Acquisition involves obtaining assets, companies, or resources to enhance your business growth and market presence. Effective acquisition strategies focus on due diligence, valuation, and integration to maximize value and minimize risks. Explore this article to discover key tactics for successful acquisitions and how they can benefit your organization.

Table of Comparison

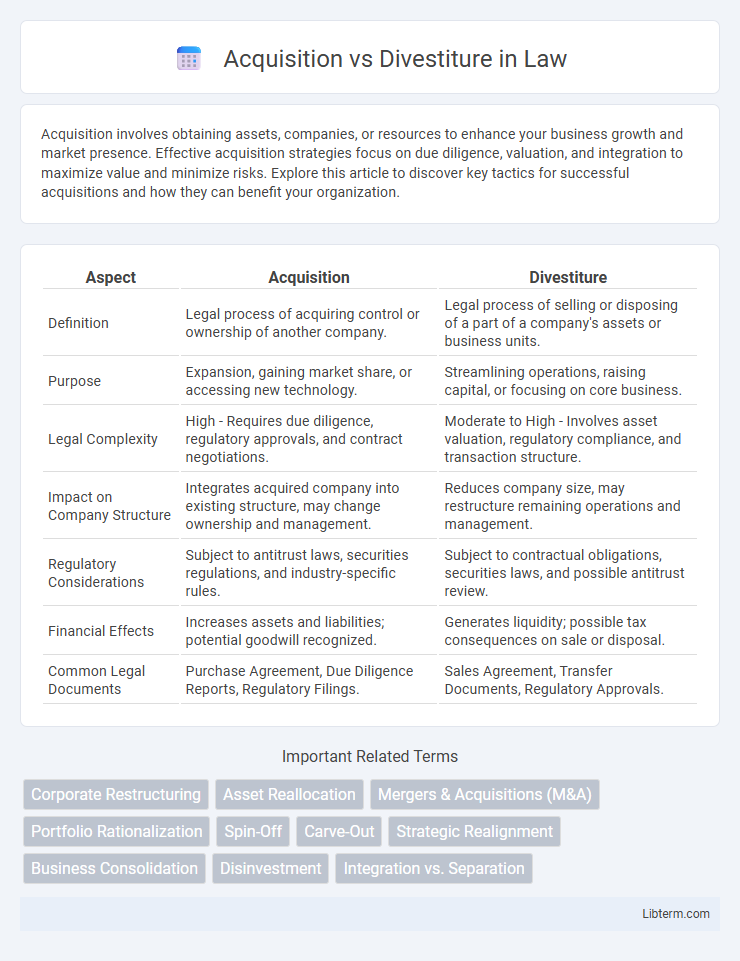

| Aspect | Acquisition | Divestiture |

|---|---|---|

| Definition | Legal process of acquiring control or ownership of another company. | Legal process of selling or disposing of a part of a company's assets or business units. |

| Purpose | Expansion, gaining market share, or accessing new technology. | Streamlining operations, raising capital, or focusing on core business. |

| Legal Complexity | High - Requires due diligence, regulatory approvals, and contract negotiations. | Moderate to High - Involves asset valuation, regulatory compliance, and transaction structure. |

| Impact on Company Structure | Integrates acquired company into existing structure, may change ownership and management. | Reduces company size, may restructure remaining operations and management. |

| Regulatory Considerations | Subject to antitrust laws, securities regulations, and industry-specific rules. | Subject to contractual obligations, securities laws, and possible antitrust review. |

| Financial Effects | Increases assets and liabilities; potential goodwill recognized. | Generates liquidity; possible tax consequences on sale or disposal. |

| Common Legal Documents | Purchase Agreement, Due Diligence Reports, Regulatory Filings. | Sales Agreement, Transfer Documents, Regulatory Approvals. |

Understanding Acquisition and Divestiture

Acquisition involves one company purchasing another to expand market share, diversify product lines, or achieve economies of scale, while divestiture refers to a firm selling or liquidating assets or divisions to streamline operations or raise capital. Understanding acquisition requires analyzing strategic fit, valuation, and integration challenges, whereas divestiture emphasizes evaluating non-core assets and maximizing sale value. Both processes significantly impact corporate structure, financial health, and long-term growth strategies.

