Mezzanine financing provides a hybrid form of capital that combines features of debt and equity, often used by businesses to expand without diluting ownership significantly. This financing option typically involves higher interest rates than traditional loans, reflecting the increased risk to lenders, but it can offer flexible repayment terms tailored to your company's cash flow. Explore the article to understand how mezzanine financing might be the strategic solution for your business growth needs.

Table of Comparison

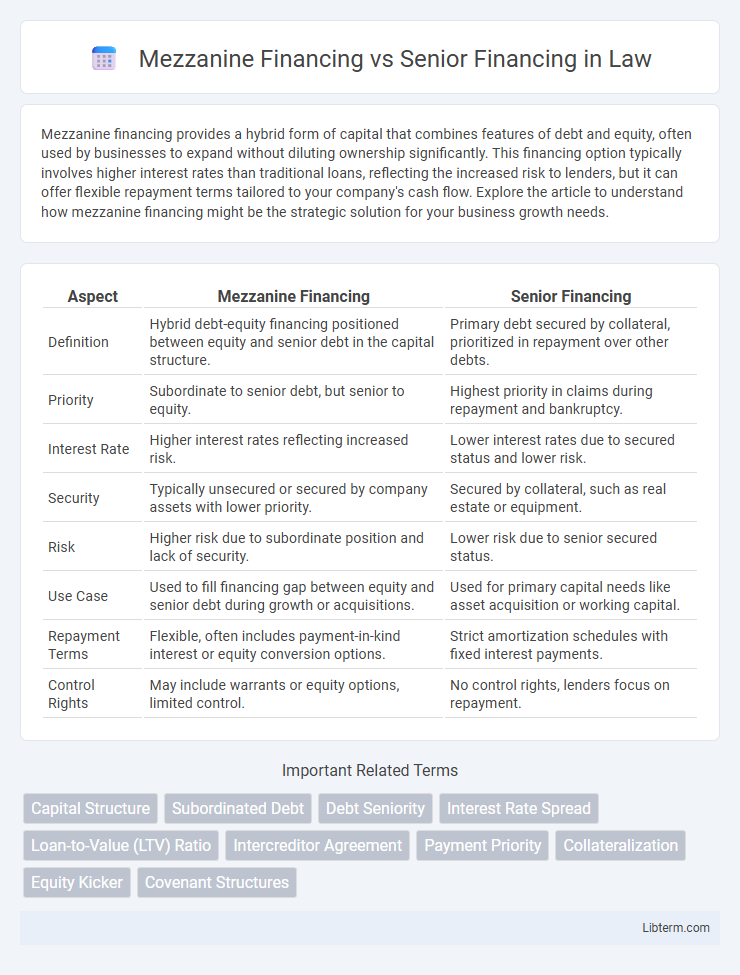

| Aspect | Mezzanine Financing | Senior Financing |

|---|---|---|

| Definition | Hybrid debt-equity financing positioned between equity and senior debt in the capital structure. | Primary debt secured by collateral, prioritized in repayment over other debts. |

| Priority | Subordinate to senior debt, but senior to equity. | Highest priority in claims during repayment and bankruptcy. |

| Interest Rate | Higher interest rates reflecting increased risk. | Lower interest rates due to secured status and lower risk. |

| Security | Typically unsecured or secured by company assets with lower priority. | Secured by collateral, such as real estate or equipment. |

| Risk | Higher risk due to subordinate position and lack of security. | Lower risk due to senior secured status. |

| Use Case | Used to fill financing gap between equity and senior debt during growth or acquisitions. | Used for primary capital needs like asset acquisition or working capital. |

| Repayment Terms | Flexible, often includes payment-in-kind interest or equity conversion options. | Strict amortization schedules with fixed interest payments. |

| Control Rights | May include warrants or equity options, limited control. | No control rights, lenders focus on repayment. |

Introduction to Mezzanine and Senior Financing

Mezzanine financing is a hybrid form of capital that blends debt and equity, typically used to finance expansion or acquisitions with higher risk tolerance and potential for equity participation. Senior financing refers to loans or debt with the highest priority claim on assets and repayment, often secured by collateral and carrying lower interest rates compared to subordinated debt. Both financing types play distinct roles in a company's capital structure, with senior financing providing stable, lower-cost capital and mezzanine financing offering flexible growth capital with enhanced return potential.

