Warranty protects your purchase by guaranteeing repairs or replacements for a specified period, ensuring product reliability and customer satisfaction. Understanding the terms and scope of coverage helps you avoid unexpected expenses and maximize your investment. Explore the rest of the article to learn how to make the most of your warranty benefits.

Table of Comparison

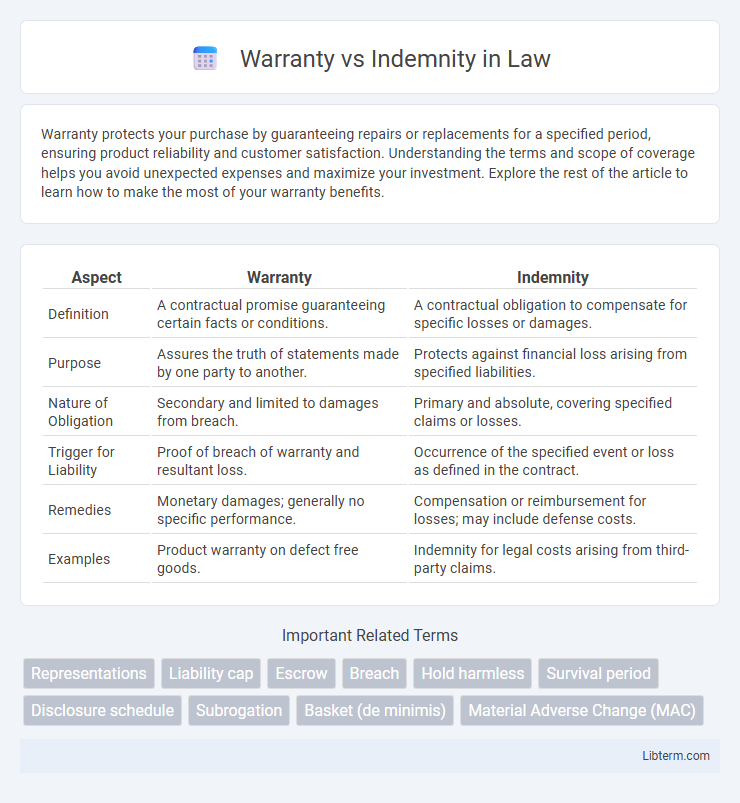

| Aspect | Warranty | Indemnity |

|---|---|---|

| Definition | A contractual promise guaranteeing certain facts or conditions. | A contractual obligation to compensate for specific losses or damages. |

| Purpose | Assures the truth of statements made by one party to another. | Protects against financial loss arising from specified liabilities. |

| Nature of Obligation | Secondary and limited to damages from breach. | Primary and absolute, covering specified claims or losses. |

| Trigger for Liability | Proof of breach of warranty and resultant loss. | Occurrence of the specified event or loss as defined in the contract. |

| Remedies | Monetary damages; generally no specific performance. | Compensation or reimbursement for losses; may include defense costs. |

| Examples | Product warranty on defect free goods. | Indemnity for legal costs arising from third-party claims. |

Understanding the Concepts: Warranty vs Indemnity

Warranty refers to a contractual assurance that specific facts or conditions about a product or service are true at the time of agreement, allowing the aggrieved party to claim damages if breached. Indemnity involves a promise to compensate for any loss or damage incurred, shifting the financial risk from one party to another regardless of fault. Understanding the distinction between warranty and indemnity is crucial for effective risk management and legal protection in commercial contracts.

Legal Definitions of Warranty and Indemnity

Warranty is a contractual promise guaranteeing that certain facts or conditions are true or will be met, providing the injured party the right to claim damages for any breach. Indemnity involves a contractual obligation where one party agrees to compensate the other for specific losses or damages incurred, effectively shifting financial risk. Legal definitions distinguish warranty as a representation of fact assurance, while indemnity serves as a risk allocation mechanism protecting against third-party claims or direct damages.

Key Differences Between Warranty and Indemnity

Warranty protects against breaches of specific promises or facts in a contract, offering the injured party the right to claim damages only after proving a loss occurred. Indemnity provides a broader financial protection, requiring one party to compensate the other for certain losses or liabilities regardless of fault or proof of breach. Key differences include the scope of protection, the need to prove loss, and the timing of compensation.

Purpose and Scope in Commercial Contracts

Warranties in commercial contracts primarily serve to provide assurances about the current state or facts of the subject matter, ensuring that certain conditions or representations are true at the time of agreement, with a scope typically limited to specific statements made by a party. Indemnities, on the other hand, are designed to allocate risk by obligating one party to compensate the other for particular losses or damages, covering a broader range of potential liabilities that may arise during the contract's execution or afterward. Understanding the purpose and scope differences is crucial for drafting enforceable provisions that clearly define the extent of liability and risk allocation between parties.

Practical Examples of Warranty and Indemnity

Warranty in contracts typically guarantees that certain facts or conditions are true, as seen in a sale agreement where the seller warrants the vehicle is free of liens. Indemnity clauses, common in construction contracts, require one party to cover losses or damages caused by their actions, such as a contractor indemnifying a client against third-party injury claims. These practical examples highlight warranties as assurances of fact, while indemnities provide financial protection against specific risks.

Risk Allocation: Who Bears the Responsibility?

Warranty clauses allocate risk by guaranteeing specific facts or conditions, with the warrantor responsible for any breaches, requiring compensation to the other party. Indemnity provisions shift broader financial responsibility for certain losses or damages to the indemnitor, covering risks beyond mere factual inaccuracies. These legal tools precisely define who bears potential liabilities, balancing risk exposure in commercial contracts.

Remedies for Breach: Claims Under Warranty and Indemnity

Claims under warranty typically allow the injured party to seek damages that compensate for losses caused by the breach, without rescinding the entire contract. Indemnity claims provide a more specific remedy, enabling the claimant to recover amounts directly incurred due to a defined risk or liability, often including third-party claims. Remedies for breach under indemnity provisions are generally broader and more certain, as they require reimbursement irrespective of fault or loss causation nuances.

Duration and Limitations of Liability

Warranty durations typically range from one to five years, depending on the product or service, and specify the period during which the seller is responsible for repair or replacement. Indemnity clauses often have no fixed duration and can extend beyond the contract term, covering losses even after services have ended. Limitations of liability in warranties generally cap claims to repair costs or product replacement, whereas indemnities may impose broader financial limits, including consequential damages and third-party claims.

Drafting Considerations for Warranties and Indemnities

Drafting considerations for warranties and indemnities require precise language to clearly define the scope, duration, and limits of each provision, ensuring enforceability and mitigation of potential disputes. Warranties must be specific about conditions guaranteed by the seller and include remedies for breach, while indemnities should detail the indemnifying party's obligations and inclusions of third-party claims, consequential damages, and caps on liability. Attention to carve-outs, notification requirements, and survival periods is essential to balance risk allocation and protect the parties' interests effectively.

Choosing Between Warranty and Indemnity: Best Practices

Choosing between warranty and indemnity in contracts depends on risk allocation and the specific obligations involved. A warranty offers assurances on the state or condition of a subject and typically limits liability to damages caused by a breach, while indemnity provides broader protection by requiring one party to compensate for losses or third-party claims. Best practices suggest clearly defining the scope, limits, and remedies of each to align with strategic risk management and negotiation objectives.

Warranty Infographic

libterm.com

libterm.com