A mortgage is a loan specifically designed for purchasing property, where the property itself serves as collateral. Understanding key elements like interest rates, loan terms, and down payments can significantly impact your long-term financial health. Explore the rest of this article to learn how to secure the best mortgage deal tailored to your needs.

Table of Comparison

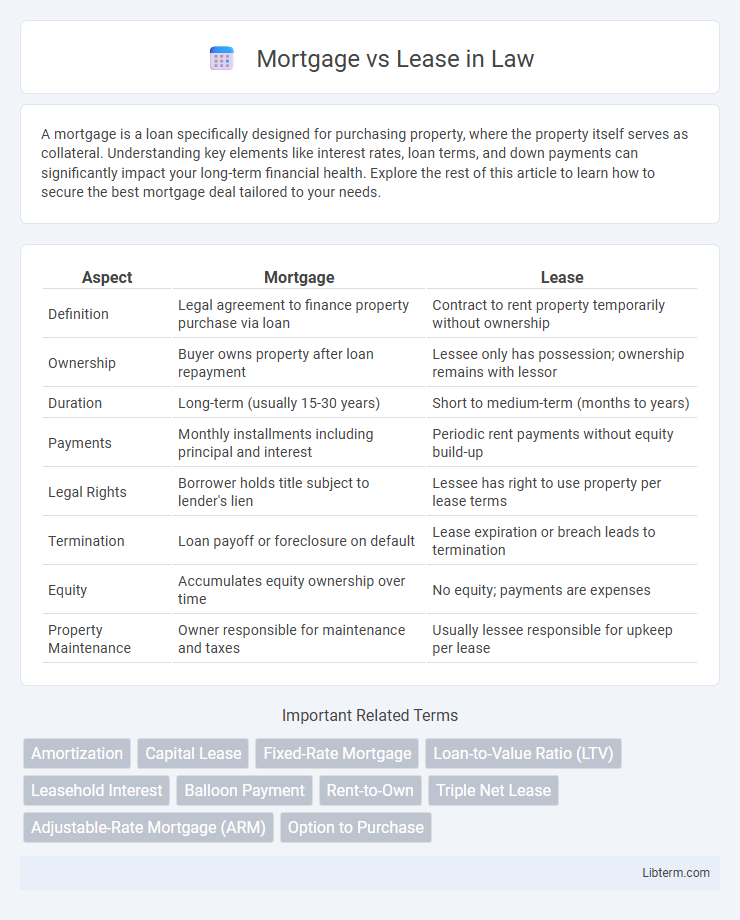

| Aspect | Mortgage | Lease |

|---|---|---|

| Definition | Legal agreement to finance property purchase via loan | Contract to rent property temporarily without ownership |

| Ownership | Buyer owns property after loan repayment | Lessee only has possession; ownership remains with lessor |

| Duration | Long-term (usually 15-30 years) | Short to medium-term (months to years) |

| Payments | Monthly installments including principal and interest | Periodic rent payments without equity build-up |

| Legal Rights | Borrower holds title subject to lender's lien | Lessee has right to use property per lease terms |

| Termination | Loan payoff or foreclosure on default | Lease expiration or breach leads to termination |

| Equity | Accumulates equity ownership over time | No equity; payments are expenses |

| Property Maintenance | Owner responsible for maintenance and taxes | Usually lessee responsible for upkeep per lease |

Overview: Mortgage vs Lease

Mortgage and lease both provide access to real property but differ fundamentally in ownership and financial structure. A mortgage is a loan used to purchase property, creating an ownership interest and building equity over time. A lease grants the right to use property for a specified period without ownership, involving periodic rental payments without equity accumulation.

Key Definitions: Mortgage and Lease Explained

A mortgage is a legal agreement where a borrower receives funds from a lender to purchase property, promising to repay with interest over a set period. A lease is a contractual arrangement allowing one party to use property owned by another for a specified time in exchange for rent. Mortgages create ownership rights with debt obligations, whereas leases grant temporary usage without transferring ownership.

Ownership: Who Holds the Title?

Mortgage agreements grant the borrower ownership rights by placing the property title in their name, while the lender holds a lien until the loan is fully repaid. Lease contracts do not transfer property ownership; instead, the lessee obtains temporary possession and usage rights without holding the title. Understanding the distinction between holding the property title in a mortgage versus possession rights in a lease is crucial for property control and long-term investment.

Financial Commitment: Upfront and Ongoing Costs

Mortgage requires a significant upfront down payment, often 10-20% of the property's value, coupled with ongoing monthly principal and interest payments that build home equity over time. Leasing involves lower initial costs, typically limited to a security deposit and first month's rent, with consistent monthly payments that do not contribute to ownership or equity. Mortgage commitments include property taxes, insurance, and maintenance expenses, whereas lease agreements may shift some maintenance responsibilities to the landlord, affecting the overall financial outlay.

Duration: Term Lengths and Flexibility

Mortgage terms typically span 15 to 30 years, offering long-term stability and the opportunity to build equity over time. Lease agreements usually range from 6 months to a few years, providing greater flexibility for short-term living arrangements or uncertain plans. Longer mortgage durations require commitment but result in ownership, while leases offer adaptable durations that accommodate changing needs without long-term obligations.

Equity Building: Investment Potential

Mortgage payments contribute to equity building as each installment reduces the principal loan balance, increasing homeownership stake and long-term asset value. Leases, conversely, involve rental payments that do not accumulate ownership or equity, providing no investment return for the lessee. Homebuyers leveraging mortgages benefit from property appreciation and potential tax advantages, enhancing overall investment potential compared to lease agreements.

Tax Implications: Deductions and Benefits

Mortgage interest payments are typically tax-deductible, allowing homeowners to reduce taxable income and benefit from significant tax savings under IRS Section 163(h). Lease payments, however, are generally considered a business expense for lessees and can be fully deducted if the property is used for business purposes, offering immediate tax relief without equity buildup. Homeownership through a mortgage also provides property tax deductions, while leasing does not grant ownership rights or property tax benefits.

Maintenance Responsibilities: Who Handles Repairs?

Mortgage holders are responsible for all maintenance and repair costs since they own the property, ensuring full control over upkeep decisions and budgeting. Leaseholders typically rely on landlords or property management for major repairs, while tenants handle minor maintenance according to lease agreements. Understanding the division of repair responsibilities is crucial for financial planning in both mortgage ownership and leasing scenarios.

End of Term: What Happens Next?

At the end of a mortgage term, homeowners must either refinance, sell the property, or pay off the remaining balance to retain ownership, whereas leaseholders typically return the property to the landlord unless a lease renewal or purchase option is exercised. Mortgage completion leads to full property ownership, while lease end involves vacating the premises or negotiating new lease terms. Understanding these distinctions is critical for financial planning and long-term housing security.

Choosing What's Right: Factors to Consider

Choosing between a mortgage and a lease depends on long-term financial goals, credit score, and property ownership preferences. Mortgages build equity and offer tax benefits but require a substantial down payment and stable income, while leases provide flexibility with lower upfront costs and less responsibility for maintenance. Evaluating monthly budget, market conditions, and future plans helps determine whether owning through a mortgage or renting via lease aligns best with individual circumstances.

Mortgage Infographic

libterm.com

libterm.com