An executor plays a crucial role in managing and distributing a deceased person's estate according to their will and legal requirements. This responsibility includes gathering assets, paying debts, and ensuring your loved one's wishes are honored efficiently. Explore the rest of the article to understand the full scope of an executor's duties and how to choose the right person for this important task.

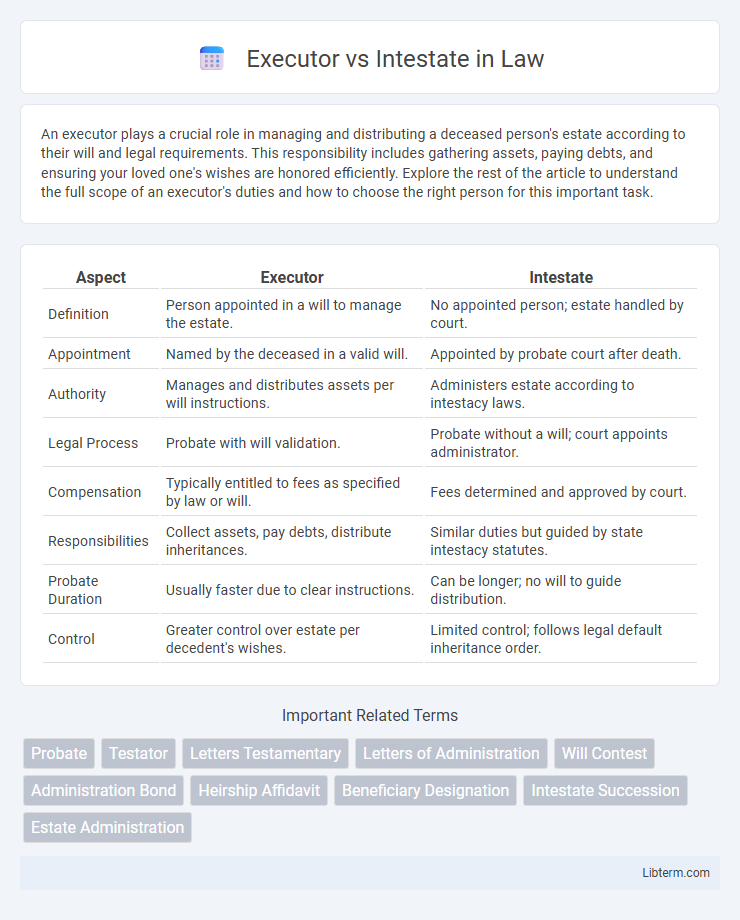

Table of Comparison

| Aspect | Executor | Intestate |

|---|---|---|

| Definition | Person appointed in a will to manage the estate. | No appointed person; estate handled by court. |

| Appointment | Named by the deceased in a valid will. | Appointed by probate court after death. |

| Authority | Manages and distributes assets per will instructions. | Administers estate according to intestacy laws. |

| Legal Process | Probate with will validation. | Probate without a will; court appoints administrator. |

| Compensation | Typically entitled to fees as specified by law or will. | Fees determined and approved by court. |

| Responsibilities | Collect assets, pay debts, distribute inheritances. | Similar duties but guided by state intestacy statutes. |

| Probate Duration | Usually faster due to clear instructions. | Can be longer; no will to guide distribution. |

| Control | Greater control over estate per decedent's wishes. | Limited control; follows legal default inheritance order. |

Understanding the Role of an Executor

An executor is a legally appointed individual responsible for administering a deceased person's estate according to their will, ensuring assets are distributed as specified. In contrast, intestate refers to the situation where no valid will exists, leading the court to appoint an administrator to manage estate distribution based on state laws. The executor's duties include validating the will, paying debts, and managing estate taxes, which distinguishes their role from administrators in intestate cases where state succession laws dictate the process.

What Does Intestate Mean?

Intestate means dying without a valid will, which triggers state laws to determine asset distribution among heirs. When someone dies intestate, an administrator--rather than an executor appointed by a will--is appointed by the court to manage the estate. This process often results in a longer probate timeline and potential disputes compared to estates with a clear executor named.

Key Differences Between Executor and Intestate

An executor is a person appointed in a will to administer and distribute a deceased person's estate according to the will's instructions, ensuring legal and financial obligations are met. In contrast, intestate refers to a situation where a person dies without a valid will, resulting in the court appointing an administrator to handle asset distribution based on state intestacy laws. Key differences include the presence of a will guiding the executor's duties, whereas intestate proceedings follow statutory rules without a named representative.

Appointment Process: Executor vs. Intestate

The appointment process for an executor begins with the testator naming a trusted individual in their will, who is then formally confirmed by the probate court to manage the estate. In cases of intestacy, where no will exists, the court appoints an administrator, often a close relative, to oversee estate distribution according to state laws. The executor's appointment is proactive and predetermined, while the intestate administrator's role arises from the absence of a valid will, requiring the court's intervention to identify a suitable appointee.

Legal Responsibilities of an Executor

The executor holds the legal responsibility to administer and distribute the deceased's estate according to the will, ensuring all debts and taxes are paid. They must file necessary probate documents, secure assets, and manage creditor claims throughout the estate settlement process. In contrast, intestate cases require a court-appointed administrator who follows state intestacy laws to distribute assets when no valid will exists.

Who Inherits When There’s No Executor?

When there's no executor appointed in a will, the probate court typically appoints an administrator to manage the estate, ensuring proper distribution of assets. If the decedent died intestate (without a valid will), state intestacy laws determine the heirs, usually prioritizing spouses, children, and close relatives based on a legal hierarchy. The absence of an executor or will often prolongs the probate process and may lead to distribution according to default state succession rules rather than the decedent's preferences.

Estate Distribution: Will vs. Intestacy

Estate distribution under a will is guided by the testator's explicit instructions, with the executor responsible for ensuring assets are transferred according to those wishes. In intestacy, estate distribution follows statutory laws where no will exists, and an administrator is appointed to allocate assets to legal heirs based on state-specific intestate succession rules. This distinction impacts how property, debts, and taxes are managed, often affecting beneficiaries' rights and timelines for inheritance.

Challenges Faced by Executors

Executors face challenges including navigating complex legal requirements and managing diverse assets while ensuring the deceased's debts and taxes are settled accurately. Communication with beneficiaries often involves resolving disputes and maintaining transparency throughout the probate process. Time management is critical as executors must meet court deadlines and avoid personal liability during estate administration.

Navigating Probate: Executor vs. Intestate Estates

Navigating probate requires understanding the critical distinction between executor and intestate estates, as executors manage the distribution of assets according to a valid will, while intestate estates follow state laws of succession in the absence of a will. An executor, often appointed by the testator, has legal authority to settle debts, pay taxes, and distribute property, streamlining the probate process. In contrast, intestate estates undergo court supervision to appoint an administrator who oversees the asset distribution, often resulting in longer probate timelines and potential family disputes.

Preventing Intestacy: Importance of a Will

Creating a valid will designates an executor who manages estate distribution according to the testator's wishes, thereby preventing intestacy and the state's default asset allocation. Without a will, intestate succession laws determine heirs, often causing delays, increased legal costs, and potential family disputes due to unclear intentions. Clearly outlining estate plans through a legally drafted will ensures a smooth probate process, protects beneficiaries' interests, and reduces administrative burdens.

Executor Infographic

libterm.com

libterm.com