A life estate grants an individual the right to use and benefit from a property for their lifetime, after which ownership transfers to another party, known as the remainderman. This legal arrangement can help manage estate planning by providing control over property succession while avoiding probate. Discover how a life estate can protect Your interests and affect inheritance by reading the rest of the article.

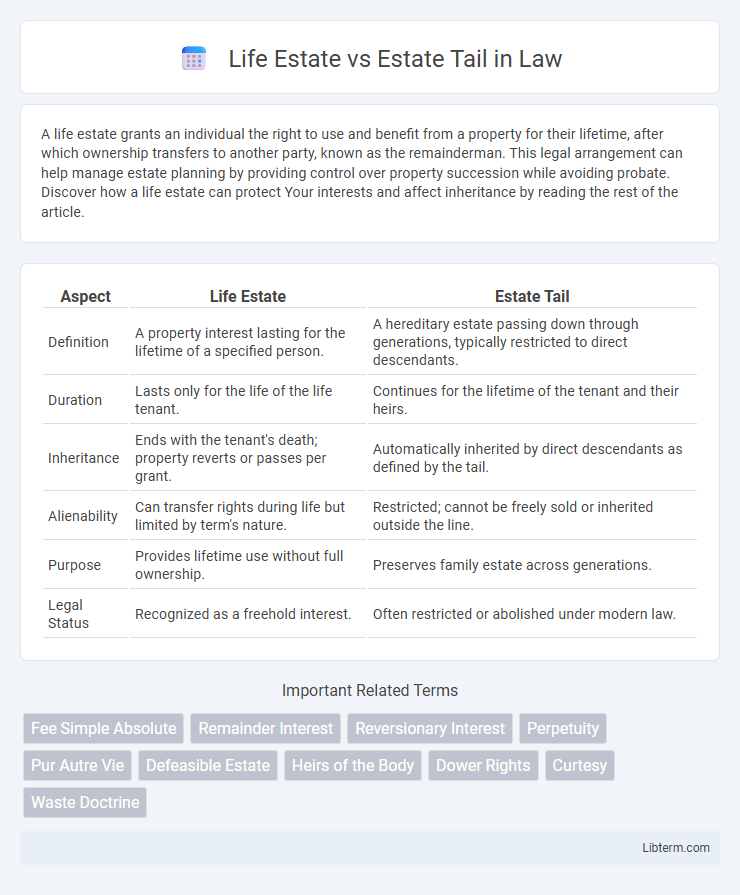

Table of Comparison

| Aspect | Life Estate | Estate Tail |

|---|---|---|

| Definition | A property interest lasting for the lifetime of a specified person. | A hereditary estate passing down through generations, typically restricted to direct descendants. |

| Duration | Lasts only for the life of the life tenant. | Continues for the lifetime of the tenant and their heirs. |

| Inheritance | Ends with the tenant's death; property reverts or passes per grant. | Automatically inherited by direct descendants as defined by the tail. |

| Alienability | Can transfer rights during life but limited by term's nature. | Restricted; cannot be freely sold or inherited outside the line. |

| Purpose | Provides lifetime use without full ownership. | Preserves family estate across generations. |

| Legal Status | Recognized as a freehold interest. | Often restricted or abolished under modern law. |

Introduction to Life Estate and Estate Tail

A life estate grants an individual ownership of property for the duration of their lifetime, after which the property passes to a designated remainderman, ensuring controlled transfer upon death. Estate tail restricts inheritance to direct descendants, preserving property within a family line and preventing its sale or transfer outside the lineage. Both interests shape property succession by limiting alienation and defining future ownership rights.

Definition of Life Estate

A Life Estate grants property ownership for the duration of an individual's lifetime, after which the property passes to a designated remainderman or reverts to the original grantor. Unlike an Estate Tail, which restricts inheritance to direct descendants and can last for multiple generations, a Life Estate terminates automatically upon the death of the life tenant. This arrangement allows the life tenant to use and benefit from the property without transferring full ownership rights beyond their lifetime.

Definition of Estate Tail

An estate tail, also known as a fee tail, is a form of property ownership that restricts inheritance to the direct descendants of the original grantee, preventing the property from being sold or bequeathed outside the family lineage. Unlike a life estate, which grants ownership for the duration of an individual's life, an estate tail creates a hereditary interest that passes down through generations. This form of estate aims to preserve family estates intact over time by limiting alienation and ensuring succession to heirs in the bloodline.

Historical Origins and Development

Life estate and estate tail both originated in English common law to regulate property succession, but estate tail emerged during the medieval period as a mechanism to keep land within a family lineage by restricting inheritance to direct descendants. Life estates developed later to provide a designated individual the right to use property for their lifetime without transferring ownership, preserving future interests for remaindermen or reversioners. Over time, estate tails declined due to legal reforms favoring free alienation, while life estates remained prevalent for estate planning and asset management.

Key Legal Differences

A life estate grants ownership rights to an individual for their lifetime, after which the property passes to a remainderman, while an estate tail restricts inheritance to direct descendants, typically preventing property from leaving the family line. Life estates allow the holder to use and benefit from the property but prohibit selling or bequeathing it beyond their lifetime. Estate tail provides a form of hereditary ownership that binds successive heirs, limiting transferability and creating long-term control over the estate's succession.

Rights and Responsibilities of Holders

Life estate holders possess the right to use and enjoy the property exclusively during their lifetime, bearing responsibility for property maintenance and taxes without the authority to sell or bequeath it. Estate tail holders have inheritable rights limited to direct descendants, ensuring property remains within the family line, but they face restrictions on alienation and bear duties to preserve the estate's value for future heirs. Both interests impose obligations to avoid waste, yet life estates terminate at death while estate tails perpetuate through successive generations.

Transferability and Inheritance

Life estates grant ownership for the duration of the grantor's life, with property transferability limited since it reverts to a remainderman or grantor upon the life tenant's death. Estate tail restricts inheritance to direct descendants, ensuring the property remains within the family bloodline, often limiting transferability outside this lineage. Both estates impose significant limitations on alienation, impacting long-term property control and succession planning.

Common Uses in Modern Law

Life estates are commonly used in modern estate planning to provide a surviving spouse or relative with the right to use property during their lifetime while preserving the remainder interest for heirs, ensuring asset protection and controlled inheritance. Estate tails, largely abolished or heavily restricted in most jurisdictions, historically aimed to keep property within a family lineage but now serve limited practical use due to modern laws favoring fee simple ownership and greater property transfer flexibility. Trusts and other estate planning tools have mostly supplanted estate tails by offering more adaptable and tax-efficient wealth management solutions.

Advantages and Disadvantages

A life estate grants property rights for the duration of an individual's lifetime, allowing control and enjoyment without full ownership transfer, which limits inheritance flexibility but offers protection against creditors. Estate tail restricts inheritance to direct descendants, preserving family land across generations but limits the owner's ability to sell or bequeath property freely. Life estates provide greater flexibility in property disposition, while estate tails enforce long-term ownership continuity at the cost of liquidity and broader control.

Conclusion and Recommendations

Life estates provide property rights limited to an individual's lifetime, offering flexibility and avoiding probate, but restrict inheritance beyond the life tenant. Estate tail ensures property passes directly to specified heirs, preserving family lineage but limiting transferability and marketability. Choosing between them depends on balancing control, inheritance goals, and legal constraints, with life estates favored for flexibility and estate tails for controlling succession.

Life Estate Infographic

libterm.com

libterm.com