A short sale allows you to sell your home for less than the outstanding mortgage balance, often helping avoid foreclosure. This process can relieve financial burden while minimizing damage to your credit score. Explore the article to understand how a short sale could be the right solution for your situation.

Table of Comparison

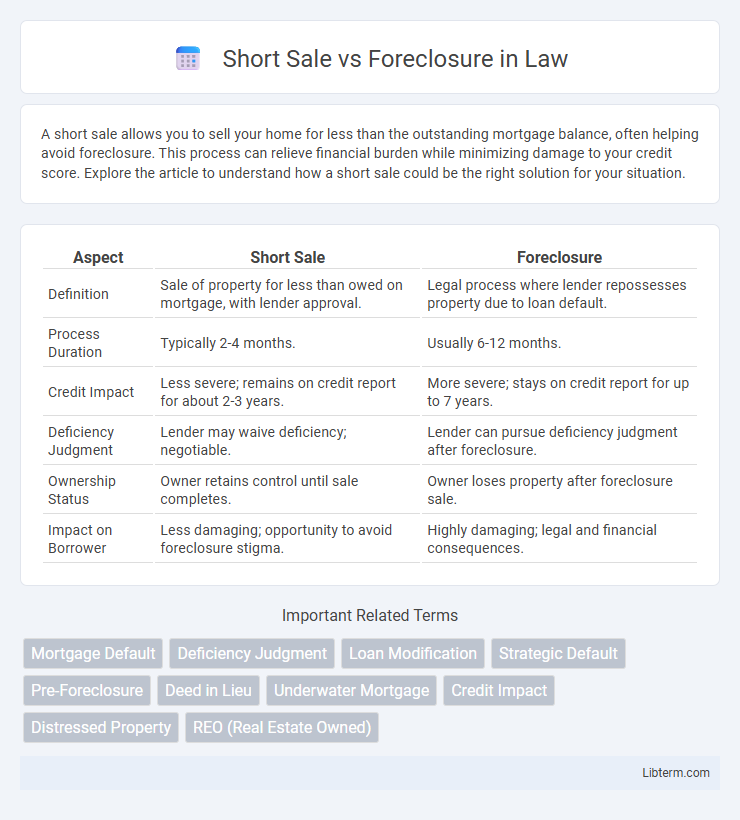

| Aspect | Short Sale | Foreclosure |

|---|---|---|

| Definition | Sale of property for less than owed on mortgage, with lender approval. | Legal process where lender repossesses property due to loan default. |

| Process Duration | Typically 2-4 months. | Usually 6-12 months. |

| Credit Impact | Less severe; remains on credit report for about 2-3 years. | More severe; stays on credit report for up to 7 years. |

| Deficiency Judgment | Lender may waive deficiency; negotiable. | Lender can pursue deficiency judgment after foreclosure. |

| Ownership Status | Owner retains control until sale completes. | Owner loses property after foreclosure sale. |

| Impact on Borrower | Less damaging; opportunity to avoid foreclosure stigma. | Highly damaging; legal and financial consequences. |

Understanding Short Sale and Foreclosure

A short sale occurs when a homeowner sells their property for less than the outstanding mortgage balance with lender approval, avoiding foreclosure and minimizing credit damage. Foreclosure is a legal process where the lender seizes and sells the property after the borrower defaults on mortgage payments, significantly impacting credit scores. Understanding these distinctions helps homeowners explore options to manage mortgage debt and credit consequences.

Key Differences Between Short Sale and Foreclosure

Short sales involve selling a home for less than the outstanding mortgage balance with lender approval, while foreclosure is a legal process where the lender repossesses the property due to loan default. Short sales typically allow homeowners to avoid the negative credit impact and lengthy court procedures associated with foreclosure. Foreclosures generally take longer to resolve, damage credit scores more severely, and result in loss of property without homeowner consent.

How a Short Sale Works

A short sale involves selling a property for less than the outstanding mortgage balance with lender approval to avoid foreclosure. The homeowner negotiates with the lender to accept a reduced payoff amount, allowing the sale to proceed and preventing credit damage from foreclosure. This process can take several months but typically results in less financial harm and a faster resolution than foreclosure.

The Foreclosure Process Explained

The foreclosure process begins when a homeowner defaults on mortgage payments, prompting the lender to initiate legal action to repossess the property. This process typically involves a series of steps, including missed payments, a notice of default, a public auction, and finally, the transfer of ownership to the lender or a third-party buyer. Understanding the timeline and legal requirements of foreclosure helps homeowners and investors navigate the risks and opportunities associated with distressed real estate.

Impact on Credit Score: Short Sale vs Foreclosure

A short sale generally has a less severe impact on credit scores compared to foreclosure, often resulting in a drop of 50 to 150 points, while foreclosure can cause a decrease of 85 to 160 points. Credit reports typically reflect a short sale as "settled for less," which is viewed more favorably by lenders than a foreclosure, marked as a "foreclosed" status. Recovery time for credit scores after a short sale ranges from 24 to 36 months, whereas foreclosure effects can linger for 7 years, complicating future mortgage approvals.

Financial Consequences for Homeowners

Short sales typically result in less severe financial consequences for homeowners compared to foreclosures, as lenders may agree to accept less than the owed mortgage balance, minimizing credit score damage. Foreclosures generally cause greater credit score declines, often 100 to 160 points, and remain on credit reports for up to seven years, affecting future loan eligibility and interest rates. Both options impact access to new mortgages, but short sales may allow homeowners to qualify for new loans sooner than foreclosures due to less prolonged negative credit effects.

Eligibility Criteria for Short Sale and Foreclosure

Short sale eligibility requires the homeowner to demonstrate financial hardship and lender approval, typically needing the mortgage balance to exceed the home's current market value. Foreclosure eligibility arises when the borrower defaults on mortgage payments for an extended period, prompting the lender to initiate a legal process to repossess the property. Both options impact credit scores differently, with short sales often viewed more favorably than foreclosures.

Effects on Future Home Buying

Short sales typically have a less severe impact on future home buying, allowing borrowers to qualify for a new mortgage within two to four years, compared to the longer seven-year waiting period often required after foreclosure. Both options negatively affect credit scores, but foreclosures usually cause a more significant drop, resulting in higher interest rates and more stringent loan requirements. Lenders view short sales as a proactive resolution, which may improve the borrower's chances of securing financing sooner than after a foreclosure event.

Pros and Cons: Short Sale Compared to Foreclosure

A short sale allows homeowners to sell their property for less than the owed mortgage balance, often resulting in less credit damage than a foreclosure. It provides a more controlled exit with potential lender negotiation, avoiding the lengthy and public process of foreclosure. However, short sales can be time-consuming and require lender approval, whereas foreclosure may be faster but significantly impacts credit scores and can lead to longer-term financial consequences.

Choosing the Best Option for Your Situation

Choosing between a short sale and foreclosure depends on financial goals, credit impact, and timeframe for recovery. A short sale allows selling the property for less than the mortgage balance with lender approval, minimizing credit damage and potentially avoiding foreclosure's lengthy process. Foreclosure leads to property repossession by the lender, severely affecting credit scores and limiting future borrowing options for years.

Short Sale Infographic

libterm.com

libterm.com