends ownership based on the lifetime of another designated person. Understanding the implications on control, inheritance, and tax considerations is essential to selecting the optimal estate structure that aligns with your long-term goals and legal requirements.

Life Estate Infographic

libterm.com

libterm.com