Pro rata distribution ensures that assets or liabilities are divided proportionally among stakeholders based on their respective shares or interests. This method is commonly applied in finance, insurance, and legal settlements to guarantee fairness and transparency. Explore the rest of the article to understand how pro rata distribution impacts your financial decisions.

Table of Comparison

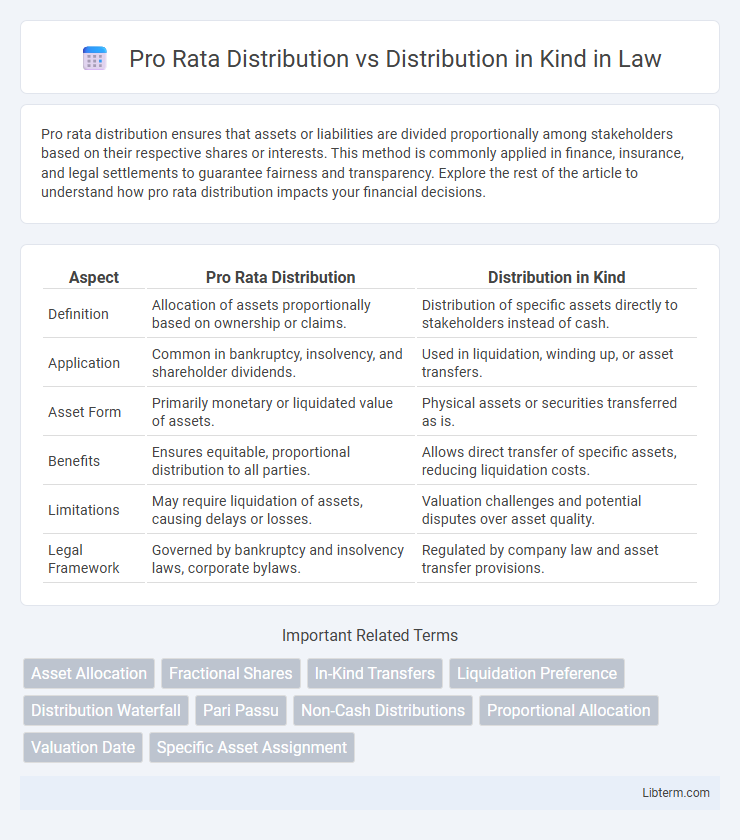

| Aspect | Pro Rata Distribution | Distribution in Kind |

|---|---|---|

| Definition | Allocation of assets proportionally based on ownership or claims. | Distribution of specific assets directly to stakeholders instead of cash. |

| Application | Common in bankruptcy, insolvency, and shareholder dividends. | Used in liquidation, winding up, or asset transfers. |

| Asset Form | Primarily monetary or liquidated value of assets. | Physical assets or securities transferred as is. |

| Benefits | Ensures equitable, proportional distribution to all parties. | Allows direct transfer of specific assets, reducing liquidation costs. |

| Limitations | May require liquidation of assets, causing delays or losses. | Valuation challenges and potential disputes over asset quality. |

| Legal Framework | Governed by bankruptcy and insolvency laws, corporate bylaws. | Regulated by company law and asset transfer provisions. |

Understanding Pro Rata Distribution

Pro Rata Distribution refers to allocating assets or funds proportionally based on each party's ownership or share percentage, ensuring equitable distribution aligned with investment size. This method contrasts with Distribution in Kind, where actual assets are distributed rather than cash or equivalent value. Understanding Pro Rata Distribution is essential for investors and companies to maintain fairness and transparency during dividends, liquidation, or profit-sharing events.

What is Distribution in Kind?

Distribution in Kind refers to the allocation of assets or securities to shareholders or beneficiaries instead of cash payments. This method allows recipients to receive specific physical assets, such as shares of stock, real estate, or other tangible property, reflecting their proportional ownership in the entity. It contrasts with cash distributions by offering investments or physical goods, often used in corporate reorganizations or estate settlements to preserve asset value.

