Redemption offers a powerful path to personal transformation by allowing individuals to make amends and restore their sense of self-worth. Embracing redemption can lead to healing past mistakes and fostering growth in your relationships and inner life. Discover how you can unlock the full potential of redemption in the rest of this article.

Table of Comparison

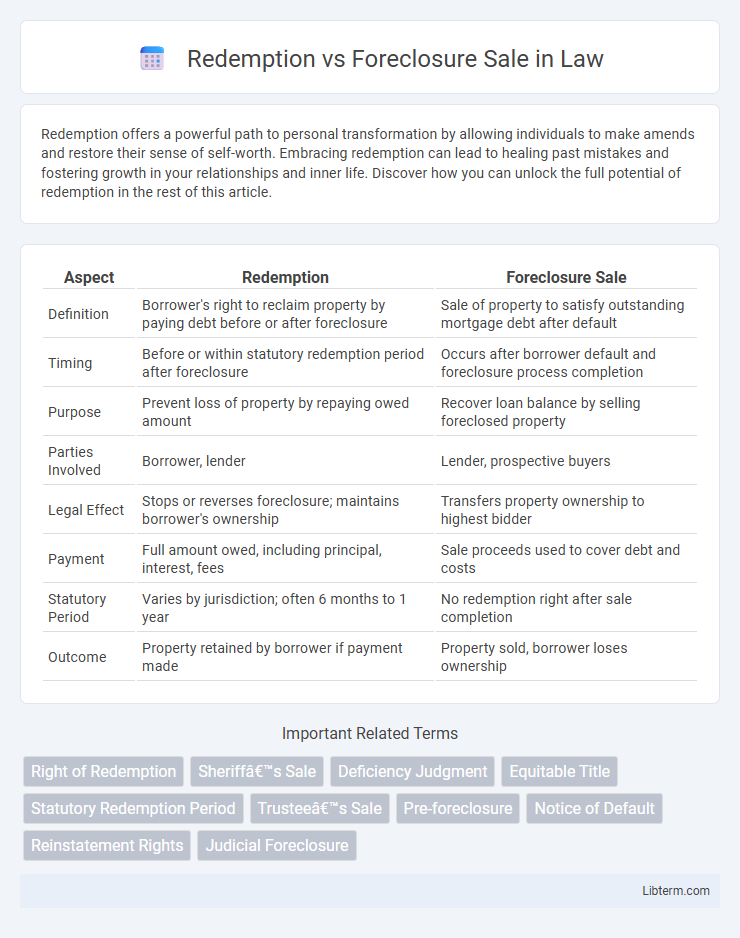

| Aspect | Redemption | Foreclosure Sale |

|---|---|---|

| Definition | Borrower's right to reclaim property by paying debt before or after foreclosure | Sale of property to satisfy outstanding mortgage debt after default |

| Timing | Before or within statutory redemption period after foreclosure | Occurs after borrower default and foreclosure process completion |

| Purpose | Prevent loss of property by repaying owed amount | Recover loan balance by selling foreclosed property |

| Parties Involved | Borrower, lender | Lender, prospective buyers |

| Legal Effect | Stops or reverses foreclosure; maintains borrower's ownership | Transfers property ownership to highest bidder |

| Payment | Full amount owed, including principal, interest, fees | Sale proceeds used to cover debt and costs |

| Statutory Period | Varies by jurisdiction; often 6 months to 1 year | No redemption right after sale completion |

| Outcome | Property retained by borrower if payment made | Property sold, borrower loses ownership |

Understanding Redemption and Foreclosure Sale: Key Differences

Redemption allows homeowners to reclaim their property by paying off the full amount owed, including fees and interest, within a specific timeframe after a foreclosure sale. Foreclosure sale is the public auction where the lender sells the property to recover the loan balance after the borrower defaults. The key difference lies in redemption providing a final chance to retain ownership, while foreclosure sale transfers ownership to the highest bidder, ending the borrower's rights.

