A merger combines two companies into one entity to enhance market share, reduce costs, and increase efficiency. Understanding the types of mergers and their impact on your business strategy is crucial for making informed decisions. Explore the rest of the article to learn how mergers can transform your company's growth trajectory.

Table of Comparison

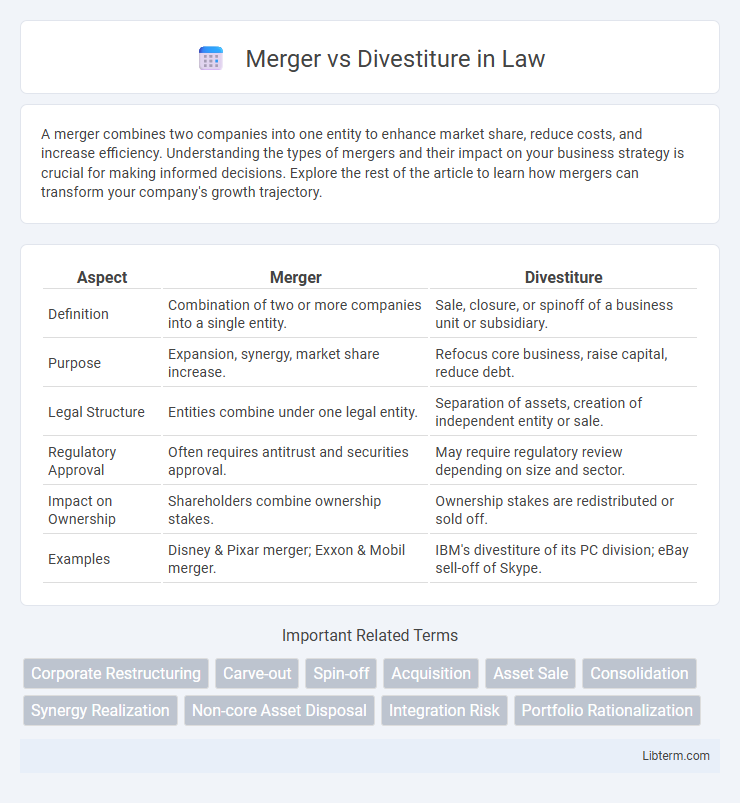

| Aspect | Merger | Divestiture |

|---|---|---|

| Definition | Combination of two or more companies into a single entity. | Sale, closure, or spinoff of a business unit or subsidiary. |

| Purpose | Expansion, synergy, market share increase. | Refocus core business, raise capital, reduce debt. |

| Legal Structure | Entities combine under one legal entity. | Separation of assets, creation of independent entity or sale. |

| Regulatory Approval | Often requires antitrust and securities approval. | May require regulatory review depending on size and sector. |

| Impact on Ownership | Shareholders combine ownership stakes. | Ownership stakes are redistributed or sold off. |

| Examples | Disney & Pixar merger; Exxon & Mobil merger. | IBM's divestiture of its PC division; eBay sell-off of Skype. |

Understanding Mergers: Definition and Types

Mergers involve the consolidation of two or more companies into a single entity to enhance competitive advantage, operational efficiency, or market share. Common types include horizontal mergers, where companies in the same industry combine; vertical mergers, involving firms at different stages of production; and conglomerate mergers, which unite unrelated businesses to diversify risk. Understanding these variations helps stakeholders assess strategic goals and potential synergies in corporate restructuring.

What Is a Divestiture? Key Concepts Explained

A divestiture involves a company selling, liquidating, or spinning off a business unit, asset, or subsidiary to focus on core operations or raise capital. Key concepts include strategic refocusing, reducing debt, and improving operational efficiency by shedding non-core or underperforming segments. This process contrasts with mergers, which consolidate entities, whereas divestitures streamline an organization's structure.

Strategic Goals: Why Companies Merge or Divest

Companies pursue mergers to achieve strategic goals such as expanding market share, acquiring new technologies, diversifying product lines, or gaining competitive advantages in key industries. Divestitures are undertaken to streamline operations, focus on core competencies, raise capital, or eliminate underperforming or non-core business segments. Both mergers and divestitures serve as vital tools for optimizing corporate portfolios and aligning business strategies with long-term growth objectives.

Financial Implications of Mergers and Divestitures

Mergers often lead to increased market share, revenue growth, and potential cost synergies, positively impacting a company's valuation and shareholder wealth. Divestitures generate immediate cash inflows and can improve financial ratios by eliminating underperforming assets, enhancing overall profitability and focus. Both strategies significantly affect a company's capital structure, tax liabilities, and investment appeal, requiring careful financial due diligence and strategic planning.

Legal and Regulatory Considerations

Mergers and divestitures involve critical legal and regulatory considerations, including antitrust laws designed to prevent monopolistic practices and ensure market competition. Regulatory bodies such as the Federal Trade Commission (FTC) and the Department of Justice (DOJ) in the United States, or the European Commission in the EU, scrutinize these transactions to assess their compliance with competition laws. Companies must also navigate securities regulations, shareholder approvals, and potential contractual obligations during both merger and divestiture processes.

Impact on Employees and Organizational Culture

Mergers often lead to employee uncertainty, role redundancies, and the challenge of integrating diverse organizational cultures, which can affect morale and productivity. Divestitures typically result in workforce reductions within the sold unit, but may provide clearer focus and improved engagement in remaining employees. Both processes necessitate transparent communication and change management strategies to maintain trust and preserve a positive organizational culture.

Risks and Challenges: Mergers vs. Divestitures

Mergers pose significant risks such as cultural clashes, integration difficulties, and potential loss of key talent, which can disrupt operations and reduce expected synergies. Divestitures present challenges including valuing assets accurately, managing regulatory approvals, and maintaining business continuity during the separation process. Both strategies require careful risk assessment and change management to mitigate financial losses and protect stakeholder interests.

Success Factors for Effective Mergers

Effective mergers rely on comprehensive due diligence to identify cultural, operational, and financial synergies between the merging entities. Clear communication strategies and strong leadership alignment ensure smooth integration and employee retention throughout the process. Prioritizing customer continuity and technology integration minimizes disruption and accelerates value realization, distinguishing successful mergers from divestitures or failed attempts.

Best Practices for Managing Divestitures

Effective management of divestitures requires thorough due diligence to identify assets, liabilities, and potential risks, ensuring clarity in scope and valuation. Strategic communication with stakeholders and clear transition planning minimize disruptions to operations and maintain employee morale. Post-divestiture integration processes should focus on aligning new business units with their goals while safeguarding intellectual property and regulatory compliance.

Choosing the Right Path: Merger or Divestiture?

Choosing the right path between a merger and divestiture depends on strategic goals such as market expansion, resource optimization, and financial health. Mergers consolidate assets and capabilities to achieve growth and competitive advantage, while divestitures streamline operations by selling off underperforming or non-core business units. Evaluating factors like operational synergy, regulatory impact, and long-term value creation guides companies in making informed decisions between merging or divesting.

Merger Infographic

libterm.com

libterm.com