The Supremacy Clause establishes that the Constitution, federal laws, and treaties are the supreme law of the land, overriding conflicting state laws. This ensures uniformity and coherence in the legal system across all states, preventing legal disputes over jurisdictional authority. Explore the rest of the article to understand how the Supremacy Clause impacts Your rights and the balance of federal and state powers.

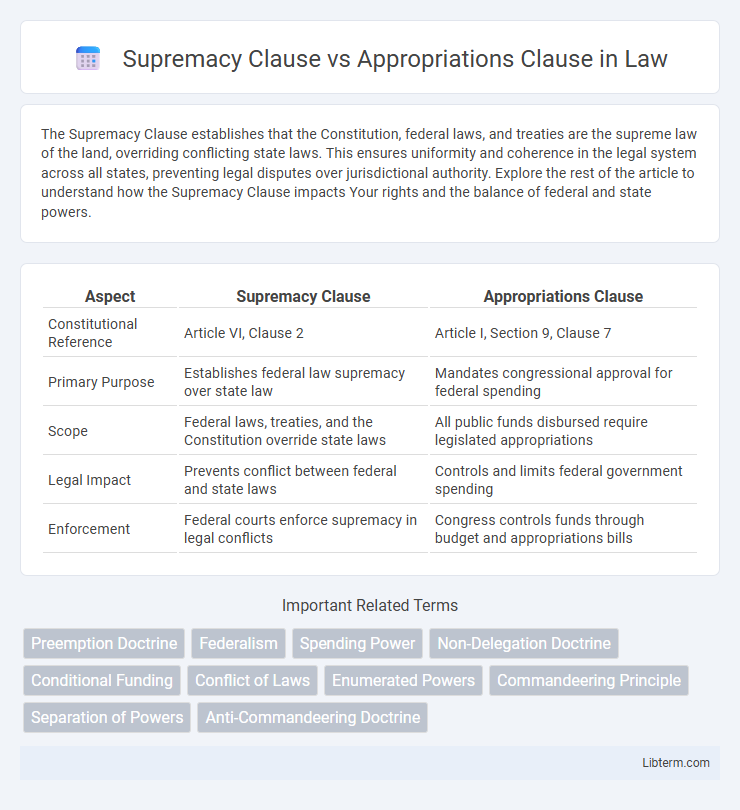

Table of Comparison

| Aspect | Supremacy Clause | Appropriations Clause |

|---|---|---|

| Constitutional Reference | Article VI, Clause 2 | Article I, Section 9, Clause 7 |

| Primary Purpose | Establishes federal law supremacy over state law | Mandates congressional approval for federal spending |

| Scope | Federal laws, treaties, and the Constitution override state laws | All public funds disbursed require legislated appropriations |

| Legal Impact | Prevents conflict between federal and state laws | Controls and limits federal government spending |

| Enforcement | Federal courts enforce supremacy in legal conflicts | Congress controls funds through budget and appropriations bills |

Introduction to the Supremacy Clause and Appropriations Clause

The Supremacy Clause, found in Article VI, Clause 2 of the U.S. Constitution, establishes that federal law takes precedence over state laws and constitutions, ensuring a unified legal framework across the nation. The Appropriations Clause, located in Article I, Section 9, Clause 7, grants Congress the exclusive power to authorize federal spending, thereby controlling government expenditures and enforcing fiscal accountability. Understanding these clauses clarifies the division of powers between federal authority and budgetary control within the U.S. constitutional system.

Constitutional Foundations of Each Clause

The Supremacy Clause, found in Article VI, Clause 2 of the U.S. Constitution, establishes that federal law takes precedence over state laws and constitutions, ensuring national unity and legal consistency. The Appropriations Clause, located in Article I, Section 9, Clause 7, mandates that no money shall be drawn from the Treasury without lawful appropriations made by Congress, reinforcing the power of the legislative branch over federal spending. Both clauses underscore foundational principles: the Supremacy Clause secures federal authority, while the Appropriations Clause enforces congressional control over fiscal policy.