Key Differences Between Acquisition and Divestiture

Acquisition involves one company purchasing another to expand market share, assets, or capabilities, resulting in consolidated ownership and control. Divestiture refers to a company selling or spinning off a business unit, asset, or subsidiary to streamline operations or raise capital. Key differences include the direction of ownership transfer--acquisition increases control by the buyer, while divestiture reduces ownership for the seller--and strategic objectives, where acquisitions focus on growth and expansion, whereas divestitures target refocusing and efficiency.

Strategic Objectives Behind Acquisition

Acquisitions aim to achieve strategic objectives such as market expansion, diversification of product offerings, and gaining competitive advantage through increased market share. Companies pursue acquisitions to access new technologies, enhance operational efficiencies, and leverage synergies that drive growth and profitability. These strategic goals revolve around strengthening the company's position within the industry and creating long-term value for stakeholders.

Strategic Reasons for Divestiture

Divestiture is driven by strategic reasons such as refocusing on core business areas, improving financial performance, and reducing operational complexities. Companies often divest underperforming or non-core assets to streamline operations and reallocate resources towards higher growth opportunities. This strategy enhances agility, drives profitability, and supports long-term business sustainability.

Financial Impact of Acquisition vs Divestiture

Acquisitions often lead to significant upfront capital expenditure and integration costs but can enhance revenue streams and market share, positively impacting long-term financial performance. Divestitures generate immediate cash inflows and improve liquidity by disposing of underperforming or non-core assets, often leading to reduced operational expenses and improved balance sheet metrics. Evaluating the financial impact requires analyzing changes in cash flow, debt levels, profitability, and return on investment post-transaction.

Common Challenges in Acquisition Processes

Common challenges in acquisition processes include cultural integration issues, misalignment of business objectives, and inaccurate valuation of the target company. Due diligence complexities often lead to overlooked liabilities, while regulatory approvals can cause significant delays. Effective communication and strategic planning are crucial to overcoming these obstacles and ensuring a successful merger.

Risks and Complexities of Divestiture

Divestiture involves substantial risks such as loss of revenue streams, employee turnover, and regulatory hurdles, which can disrupt business continuity. Complexities arise from accurately valuing the divested assets, managing stakeholder expectations, and ensuring compliance with antitrust laws and contractual obligations. Effective divestiture requires meticulous planning to mitigate financial impact and maintain operational stability during the separation process.

Legal and Regulatory Considerations

Acquisition involves navigating complex legal frameworks including antitrust laws, due diligence requirements, and regulatory approvals from bodies such as the Federal Trade Commission (FTC) or the European Commission to prevent monopolistic practices. Divestiture requires compliance with court orders, regulatory mandates, or corporate restructuring rules, often necessitating asset valuation, contract renegotiations, and shareholder consent. Both transactions demand strict adherence to securities laws, employment regulations, and cross-border legal standards to ensure smooth execution and avoid litigation risks.

Best Practices for Acquisition Success

Successful acquisitions require thorough due diligence, clear strategic alignment, and effective integration planning to maximize value and minimize risks. Prioritizing cultural compatibility and transparent communication fosters smoother transitions and employee retention. Leveraging data-driven insights and stakeholder engagement further enhances decision-making and post-acquisition performance.

When to Choose Acquisition Over Divestiture

Choosing acquisition over divestiture is strategic when a company aims to expand market share, acquire new technologies, or enter new geographic regions quickly. Acquisition is favored when the goal is to gain competitive advantage through synergies, such as combined resources or enhanced innovation capabilities. Companies also opt for acquisition to strengthen their product portfolio and achieve economies of scale that are difficult to realize through organic growth.

Acquisition Infographic

libterm.com

libterm.com