Key Differences between Pro Rata and In-Kind Distributions

Pro Rata Distribution allocates assets proportionally to all shareholders based on their ownership percentage, ensuring each investor receives an equivalent percentage of each asset. Distribution in Kind involves transferring specific assets directly to shareholders, rather than cash or fractional interests, often resulting in uneven or targeted allocations. The key difference lies in Pro Rata's equal proportionality versus In-Kind's individualized, non-cash asset transfer approach.

Advantages of Pro Rata Distribution

Pro Rata Distribution ensures equitable allocation of assets among shareholders by distributing shares or dividends proportionally based on ownership stakes, promoting fairness and transparency. This method reduces potential conflicts by maintaining consistency across all investors and simplifies the distribution process without the need for individualized assessments of asset values. Pro Rata Distribution also enhances liquidity and investor confidence, as stakeholders receive distributions aligned with their percentage ownership, supporting more predictable financial planning.

Benefits of Distribution in Kind

Distribution in Kind allows shareholders to receive assets directly, preserving the company's cash flow and potentially offering tax advantages. It provides investors with tangible assets rather than cash, which can be more beneficial for those seeking specific holdings or long-term investment value. This method reduces the need for immediate liquidation, maintaining asset appreciation and aligning distributions with shareholder preferences.

Drawbacks of Pro Rata Distribution

Pro Rata Distribution can result in uneven value allocation when individual shares possess varying intrinsic worth, leading to perceived unfairness among stakeholders. It often complicates asset division in liquidation scenarios by ignoring asset heterogeneity, which may cause disputes and legal challenges. This distribution method lacks flexibility, potentially forcing investors to receive less desirable assets and reducing overall satisfaction with the settlement.

Challenges with Distribution in Kind

Distribution in kind presents challenges such as valuing non-cash assets accurately, leading to potential disputes among shareholders due to inconsistent asset appraisals. Unlike pro rata distribution which simplifies equity division via cash payments proportional to shares, distribution in kind requires complex legal and tax considerations to manage asset transfers. This complexity often results in increased administrative costs and potential liquidity issues for recipients who receive illiquid or non-marketable assets.

Common Scenarios for Each Distribution Method

Pro Rata Distribution is commonly used in corporate mergers and venture capital exits where shareholders receive proceeds proportionate to their ownership percentage, ensuring fairness and alignment with investment stakes. Distribution in Kind frequently occurs in estate settlements or real estate partnerships, allowing beneficiaries or partners to receive specific assets like property or shares instead of cash, which helps preserve asset value and minimize liquidation costs. Both methods address different priorities: Pro Rata promotes equitable financial returns, while Distribution in Kind emphasizes non-cash asset allocation tailored to stakeholder preferences.

Legal and Tax Implications

Pro Rata Distribution allocates assets proportionally based on each shareholder's ownership percentage, ensuring equitable treatment under corporate and tax law by maintaining consistency in asset valuation and preventing preferential treatment. Distribution in Kind transfers specific assets directly to shareholders instead of cash, triggering complex tax implications, including potential capital gains recognition at both corporate and individual levels due to asset revaluation at the time of distribution. Legal considerations require precise documentation to avoid disputes, with pro rata distributions generally favored for their straightforward tax reporting and compliance benefits.

Choosing the Right Distribution Method

Choosing the right distribution method depends on the nature of the assets and investor preferences; pro rata distribution ensures equal allocation based on ownership percentage, maintaining fairness and simplicity. Distribution in kind involves transferring actual assets rather than cash or shares, suitable for illiquid or unique assets that cannot be easily divided. Evaluating liquidity, tax implications, and administrative complexity helps determine whether pro rata or distribution in kind aligns better with fund objectives and stakeholder interests.

Pro Rata Distribution Infographic

libterm.com

libterm.com