Planning for retirement early secures your financial independence and peace of mind during your later years. By understanding investment options, managing expenses, and setting realistic goals, you can build a robust savings strategy tailored to your future needs. Explore the full article to discover essential tips and strategies for a comfortable and confident retirement.

Table of Comparison

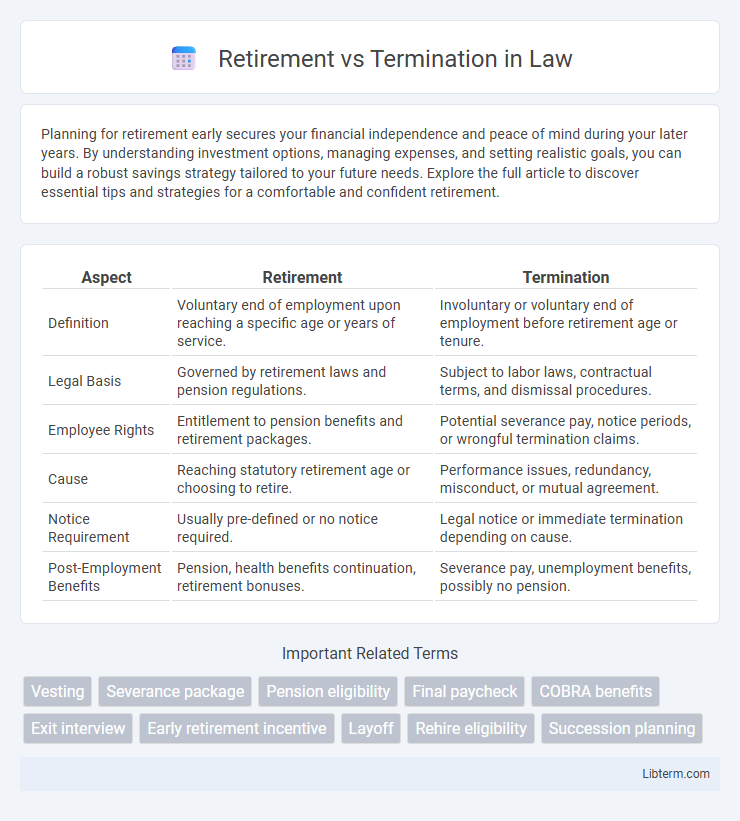

| Aspect | Retirement | Termination |

|---|---|---|

| Definition | Voluntary end of employment upon reaching a specific age or years of service. | Involuntary or voluntary end of employment before retirement age or tenure. |

| Legal Basis | Governed by retirement laws and pension regulations. | Subject to labor laws, contractual terms, and dismissal procedures. |

| Employee Rights | Entitlement to pension benefits and retirement packages. | Potential severance pay, notice periods, or wrongful termination claims. |

| Cause | Reaching statutory retirement age or choosing to retire. | Performance issues, redundancy, misconduct, or mutual agreement. |

| Notice Requirement | Usually pre-defined or no notice required. | Legal notice or immediate termination depending on cause. |

| Post-Employment Benefits | Pension, health benefits continuation, retirement bonuses. | Severance pay, unemployment benefits, possibly no pension. |

Understanding Retirement and Termination

Understanding retirement involves recognizing it as the voluntary decision to leave the workforce after reaching a certain age or fulfilling career goals, often accompanied by eligibility for pension or social security benefits. Termination refers to the involuntary end of employment initiated by the employer or employee due to various reasons such as performance issues, company downsizing, or mutual agreement. Distinguishing between retirement and termination is crucial for accessing appropriate benefits, legal rights, and future employment opportunities.

Key Differences Between Retirement and Termination

Retirement involves an employee voluntarily ending their career after reaching a specific age or fulfilling service requirements, often accompanied by pension benefits and retirement plans. Termination refers to the involuntary or voluntary end of employment due to factors like performance issues, company downsizing, or mutual agreement, typically lacking the structured benefits of retirement. Key differences include eligibility criteria, financial benefits, and the nature of the departure, with retirement emphasizing planned transition and termination often reflecting unforeseen or performance-related separation.

Eligibility Criteria for Retirement

Eligibility criteria for retirement typically include reaching a specified minimum age, often between 60 and 65 years, and completing a requisite number of years of service, which can range from 10 to 40 years depending on the pension scheme or governmental regulations. Many retirement systems require employees to have contributed consistently to a pension fund or social security plan to qualify for full retirement benefits. Unlike termination, which can occur at any employment stage and may involve severance terms, retirement eligibility emphasizes age and service milestones to access retirement benefits.

Common Reasons for Employment Termination

Common reasons for employment termination include performance issues, violation of company policies, downsizing, and restructuring initiatives. Employers may also terminate employees due to attendance problems, misconduct, or failure to meet job expectations. In contrast, retirement is a voluntary decision based on age, years of service, or financial readiness to cease working.

Financial Implications of Retirement vs Termination

Retirement often allows individuals to access pension plans, social security benefits, and retirement savings with favorable tax treatment, providing a steady income stream over time. Termination may trigger immediate lump-sum severance payments but can also result in the loss of accrued benefits, potential unemployment periods, and different tax consequences. Understanding the impact on health insurance, pension vesting, and retirement fund penalties is crucial for effective financial planning during the transition.

Employee Benefits After Retirement and Termination

Employees typically retain access to certain benefits after retirement, such as pension plans, health insurance continuation under COBRA, and post-retirement medical coverage depending on company policy. In contrast, termination often results in the immediate loss of active employment benefits, with severance packages, accrued vacation payouts, and continuation of health insurance for a limited period being common post-termination benefits. Understanding the distinctions between retirement and termination benefits is crucial for employees to effectively plan their financial and healthcare needs after their employment ends.

Legal Considerations in Retirement and Termination

Legal considerations in retirement primarily involve compliance with age discrimination laws, pension plan regulations, and securing entitlement to retirement benefits under ERISA and the Age Discrimination in Employment Act (ADEA). Termination cases require careful adherence to employment contracts, wrongful dismissal protections, and adherence to the Worker Adjustment and Retraining Notification (WARN) Act to prevent legal disputes. Both scenarios demand thorough documentation and consultation with labor law experts to ensure compliance with federal and state-specific regulations governing employee separation.

Emotional Impact: Retirement vs Termination

Retirement often brings a sense of accomplishment, closure, and anticipation for new life phases, positively influencing emotional well-being. Termination, by contrast, can trigger feelings of uncertainty, loss, and stress, significantly impacting mental health and self-esteem. Understanding these emotional differences is crucial for providing appropriate psychological support during career transitions.

Re-employment Opportunities After Retirement and Termination

Re-employment opportunities after retirement often depend on company policies and local labor laws, with retirees sometimes eligible for part-time or consultancy roles leveraging their experience. In contrast, termination typically requires negotiating rehire eligibility, which may be restricted based on the reasons for separation and the employer's reemployment criteria. Understanding these distinctions helps employees and employers navigate post-employment engagement effectively, ensuring compliance and mutual benefit.

Planning Ahead: Preparing for Retirement or Termination

Effective planning ahead for retirement or termination involves understanding eligibility criteria, benefit calculations, and timing to maximize financial security. Evaluating pension plans, savings, and healthcare options ensures a smooth transition and mitigates unexpected expenses. Proactive communication with HR and financial advisors enables optimized decision-making and long-term financial stability.

Retirement Infographic

libterm.com

libterm.com