Textual Analysis: Comparing the Clauses

The Supremacy Clause, found in Article VI, Clause 2 of the U.S. Constitution, establishes that federal law takes precedence over conflicting state laws, ensuring a unified legal framework. In contrast, the Appropriations Clause, located in Article I, Section 9, Clause 7, restricts federal spending by requiring congressional approval before public funds can be expended. Textual analysis highlights the Supremacy Clause's emphasis on legal hierarchy and uniformity, whereas the Appropriations Clause underscores legislative control over fiscal decisions, reflecting a balance between federal authority and budgetary oversight.

Primary Purpose and Scope

The Supremacy Clause establishes that federal law takes precedence over conflicting state laws, ensuring national uniformity and legal hierarchy within the U.S. Constitution. In contrast, the Appropriations Clause grants Congress the exclusive power to allocate federal funds, emphasizing control over government expenditures rather than legal authority. While the Supremacy Clause defines the primacy of federal law in legal conflicts, the Appropriations Clause limits financial commitments, focusing on budgetary oversight and fiscal responsibility.

Historical Origins and Development

The Supremacy Clause, rooted in Article VI of the U.S. Constitution, established federal law as the supreme law of the land to resolve conflicts between state and federal statutes, reflecting the framers' intent to unify national authority after the weaknesses of the Articles of Confederation. The Appropriations Clause, found in Article I, Section 9, Clause 7, originated to ensure Congressional control over federal expenditures, emphasizing the importance of legislative power in checking executive spending authority to prevent misuse of public funds. Both clauses evolved through early American legal disputes and Supreme Court interpretations that reinforced federalism and separation of powers principles essential to the U.S. constitutional framework.

Key Supreme Court Interpretations

The Supremacy Clause, found in Article VI of the U.S. Constitution, establishes that federal law takes precedence over conflicting state laws, as interpreted in landmark cases like McCulloch v. Maryland (1819) and Cooper v. Aaron (1958), which reinforced federal authority. The Appropriations Clause, detailed in Article I, Section 9, Clause 7, restricts federal spending without Congressional approval, with Supreme Court rulings such as Office of Personnel Management v. Richmond (1990) emphasizing Congress's power over government expenditures. These interpretations underscore the balance of federal supremacy in law and legislative control over federal funds.

Application in Federal-State Conflicts

The Supremacy Clause establishes that federal law takes precedence over conflicting state laws, ensuring uniformity in the application of constitutional and statutory provisions. The Appropriations Clause restricts federal spending to amounts explicitly authorized by Congress, thereby limiting the executive branch's financial actions. In federal-state conflicts, the Supremacy Clause enforces federal authority, while the Appropriations Clause governs the legality of federal funding supporting state or federal initiatives.

Impact on Federal Legislation and Spending

The Supremacy Clause establishes that federal laws and treaties override conflicting state laws, ensuring consistent national governance and preempting state interference in federal legislation. The Appropriations Clause restricts federal spending by requiring congressional authorization for government expenditures, directly influencing the scope and implementation of federal programs. Together, these clauses balance federal authority by enabling broad legislative power while maintaining congressional control over funding allocation and fiscal priorities.

Notable Case Studies and Examples

The Supremacy Clause, enshrined in Article VI of the U.S. Constitution, establishes that federal law supersedes conflicting state laws, as demonstrated in landmark cases like McCulloch v. Maryland (1819), which affirmed federal power over states. The Appropriations Clause, found in Article I, Section 9, restricts federal spending to amounts approved by Congress, illustrated by the case of United States v. Lovett (1946), where unauthorized expenditure was deemed unconstitutional. These pivotal legal decisions underscore the balance between federal authority and fiscal oversight within the constitutional framework.

Implications for Modern Governance

The Supremacy Clause ensures that federal laws take precedence over state laws, creating a unified legal framework essential for maintaining national cohesion. The Appropriations Clause grants Congress the power of the purse, controlling federal spending and limiting executive overreach by requiring congressional approval for expenditures. Together, these clauses shape modern governance by balancing centralized authority with fiscal accountability, influencing federal-state relations and government budgetary processes.

Supremacy Clause Infographic

libterm.com

libterm.com