The Legal Process of Foreclosure Sale

The legal process of a foreclosure sale involves the lender initiating a lawsuit or a non-judicial procedure to reclaim the property after the borrower defaults on mortgage payments. The foreclosure sale is conducted publicly, often by auction, where the property is sold to the highest bidder to satisfy the outstanding debt. Redemption rights may allow the borrower to recover the property by paying the full amount owed before the sale is finalized, depending on state laws.

How Redemption Rights Work in Real Estate

Redemption rights in real estate allow a homeowner to reclaim their property after a foreclosure sale by paying the full amount owed, including principal, interest, and costs, within a statutory redemption period. This period varies by state but typically ranges from a few months to up to one year, offering the debtor a final opportunity to prevent loss of ownership. These rights ensure that the borrower can retain property title, even after the sale, by satisfying the outstanding debt before the redemption deadline expires.

Factors Affecting Eligibility for Redemption

Eligibility for redemption after a foreclosure sale depends largely on state laws, which specify the redemption period and conditions. Key factors include whether the property is residential or commercial, the type of foreclosure process used, and the timeliness of the redemption payment. Lenders' requirements and the borrower's ability to repay the full amount owed, including penalties and fees, also critically impact the right to redeem.

Timelines: Redemption Period vs Foreclosure Sale Date

The redemption period is the legally defined timeframe during which a borrower can repay the outstanding debt and reclaim their property after a foreclosure sale notice, typically lasting from a few months to one year depending on state laws. Foreclosure sale date marks the scheduled auction when the lender sells the property, often occurring at the end of the notice period if the borrower fails to redeem. Understanding the precise timelines of both the redemption period and foreclosure sale date is crucial for homeowners to exercise their rights and potentially avoid losing their property.

Financial Implications: Costs of Redemption vs Foreclosure

Redemption after a foreclosure involves paying the full loan balance, accrued interest, late fees, and foreclosure costs, often making it more expensive than the foreclosure sale price itself. Foreclosure sales typically recover only a portion of the owed debt through auction bids, potentially leaving the homeowner liable for any deficiency judgments. Understanding these financial implications helps homeowners assess whether redeeming the property or allowing foreclosure is more cost-effective based on outstanding debt and fees.

Impact on Credit Score: Redemption vs Foreclosure Sale

Redemption after a foreclosure allows homeowners to reclaim their property by paying off the sale price plus fees, which may soften the negative impact on credit scores compared to a foreclosure sale alone. A foreclosure sale typically results in a significant and immediate drop in credit score, often by 100 to 160 points, due to the default and property repossession. Exercising redemption rights can demonstrate financial responsibility, potentially mitigating long-term credit damage compared to the permanent mark of a foreclosure sale.

State Laws Governing Redemption and Foreclosure

State laws governing redemption and foreclosure sales vary, impacting timelines and rights of property owners differently across jurisdictions. Redemption rights often allow the borrower to reclaim the property within a statutory period after a foreclosure sale by paying the owed amount, which can range from months to over a year depending on the state. Foreclosure procedures, including notice requirements and sale processes, are strictly regulated by state statutes such as California's Civil Code or Texas Property Code to ensure compliance and protect stakeholders.

Benefits and Risks: Redemption vs Foreclosure Sale

Redemption allows homeowners to reclaim their property by paying the owed debt before or shortly after a foreclosure sale, providing a valuable opportunity to avoid losing their home permanently. Foreclosure sales transfer ownership to a third party, which can lead to quicker resolution but also pose risks such as loss of equity and damage to credit scores for the original owner. Understanding the timing and financial implications of redemption versus foreclosure sales is essential for making informed decisions that balance recovery potential with financial risks.

Strategies for Homeowners Facing Foreclosure

Homeowners facing foreclosure can pursue redemption by paying the full loan balance plus fees within the redemption period to reclaim their property, effectively stopping the foreclosure sale. Alternatively, negotiating a short sale or loan modification before the foreclosure sale can provide viable options to avoid losing the home. Understanding state-specific redemption rights and timelines is crucial to developing an effective foreclosure defense strategy.

Redemption Infographic

libterm.com

libterm.com