Junior financing offers a strategic solution for businesses seeking additional capital without diluting control or exhausting senior debt options. This form of funding typically carries higher interest rates but provides flexible terms that can support growth initiatives and bridge funding gaps. Explore this article to understand how junior financing can empower your business and enhance your financial strategy.

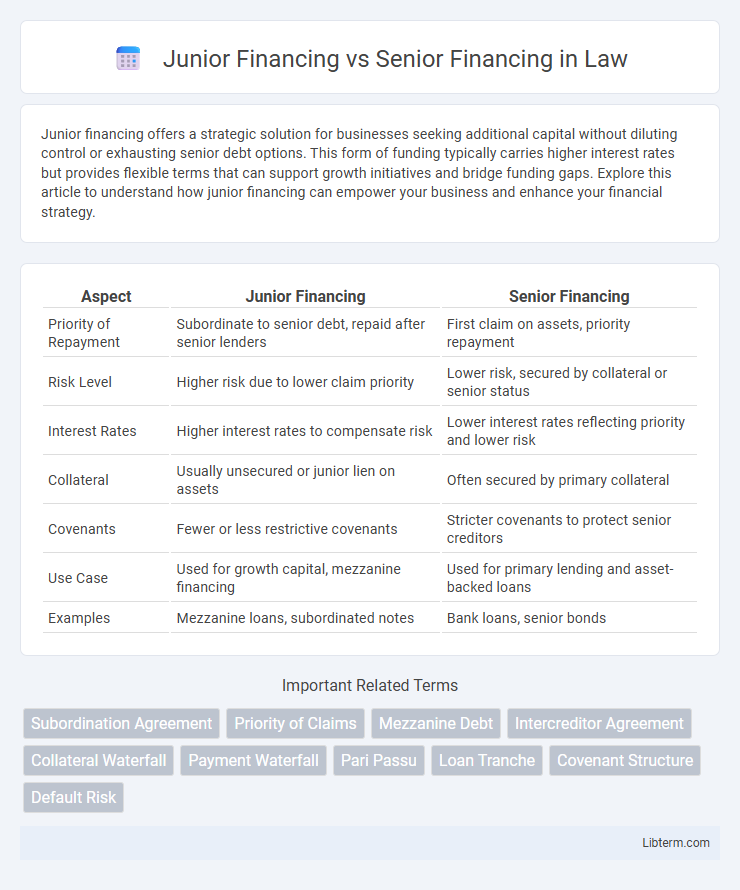

Table of Comparison

| Aspect | Junior Financing | Senior Financing |

|---|---|---|

| Priority of Repayment | Subordinate to senior debt, repaid after senior lenders | First claim on assets, priority repayment |

| Risk Level | Higher risk due to lower claim priority | Lower risk, secured by collateral or senior status |

| Interest Rates | Higher interest rates to compensate risk | Lower interest rates reflecting priority and lower risk |

| Collateral | Usually unsecured or junior lien on assets | Often secured by primary collateral |

| Covenants | Fewer or less restrictive covenants | Stricter covenants to protect senior creditors |

| Use Case | Used for growth capital, mezzanine financing | Used for primary lending and asset-backed loans |

| Examples | Mezzanine loans, subordinated notes | Bank loans, senior bonds |

Introduction to Junior and Senior Financing

Junior financing refers to subordinated debt or equity that ranks below senior financing in the repayment hierarchy, typically carrying higher interest rates due to increased risk. Senior financing consists of secured loans or bonds with priority claims on assets and repayment, often used for primary funding in corporate capital structures. Understanding the distinctions between junior and senior financing is crucial for assessing risk, cost of capital, and capital structure strategy.

Key Differences Between Junior and Senior Financing

Senior financing holds priority over junior financing in repayment order, ensuring senior lenders are paid first during liquidation or bankruptcy. Junior financing usually carries higher interest rates due to increased risk and often comes with more restrictive covenants compared to senior debt. Collateral security for senior financing is typically stronger, with junior financing positioned as subordinate claims on assets, reflecting its higher risk and potential for greater returns.

Structural Hierarchy in Corporate Financing

Senior financing holds the highest priority in the structural hierarchy of corporate financing, securing repayment before junior financing in the event of liquidation. Junior financing is subordinate, often carrying higher risk and higher interest rates, as it is repaid only after all senior obligations are fulfilled. This hierarchy impacts corporate capital structure, influencing creditor rights, risk exposure, and debt covenants.

Risk Profiles: Junior vs Senior Debt

Junior financing carries higher risk due to its subordinate claim on assets and cash flows compared to senior financing, which has priority in repayment during defaults. Senior debt generally offers lower interest rates reflecting its lower risk profile, while junior debt demands higher returns to compensate for increased exposure to loss. Investors assess these risk profiles carefully, balancing potential yields against the likelihood of recovery in distressed scenarios.

Collateral and Security Arrangements

Senior financing holds priority claims on collateral and security arrangements, ensuring lenders have first rights to assets in the event of borrower default. Junior financing is subordinate, offering lower priority claims and typically requiring additional risk premiums due to its secondary position in collateral claims. Senior loans are often secured by primary liens on assets, while junior loans may have unsecured or secondary lien positions, increasing their risk profile.

Interest Rates and Repayment Terms

Junior financing typically carries higher interest rates due to increased risk, while senior financing benefits from lower rates because of its priority claim on assets. Repayment terms for junior financing are often more flexible and subordinate to senior debt, which requires strict adherence to fixed schedules and takes precedence in repayment. This hierarchy influences the cost of capital and risk exposure for borrowers and lenders alike.

Use Cases for Junior Financing

Junior financing is often used in real estate development projects to provide additional capital without disrupting existing senior loan agreements, allowing developers to leverage equity while maintaining control. It serves as a strategic option for businesses seeking growth capital when senior financing limits are met, typically bearing higher interest rates due to increased risk. Common use cases include funding expansions, acquisitions, or bridge financing where subordinated debt complements primary loans, enhancing financial flexibility.

Advantages of Senior Financing

Senior financing offers lower interest rates and priority repayment in the capital structure, reducing the lender's risk exposure. It typically provides stronger collateral claims, enhancing the security of the investment. This prioritization ensures more predictable cash flows and better protection in cases of borrower default or bankruptcy.

Impact on Creditors and Borrowers

Junior financing holds a lower priority in the capital structure, meaning creditors face higher risks due to subordinate claims in case of default, impacting their recovery rates. Borrowers may find junior financing more expensive but flexible, often used to bridge funding gaps or support growth without immediate refinancing pressure. In contrast, senior financing offers creditor protection with priority claims, lowering borrowing costs for borrowers but imposing stricter covenants and repayment terms.

Choosing the Right Financing Option for Your Business

Choosing between junior financing and senior financing depends on your business's risk tolerance, capital needs, and repayment capacity. Senior financing offers lower interest rates and priority in repayment but often requires stringent covenants and collateral. Junior financing carries higher interest rates and subordinated claims but provides more flexible terms and easier access for businesses with limited credit history.

Junior Financing Infographic

libterm.com

libterm.com