Foreclosure occurs when a homeowner defaults on mortgage payments, leading the lender to seize and sell the property to recover the debt. This process can severely impact your credit score and financial stability, making it essential to understand your options before it reaches this stage. Discover effective strategies to prevent foreclosure and protect your investment in the following article.

Table of Comparison

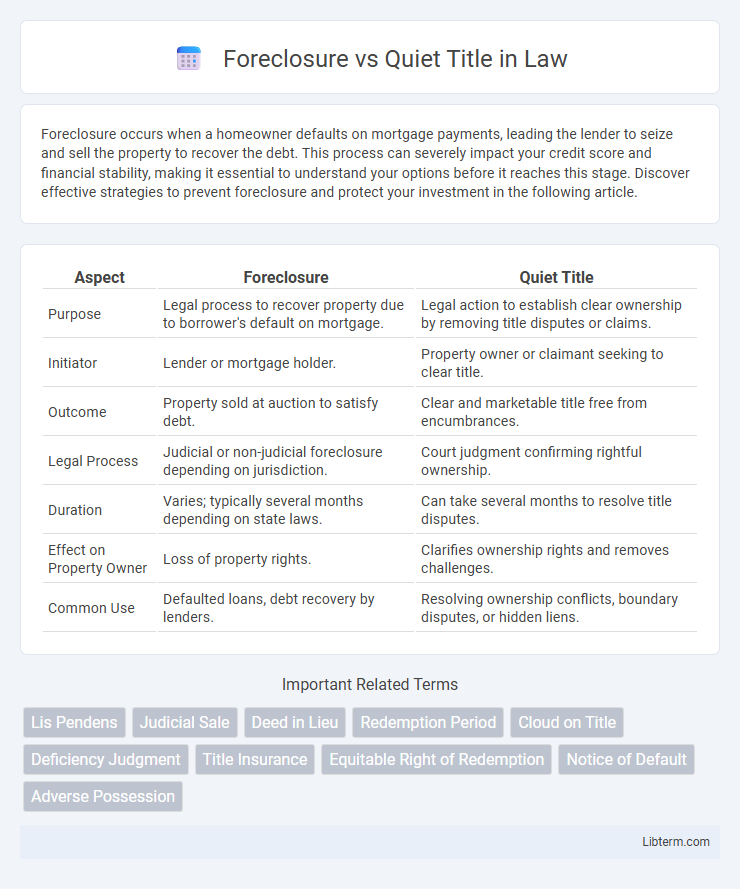

| Aspect | Foreclosure | Quiet Title |

|---|---|---|

| Purpose | Legal process to recover property due to borrower's default on mortgage. | Legal action to establish clear ownership by removing title disputes or claims. |

| Initiator | Lender or mortgage holder. | Property owner or claimant seeking to clear title. |

| Outcome | Property sold at auction to satisfy debt. | Clear and marketable title free from encumbrances. |

| Legal Process | Judicial or non-judicial foreclosure depending on jurisdiction. | Court judgment confirming rightful ownership. |

| Duration | Varies; typically several months depending on state laws. | Can take several months to resolve title disputes. |

| Effect on Property Owner | Loss of property rights. | Clarifies ownership rights and removes challenges. |

| Common Use | Defaulted loans, debt recovery by lenders. | Resolving ownership conflicts, boundary disputes, or hidden liens. |

Understanding Foreclosure: Definition and Process

Foreclosure is a legal process initiated by a lender to recover the balance of a loan from a borrower who has stopped making payments, typically resulting in the forced sale of the property. The process begins with a notice of default, followed by a public auction where the property is sold to the highest bidder, which can be the lender if no higher bids are received. Understanding foreclosure involves recognizing its impact on credit scores, potential for deficiency judgments, and the timeline that varies by state and loan type.

What is a Quiet Title Action?

A Quiet Title Action is a legal proceeding used to resolve disputes over property ownership and establish a clear title free from claims or encumbrances. Unlike foreclosure, which involves the forced sale of a property to satisfy a debt, a Quiet Title Action aims to clarify ownership rights, remove clouds on the title, and prevent future challenges. This process is essential for property owners seeking to confirm their ownership status and ensure marketable title.

Key Differences Between Foreclosure and Quiet Title

Foreclosure is a legal process where a lender seeks to recover the balance of a loan by forcing the sale of a property after the borrower defaults, often resulting in loss of ownership. Quiet title is a lawsuit filed to establish ownership of real property by resolving any disputes or claims and clearing the title from liens or encumbrances. The key difference lies in foreclosure addressing debt recovery and possession, while quiet title focuses on clarifying and securing property ownership without involving foreclosure or payment defaults.

Legal Grounds for Foreclosure

Legal grounds for foreclosure typically include borrower default on mortgage payments, violation of loan terms, or failure to pay property taxes, which legally justify the lender's right to initiate foreclosure proceedings. Foreclosure seeks to recover the unpaid loan balance through forced sale of the property, whereas a quiet title action resolves disputes over property ownership by removing clouds or defects from the title. Understanding these distinct legal bases is crucial for lenders, borrowers, and property owners navigating foreclosure or title disputes.

When to File a Quiet Title Lawsuit

A quiet title lawsuit should be filed when there is a dispute or uncertainty regarding the ownership of a property, such as after a foreclosure sale where the title might be clouded by claims or liens. This legal action helps to establish clear ownership by resolving any competing interests or defects in the title. Foreclosure ends the previous owner's rights due to loan default, but a quiet title ensures the new owner's claim is uncontested and legally recognized.

Implications for Property Owners

Foreclosure significantly impacts property owners by potentially causing loss of ownership and damaging credit scores due to unpaid mortgage debts. Quiet title actions help property owners resolve ownership disputes and clear clouds on the title, ensuring undisputed property rights. Understanding these legal processes is crucial for property owners to protect their real estate investments and avoid costly litigation.

Impact on Real Estate Investors

Foreclosure often results in a loss of property and damages an investor's credit score, limiting future borrowing power and investment opportunities. Quiet title actions streamline ownership disputes, providing clear title and reducing legal risks, which enhances a property's marketability and investor confidence. Understanding these processes is crucial for real estate investors aiming to protect assets and ensure smooth property transactions.

Common Disputes Resolved by Quiet Title

Quiet title actions primarily resolve common disputes involving unclear property ownership claims, such as boundary disagreements, competing liens, and claims of adverse possession. These cases clarify title defects and remove clouds on property titles without affecting lien priorities, unlike foreclosure actions that primarily address unpaid mortgage debts. Quiet title suits provide legal certainty by establishing clear ownership rights, essential for selling or financing real estate.

Choosing the Right Legal Action

Choosing the right legal action between foreclosure and quiet title depends on the specific property dispute and financial circumstances. Foreclosure is typically pursued to recover unpaid mortgage debt by selling the property, while quiet title actions aim to resolve ownership disputes and clear title defects. Evaluating the goal--debt recovery versus establishing clear ownership--ensures selecting the most effective legal process.

Frequently Asked Questions: Foreclosure vs Quiet Title

Foreclosure involves a lender's legal process to reclaim property due to mortgage default, whereas quiet title is a lawsuit to establish clear property ownership and remove claims or liens. Common questions include: Can a quiet title action stop a foreclosure? Generally, no; quiet title clarifies ownership but does not prevent foreclosure if the mortgage is unpaid. Another FAQ is whether foreclosure affects quiet title; foreclosure can cloud title, making quiet title actions necessary to resolve ownership disputes after foreclosure sales.

Foreclosure Infographic

libterm.com

libterm.com