Contract laws govern the legally binding agreements between parties, outlining the rights and obligations involved in transactions. Understanding key concepts such as offer, acceptance, consideration, and breach is essential to protect your interests and ensure enforceability. Explore the rest of the article to gain a comprehensive insight into contract laws and their practical applications.

Table of Comparison

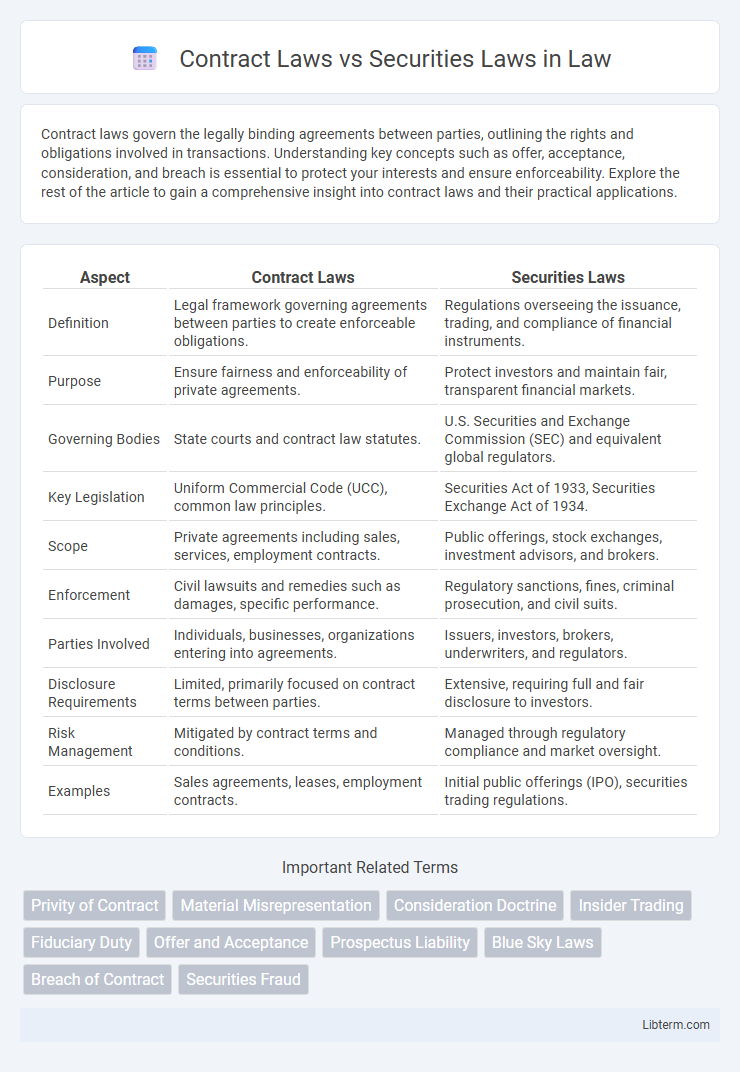

| Aspect | Contract Laws | Securities Laws |

|---|---|---|

| Definition | Legal framework governing agreements between parties to create enforceable obligations. | Regulations overseeing the issuance, trading, and compliance of financial instruments. |

| Purpose | Ensure fairness and enforceability of private agreements. | Protect investors and maintain fair, transparent financial markets. |

| Governing Bodies | State courts and contract law statutes. | U.S. Securities and Exchange Commission (SEC) and equivalent global regulators. |

| Key Legislation | Uniform Commercial Code (UCC), common law principles. | Securities Act of 1933, Securities Exchange Act of 1934. |

| Scope | Private agreements including sales, services, employment contracts. | Public offerings, stock exchanges, investment advisors, and brokers. |

| Enforcement | Civil lawsuits and remedies such as damages, specific performance. | Regulatory sanctions, fines, criminal prosecution, and civil suits. |

| Parties Involved | Individuals, businesses, organizations entering into agreements. | Issuers, investors, brokers, underwriters, and regulators. |

| Disclosure Requirements | Limited, primarily focused on contract terms between parties. | Extensive, requiring full and fair disclosure to investors. |

| Risk Management | Mitigated by contract terms and conditions. | Managed through regulatory compliance and market oversight. |

| Examples | Sales agreements, leases, employment contracts. | Initial public offerings (IPO), securities trading regulations. |

Introduction to Contract Laws and Securities Laws

Contract laws govern the formation, interpretation, and enforcement of agreements between parties, ensuring that promises made in contracts are legally binding and actionable in courts. Securities laws regulate the issuance, trading, and disclosure requirements of financial instruments like stocks and bonds to protect investors and maintain market integrity. Understanding the distinctions between contract laws and securities laws is crucial for navigating legal obligations in business transactions and capital markets.

