Distribution in property refers to the process of transferring ownership or allocation of assets, whether during an estate settlement or within a business context. Understanding the legal and financial implications ensures your property is divided accurately and fairly according to applicable laws or agreements. Explore the rest of the article to learn how to manage property distribution effectively and protect your interests.

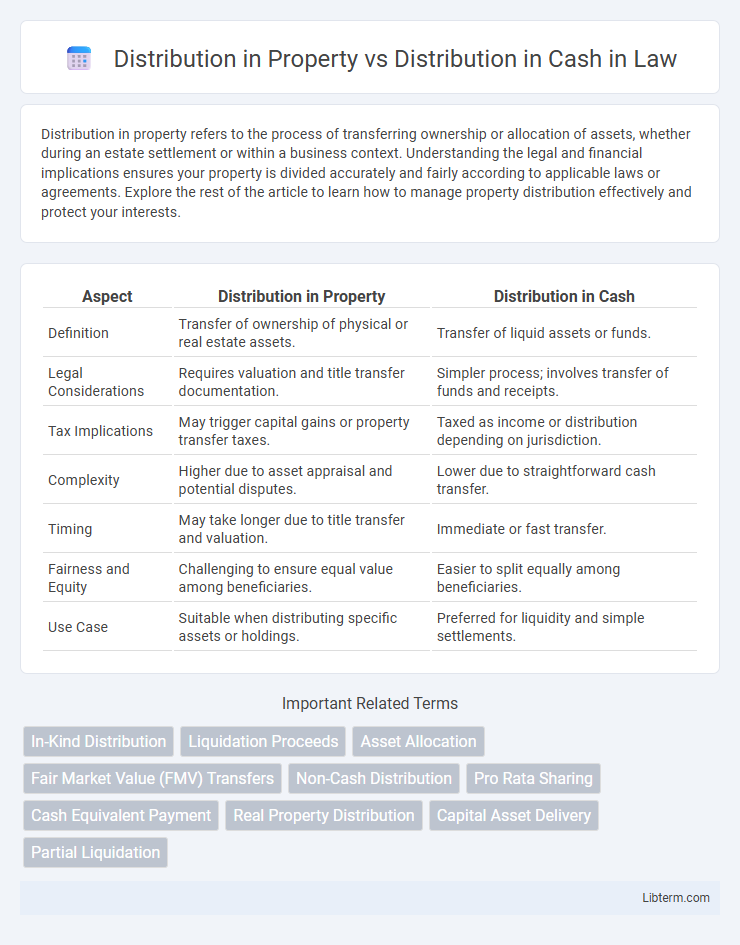

Table of Comparison

| Aspect | Distribution in Property | Distribution in Cash |

|---|---|---|

| Definition | Transfer of ownership of physical or real estate assets. | Transfer of liquid assets or funds. |

| Legal Considerations | Requires valuation and title transfer documentation. | Simpler process; involves transfer of funds and receipts. |

| Tax Implications | May trigger capital gains or property transfer taxes. | Taxed as income or distribution depending on jurisdiction. |

| Complexity | Higher due to asset appraisal and potential disputes. | Lower due to straightforward cash transfer. |

| Timing | May take longer due to title transfer and valuation. | Immediate or fast transfer. |

| Fairness and Equity | Challenging to ensure equal value among beneficiaries. | Easier to split equally among beneficiaries. |

| Use Case | Suitable when distributing specific assets or holdings. | Preferred for liquidity and simple settlements. |

Introduction to Distribution in Property vs Distribution in Cash

Distribution in property involves transferring assets such as real estate, stocks, or tangible goods to beneficiaries instead of liquid cash, often used in estate planning or business settlements. Distribution in cash provides immediate liquidity, enabling recipients to use funds without the complexities of asset valuation or sale. Understanding the tax implications and administrative processes of each method is critical for optimizing beneficiary outcomes and legal compliance.

