Willpower is a critical factor in achieving your goals, enabling you to resist short-term temptations in favor of long-term rewards. Developing strong willpower can improve focus, discipline, and overall success in personal and professional life. Explore this article to discover effective strategies for strengthening your willpower and boosting your motivation.

Table of Comparison

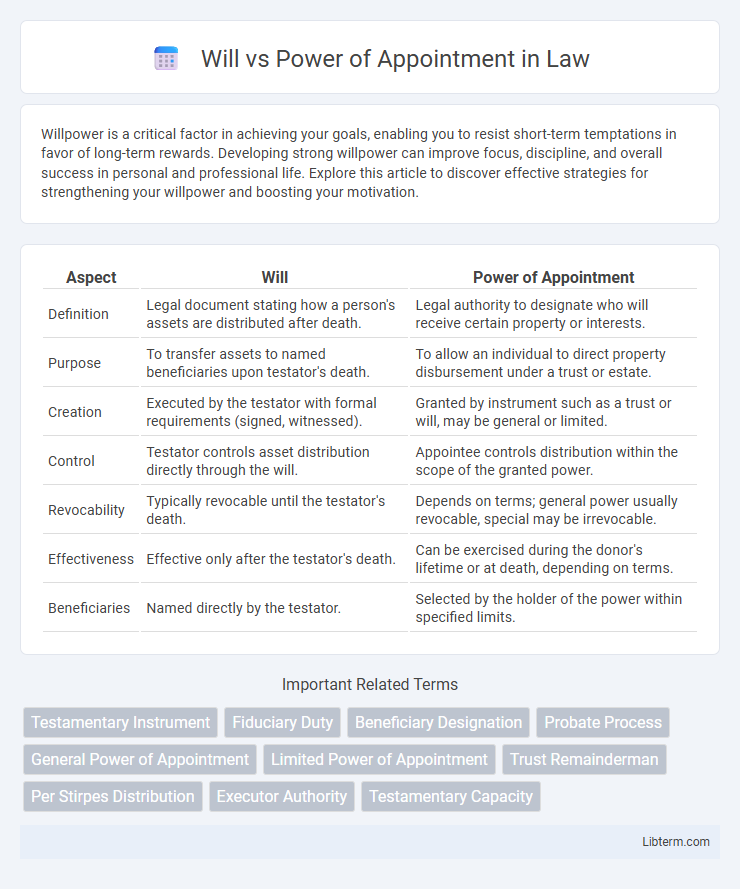

| Aspect | Will | Power of Appointment |

|---|---|---|

| Definition | Legal document stating how a person's assets are distributed after death. | Legal authority to designate who will receive certain property or interests. |

| Purpose | To transfer assets to named beneficiaries upon testator's death. | To allow an individual to direct property disbursement under a trust or estate. |

| Creation | Executed by the testator with formal requirements (signed, witnessed). | Granted by instrument such as a trust or will, may be general or limited. |

| Control | Testator controls asset distribution directly through the will. | Appointee controls distribution within the scope of the granted power. |

| Revocability | Typically revocable until the testator's death. | Depends on terms; general power usually revocable, special may be irrevocable. |

| Effectiveness | Effective only after the testator's death. | Can be exercised during the donor's lifetime or at death, depending on terms. |

| Beneficiaries | Named directly by the testator. | Selected by the holder of the power within specified limits. |

Understanding Wills: Definition and Purpose

A will is a legal document that outlines how a person's assets and property should be distributed after their death, ensuring their wishes are carried out. The power of appointment is a specific legal authority granted in a will or trust that allows an appointed person to direct the distribution of certain property to designated beneficiaries. Understanding the distinction between a will and the power of appointment helps in effective estate planning and asset management.

What Is a Power of Appointment?

A Power of Appointment is a legal authority granted to an individual, known as the appointee, allowing them to decide how to distribute certain property or assets in a trust or estate. Unlike a will, which specifies the testator's direct instructions for asset distribution after death, a power of appointment gives flexibility to alter beneficiaries within the scope defined by the original grantor. This tool is often used in estate planning to provide adaptability and control over the allocation of assets, especially for trust management or complex family circumstances.

Key Differences Between Wills and Powers of Appointment

A will serves as a legal document specifying the distribution of a deceased person's estate, effective only after death. In contrast, a power of appointment grants an individual the authority to designate who will receive certain property, often during the grantor's lifetime or upon their death. Key differences include the will's role in probate and direct instruction of asset distribution, while a power of appointment provides flexibility by allowing the appointee to choose beneficiaries within the scope defined by the grantor.

How Wills Direct Asset Distribution

Wills direct asset distribution by specifying how a testator's estate is allocated among beneficiaries upon death, often detailing specific property or amounts to individuals or organizations. This legal document ensures clear instructions that courts follow during probate to transfer ownership effectively and avoid disputes. Unlike a power of appointment, which grants someone the authority to decide asset distribution, a will directly outlines the decedent's final wishes for asset division.

Types of Powers of Appointment Explained

Powers of appointment are legal mechanisms that allow an individual to designate who will receive property under a will, trust, or other estate plan, and they come in two main types: general and special (or limited) powers. General powers of appointment grant the holder the authority to appoint assets to themselves, their creditors, or their estate, creating potential estate tax implications. Special powers of appointment restrict the appointee to selecting beneficiaries from a specific group, often excluding the holder, which influences control, tax treatment, and fiduciary responsibilities in estate planning.

Legal Requirements for Valid Wills

A valid will must comply with state-specific legal requirements, including being in writing, signed by the testator, and witnessed by at least two competent individuals. Unlike a power of appointment, which grants someone the authority to designate beneficiaries under a trust or will, a will formalizes the testator's direct instructions for asset distribution after death. Proper execution of a will ensures its enforceability in probate court, while powers of appointment often require separate documentation and may be governed by different statutory rules.

Exercising a Power of Appointment in Estate Planning

Exercising a power of appointment in estate planning allows a designated individual to direct the distribution of trust or estate assets according to the grantor's terms, enhancing flexibility in asset management. Unlike a will, which dictates the distribution of a decedent's property, the power of appointment enables the appointee to modify beneficiaries or terms within specified limits, providing strategic control over the estate. Proper use of this power can optimize tax benefits and address changing family dynamics, making it a critical tool for personalized estate planning.

Limitations and Flexibility: Will vs Power of Appointment

A will provides limited post-death control restricted by probate laws and challenges in modifying terms once executed, whereas a power of appointment offers greater flexibility by allowing designated individuals to alter property distribution during their lifetime or at death. Powers of appointment can be general or special, limiting or expanding the appointee's authority, while wills are rigid legal documents subject to probate court oversight. This flexibility in powers of appointment enables tailored estate planning strategies that adapt to changing circumstances, unlike the more fixed provisions of a will.

Common Misconceptions About Wills and Powers of Appointment

Many mistakenly believe a will automatically grants powers of appointment, but these are distinct legal tools with different functions; a will directs asset distribution upon death, while a power of appointment allows a designated person to decide who receives certain property, often in trusts. Another common misconception is that powers of appointment can only be exercised through a will, whereas they may be exercised during life or death depending on the instrument's terms. Understanding how each operates is crucial for effective estate planning and avoiding unintended property transfers.

Choosing Between a Will and a Power of Appointment

Choosing between a will and a power of appointment depends on the level of control desired over asset distribution and flexibility for heirs. A will offers clear instructions for asset transfer at death, while a power of appointment allows a designated individual to decide how to distribute property, which can adapt to changing circumstances. Understanding estate goals and potential tax implications helps determine which instrument aligns best with long-term planning needs.

Will Infographic

libterm.com

libterm.com