Defining Mezzanine Financing

Mezzanine financing is a hybrid form of capital that combines elements of debt and equity, typically used to finance the expansion of established companies without diluting ownership excessively. Unlike senior financing, which has priority claims on assets and lower risk, mezzanine financing carries higher risk and offers higher returns through subordinated debt or preferred equity. This capital structure allows businesses to access growth funds while maintaining operational control and preparing for future equity offerings or buyouts.

What is Senior Financing?

Senior financing refers to debt that holds the highest priority claim on a company's assets in the event of default or liquidation, ensuring repayment before other creditors. It typically features lower interest rates and stricter covenants due to its secured position, often backed by collateral such as property or equipment. This form of financing is crucial for companies seeking stable, low-risk capital to fund operations or acquisitions while maintaining creditor confidence.

Key Differences Between Mezzanine and Senior Financing

Mezzanine financing involves subordinated debt or preferred equity that sits between senior debt and equity in a company's capital structure, carrying higher risk and offering higher returns. Senior financing is secured debt with priority claims on assets and cash flows, typically featuring lower interest rates and stricter covenants. The key differences include mezzanine's flexible terms and equity participation versus senior financing's lower cost and greater security.

Risk Profiles: Mezzanine vs Senior Debt

Mezzanine financing carries higher risk compared to senior debt due to its subordinate position in the capital structure, resulting in lower priority for repayment in case of default. Senior debt offers more security with fixed interest payments and collateral backing, reducing lender risk and often leading to lower interest rates. Mezzanine finance fills the gap between equity and senior debt, providing flexible funding but demanding higher returns to compensate for its elevated risk profile.

Cost of Capital and Interest Rates Comparison

Mezzanine financing typically carries higher interest rates ranging from 12% to 20%, reflecting its subordinated position and greater risk compared to senior financing, which often has interest rates between 4% and 8%. The cost of capital for mezzanine debt is higher due to its hybrid debt-equity nature and potential equity participation, increasing the overall financing expense. Senior financing offers lower costs of capital because it is secured by assets and has priority in claims during default, making it a less risky investment for lenders.

Collateral and Security Structures

Mezzanine financing typically involves unsecured or subordinated debt with little to no collateral, relying instead on equity warrants or convertible features to enhance lender returns. Senior financing is secured by primary collateral such as property, equipment, or receivables, giving lenders priority rights in asset claims and repayment. The security structure of senior debt prioritizes its claim over mezzanine debt, which ranks lower in bankruptcy proceedings and carries higher risk and interest rates.

Use Cases: When to Choose Mezzanine or Senior Financing

Mezzanine financing suits companies seeking growth capital without immediate dilution of equity, commonly used in expansions, acquisitions, or recapitalizations where senior debt limits are maxed out. Senior financing is ideal for businesses requiring lower-cost, secured loans with priority repayment, often utilized for asset purchases or working capital needs with established cash flows. Choosing mezzanine or senior financing depends on the firm's risk tolerance, capital structure goals, and ability to provide collateral or accept higher interest rates.

Impact on Ownership and Control

Mezzanine financing typically involves issuing subordinated debt or preferred equity, which can dilute ownership and shift control through warrants or conversion options, impacting the equity stake of existing shareholders. Senior financing, secured by company assets, generally does not affect ownership or control as it comprises senior debt with fixed repayment terms and limited influence on management decisions. Companies seeking capital must weigh mezzanine financing's potential for ownership dilution against senior financing's stricter covenants and repayment obligations.

Conclusion: Choosing the Right Financing Option

Choosing between mezzanine financing and senior financing depends on the company's risk tolerance, capital structure, and growth objectives. Mezzanine financing offers higher capital with flexible terms but comes at a higher interest rate and subordinate claim, suitable for companies seeking growth without diluting equity. Senior financing provides lower-cost debt with priority repayment, ideal for established firms prioritizing financial stability and lower risk.

Mezzanine Financing Infographic

libterm.com

libterm.com