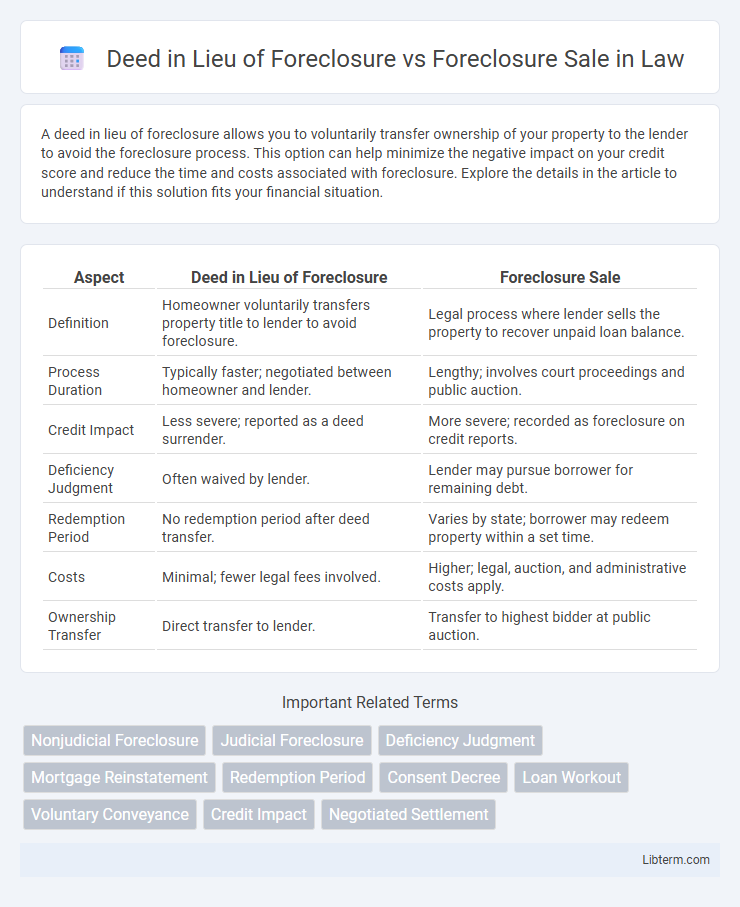

A deed in lieu of foreclosure allows you to voluntarily transfer ownership of your property to the lender to avoid the foreclosure process. This option can help minimize the negative impact on your credit score and reduce the time and costs associated with foreclosure. Explore the details in the article to understand if this solution fits your financial situation.

Table of Comparison

| Aspect | Deed in Lieu of Foreclosure | Foreclosure Sale |

|---|---|---|

| Definition | Homeowner voluntarily transfers property title to lender to avoid foreclosure. | Legal process where lender sells the property to recover unpaid loan balance. |

| Process Duration | Typically faster; negotiated between homeowner and lender. | Lengthy; involves court proceedings and public auction. |

| Credit Impact | Less severe; reported as a deed surrender. | More severe; recorded as foreclosure on credit reports. |

| Deficiency Judgment | Often waived by lender. | Lender may pursue borrower for remaining debt. |

| Redemption Period | No redemption period after deed transfer. | Varies by state; borrower may redeem property within a set time. |

| Costs | Minimal; fewer legal fees involved. | Higher; legal, auction, and administrative costs apply. |

| Ownership Transfer | Direct transfer to lender. | Transfer to highest bidder at public auction. |

Introduction to Deed in Lieu of Foreclosure and Foreclosure Sale

A Deed in Lieu of Foreclosure allows a borrower to voluntarily transfer property ownership to the lender to avoid the foreclosure process, minimizing credit damage and legal fees. In contrast, a Foreclosure Sale occurs when the lender repossesses and sells the property at a public auction due to the borrower's failure to meet mortgage obligations. Choosing a Deed in Lieu typically results in a quicker resolution and less impact on the borrower's credit score compared to a Foreclosure Sale.