Defining Distribution in Property

Distribution in property refers to the transfer of non-cash assets, such as real estate, stocks, or equipment, from a corporation or trust to its shareholders or beneficiaries. This form of distribution carries specific tax implications, often involving the fair market value of the property being treated as income or dividend to the recipient. Unlike cash distributions, property distributions require careful valuation and documentation to ensure compliance with regulatory and tax reporting requirements.

Understanding Distribution in Cash

Distribution in cash involves transferring actual monetary funds directly to shareholders or partners, providing immediate liquidity without altering ownership stakes. Unlike distribution in property, which includes physical or non-liquid assets and might require valuation and transfer procedures, cash distributions simplify tax reporting and reduce administrative complexities. Understanding distribution in cash is crucial for investors seeking straightforward income realization and efficient portfolio management.

Key Differences Between Property and Cash Distributions

Distribution in property involves transferring physical or tangible assets to stakeholders, whereas distribution in cash entails direct monetary payments. Property distributions may include real estate, equipment, or inventory, which can affect asset base and tax implications differently compared to cash distributions, which reduce liquid assets immediately. Tax treatment varies significantly; property distributions often trigger capital gains or losses based on asset valuation, while cash distributions are typically treated as dividends or return of capital.

Tax Implications of Property vs Cash Distributions

Distribution in property involves transferring assets like real estate or securities to shareholders, which can trigger capital gains tax based on the property's fair market value exceeding its original basis. Cash distributions are typically taxed as dividends or return of capital, affecting the recipient's taxable income differently depending on the corporation's earnings and profits. Understanding the tax basis adjustment for property distributions is crucial, as shareholders may face immediate tax liabilities despite not receiving liquid cash.

Legal Considerations and Compliance

Distribution in property involves transferring assets such as real estate or shares, which requires strict adherence to property laws, tax regulations, and valuation standards to ensure compliance and avoid disputes. Distribution in cash demands careful compliance with financial regulations, accounting standards, and anti-money laundering laws to maintain transparent record-keeping and legal integrity. Both methods necessitate thorough documentation and adherence to jurisdiction-specific legal frameworks to prevent legal challenges and ensure equitable treatment of beneficiaries.

Advantages of Property Distributions

Distributions in property allow shareholders to receive assets that may appreciate over time, offering potential long-term tax deferral advantages compared to immediate taxation on cash distributions. Property distributions can preserve corporate cash flow and provide investors with tangible assets that might generate passive income or capital gains upon future sale. This method can also simplify the company's liquidity management by reducing cash outflows while maintaining shareholder value through asset appreciation.

Advantages of Cash Distributions

Cash distributions offer immediate liquidity, allowing investors to reinvest or use funds without delay, enhancing financial flexibility. They simplify tax reporting since cash payments are straightforward compared to tracking in-kind property distributions, which may require valuation and complex tax basis calculations. Investors avoid potential market risk associated with holding distributed property that might decrease in value post-distribution, preserving capital.

Situations Favoring Property Over Cash Distributions

Distributions in property are favored over cash distributions in situations where the distributing corporation retains valuable assets while providing shareholders with tangible ownership interests, especially in closely held companies or real estate investments. Property distributions allow shareholders to avoid immediate tax consequences linked to cash dividends, as the basis of the received property can be adjusted according to tax regulations such as IRC Section 311. This method optimizes shareholder value when reinvestment in company assets or liquidity conservation is a priority, particularly during periods of limited cash flow or corporate restructuring.

Conclusion: Choosing the Optimal Distribution Method

Choosing the optimal distribution method depends on tax implications, liquidity needs, and asset type, where distribution in property preserves cash flow but may trigger deferred capital gains. Distribution in cash offers immediate liquidity and simplicity in valuation but can reduce investment capital and may involve higher tax burdens. Evaluating individual financial goals and tax circumstances ensures the selected method maximizes overall returns and minimizes tax liabilities.

Distribution in Property Infographic

libterm.com

libterm.com