Defining Contract Laws: Scope and Principles

Contract laws govern legally binding agreements between parties, ensuring the enforcement of promises and obligations through remedies such as damages or specific performance. These laws encompass elements like offer, acceptance, consideration, and mutual consent, establishing the foundation for valid contracts across various transactions. Unlike securities laws, which regulate financial instruments and market practices, contract laws broadly cover private agreements and commercial dealings without directly addressing investment or trading activities.

Overview of Securities Laws: Objectives and Framework

Securities laws are designed to regulate the issuance, trading, and disclosure of financial instruments to protect investors and maintain fair, efficient markets. The framework is primarily established by statutes like the Securities Act of 1933 and the Securities Exchange Act of 1934, enforced by the Securities and Exchange Commission (SEC). These laws aim to ensure transparency, prevent fraud, and promote investor confidence by requiring full disclosure of material information and regulating market activities.

Key Differences Between Contract and Securities Laws

Contract laws govern agreements between private parties, emphasizing the formation, performance, and enforcement of contracts, while securities laws regulate the issuance, trading, and disclosure of financial instruments to protect investors and maintain market integrity. Contract laws primarily address mutual obligations and remedies for breach, whereas securities laws focus on transparency, fraud prevention, and compliance with regulatory frameworks established by bodies such as the SEC. Understanding these distinctions is crucial for legal professionals navigating corporate transactions involving both contractual agreements and securities offerings.

Parties Involved: Contractual Relationships vs. Investor Protections

Contract laws primarily govern relationships between parties involved in agreements, ensuring obligations and rights are clearly defined and enforceable. Securities laws focus on protecting investors by regulating the issuance, trading, and disclosure requirements of financial instruments to maintain market integrity. The key distinction lies in contract laws addressing private party obligations, while securities laws emphasize public investor protections and transparency.

Regulatory Agencies: Who Governs What?

Contract laws are primarily governed by state courts and state legislatures, with the Uniform Commercial Code (UCC) providing standardized regulations for commercial contracts. Securities laws fall under the jurisdiction of federal agencies, mainly the Securities and Exchange Commission (SEC), which enforces regulations such as the Securities Act of 1933 and the Securities Exchange Act of 1934 to protect investors and ensure market transparency. While contract disputes are often resolved through judicial systems focusing on agreement terms, securities regulations emphasize disclosure, fraud prevention, and market integrity monitored by specialized regulatory bodies.

Common Legal Issues in Contract Law vs. Securities Law

Common legal issues in contract law include breach of contract, misrepresentation, and enforceability of terms, focusing on the parties' obligations and rights under an agreement. In securities law, prevalent challenges involve insider trading, fraud in securities offerings, and regulatory compliance with the Securities Act of 1933 and the Securities Exchange Act of 1934. Both areas require careful analysis of applicable statutes and case law to resolve disputes and ensure legal adherence.

Enforcement Mechanisms and Dispute Resolution

Enforcement mechanisms in contract laws primarily involve civil litigation where courts award damages or specific performance based on breach of agreement, relying heavily on parties' initiation of lawsuits. Securities laws feature regulatory enforcement by agencies like the SEC, empowered to conduct investigations, impose fines, and pursue criminal charges for violations such as insider trading or fraud. Dispute resolution in contract law often utilizes arbitration and mediation, whereas securities law disputes may lead to administrative proceedings or class action lawsuits to address broad market impacts.

Impact on Business Transactions and Investments

Contract laws establish the legal framework for agreements between parties, ensuring enforceability and clarity in business transactions, which minimizes disputes and fosters trust. Securities laws regulate the issuance, trading, and disclosure requirements of financial instruments, protecting investors from fraud and maintaining market integrity. Together, these laws create a balanced environment where business deals are both legally sound and financially transparent, enhancing investor confidence and facilitating capital formation.

Conclusion: Choosing the Right Legal Framework

Selecting the appropriate legal framework between contract laws and securities laws depends on the nature of the transaction and regulatory requirements. Contract laws govern private agreements and enforceable obligations between parties, while securities laws regulate the issuance, trading, and disclosure of financial instruments to protect investors. Understanding the specific legal objectives and compliance obligations ensures the correct application of either contract or securities laws in business dealings.

Contract Laws Infographic

libterm.com

libterm.com