Key Differences Between Deed in Lieu and Foreclosure Sale

Deed in Lieu of Foreclosure involves the homeowner voluntarily transferring the property title to the lender to avoid the foreclosure process, resulting in less damage to credit scores compared to Foreclosure Sale, where the lender sells the property after a legal foreclosure process. Unlike Foreclosure Sale, a Deed in Lieu can reduce legal expenses and expedite resolution since it bypasses lengthy court proceedings. Foreclosure Sales often remain public records and may carry more significant financial and reputational consequences for the borrower than a Deed in Lieu transaction.

How Does a Deed in Lieu of Foreclosure Work?

A Deed in Lieu of Foreclosure involves the homeowner voluntarily transferring property ownership to the lender to satisfy the mortgage debt and avoid foreclosure proceedings. This process typically requires the lender's approval and can help the borrower minimize credit damage compared to a Foreclosure Sale, which is a public auction of the property after the borrower defaults. By completing a Deed in Lieu, the borrower bypasses the lengthy court process, reducing legal fees and time associated with foreclosure sales.

The Foreclosure Sale Process Explained

The foreclosure sale process begins when a lender files a notice of default due to missed mortgage payments, leading to a public auction of the property to recover the outstanding loan balance. Bidders, including investors and sometimes the lender, compete at the auction, with the highest bid typically required to meet or exceed the property's appraised value. If the property sells, the proceeds pay off the mortgage debt, while any surplus may go to the homeowner, and if no adequate bids are made, the lender may take ownership through a Real Estate Owned (REO) status.

Eligibility Criteria for Deed in Lieu vs Foreclosure Sale

Eligibility for a Deed in Lieu of Foreclosure requires the borrower to demonstrate clear ownership and free title to the property, along with lender approval and often proof of financial hardship. In contrast, a Foreclosure Sale eligibility is determined by the lender after the borrower defaults on the mortgage, triggering a legal process to recover the owed debt through public auction. The Deed in Lieu process often has stricter preconditions to ensure voluntary surrender, while Foreclosure Sale follows statutory notice and timeline requirements post-default.

Pros and Cons of Deed in Lieu of Foreclosure

A deed in lieu of foreclosure allows homeowners to transfer property ownership directly to the lender, avoiding the lengthy foreclosure process and potentially reducing credit damage compared to a foreclosure sale. This option can accelerate debt resolution and minimize legal fees but may require lender approval and does not guarantee release from all mortgage obligations, such as deficiency judgments. However, the deed in lieu process can negatively affect credit scores and may not be suitable if additional liens exist on the property.

Pros and Cons of Foreclosure Sale

Foreclosure sale allows lenders to recoup losses by selling the property at auction, potentially generating a higher return than a deed in lieu of foreclosure. However, it often results in lengthy legal processes, significant costs, and uncertain sale outcomes due to market fluctuations. Borrowers face credit score damage and the risk of deficiency judgments, making foreclosure sales financially and emotionally challenging.

Impact on Credit Score: Deed in Lieu vs Foreclosure

A Deed in Lieu of Foreclosure typically has a less severe impact on credit scores compared to a Foreclosure Sale, often resulting in fewer negative points and a shorter recovery period. While both options significantly damage credit, a Foreclosure Sale remains on credit reports for up to seven years and can lower scores more dramatically. Opting for a Deed in Lieu can demonstrate a proactive attempt to resolve debt, potentially mitigating some credit damage over time.

Legal and Financial Implications for Homeowners

A Deed in Lieu of Foreclosure allows homeowners to voluntarily transfer property ownership to the lender, avoiding the lengthy foreclosure process and potentially causing less damage to credit scores. Foreclosure Sale involves the lender selling the property after repossession, often leading to a public auction that can result in a more severe financial and credit impact for the homeowner. Legal risks differ as Deed in Lieu may limit deficiency judgments, while foreclosure sales can leave homeowners responsible for any mortgage balance remaining after the sale.

Choosing the Best Option for Your Financial Situation

Choosing between a deed in lieu of foreclosure and a foreclosure sale depends on your financial stability and credit impact priorities. A deed in lieu often results in less damage to credit scores and quicker resolution, but requires lender approval and forfeiting the property voluntarily. Foreclosure sales are public auctions that may take longer and lead to a greater credit score decline, but might allow for redemption rights or higher sale proceeds.

Deed in Lieu of Foreclosure Infographic

libterm.com

libterm.com