A defeasible fee is a type of property ownership that can be voided or annulled upon the occurrence of a specific event or condition. This interest provides owners with rights that are qualified, meaning the property may revert to the original grantor or another party if the condition is breached. Explore this article to understand how defeasible fees might impact Your property rights and estate planning.

Table of Comparison

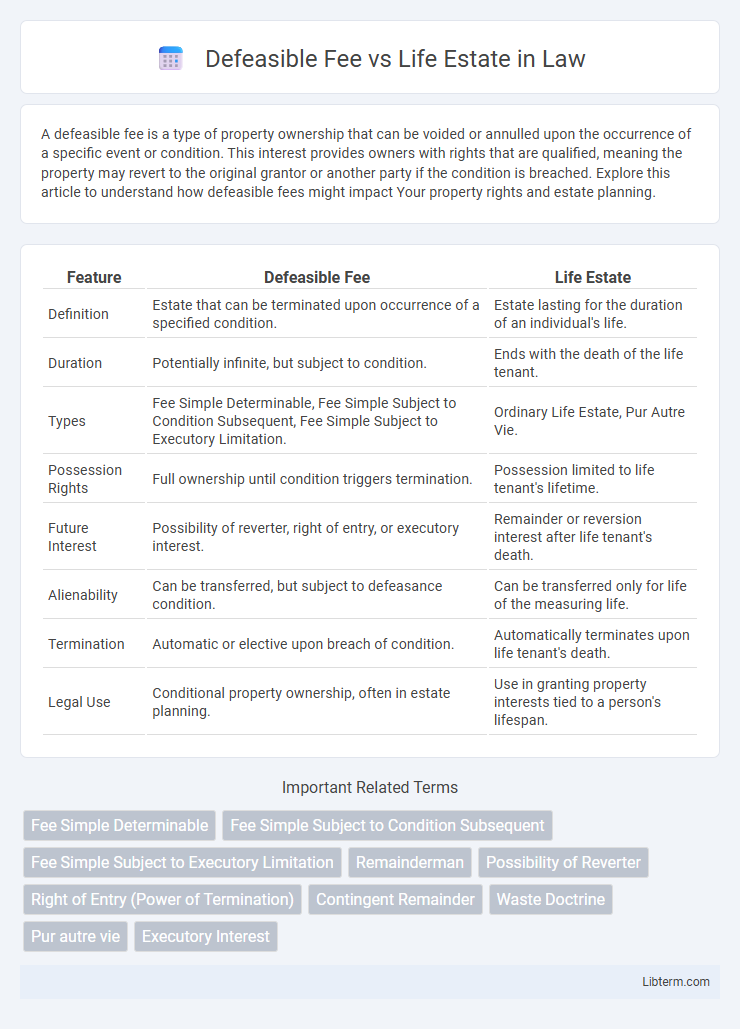

| Feature | Defeasible Fee | Life Estate |

|---|---|---|

| Definition | Estate that can be terminated upon occurrence of a specified condition. | Estate lasting for the duration of an individual's life. |

| Duration | Potentially infinite, but subject to condition. | Ends with the death of the life tenant. |

| Types | Fee Simple Determinable, Fee Simple Subject to Condition Subsequent, Fee Simple Subject to Executory Limitation. | Ordinary Life Estate, Pur Autre Vie. |

| Possession Rights | Full ownership until condition triggers termination. | Possession limited to life tenant's lifetime. |

| Future Interest | Possibility of reverter, right of entry, or executory interest. | Remainder or reversion interest after life tenant's death. |

| Alienability | Can be transferred, but subject to defeasance condition. | Can be transferred only for life of the measuring life. |

| Termination | Automatic or elective upon breach of condition. | Automatically terminates upon life tenant's death. |

| Legal Use | Conditional property ownership, often in estate planning. | Use in granting property interests tied to a person's lifespan. |

Introduction to Defeasible Fee and Life Estate

Defeasible fee is a type of estate in land that grants ownership subject to specific conditions or limitations, which, if violated, may cause the property to revert to the original grantor or a third party. A life estate provides ownership rights that last for the duration of a person's life, after which the property passes to a remainderman or reverts to the grantor. Both defeasible fee and life estate represent conditional forms of property ownership but differ in duration and conditions governing the estate's termination.

Definition of Defeasible Fee

A defeasible fee is a type of freehold estate in real property that automatically terminates or can be voided upon the occurrence of a specified condition, reverting ownership to the grantor or a third party. This estate includes variants such as fee simple determinable, fee simple subject to condition subsequent, and fee simple subject to executory limitation. Unlike a life estate, which lasts only for the lifetime of a designated individual, a defeasible fee potentially extends beyond a life term but is contingent on meeting or violating stipulated conditions.

Types of Defeasible Fees

Defeasible fees include fee simple determinable, fee simple subject to condition subsequent, and fee simple subject to executory limitation, each creating different conditions under which property ownership can end. Fee simple determinable automatically ends upon the occurrence of a specified event, while fee simple subject to condition subsequent requires a right of reentry to reclaim the property. Fee simple subject to executory limitation transfers ownership to a third party if a condition is violated, distinguishing it from a life estate which grants possession only for the duration of a person's life.

Definition of Life Estate

A life estate grants ownership rights in real property for the duration of an individual's life, after which the property transfers to a designated remainderman or reverts to the original grantor. Unlike a defeasible fee, which may terminate upon the occurrence of a specified event, a life estate is explicitly tied to the lifespan of the life tenant. The life tenant holds the right to possess and use the property but cannot waste or otherwise damage it, ensuring the future interest remains intact.

Key Differences Between Defeasible Fee and Life Estate

Defeasible fee estates grant ownership subject to specific conditions or events that can terminate the estate, allowing full possessory rights until such conditions occur. In contrast, a life estate provides ownership only for the duration of a specified individual's life, after which the property reverts to another party or remainderman. Key differences include the conditional nature and potential for termination of defeasible fees versus the temporal limitation and reversionary interest inherent in life estates.

Rights and Obligations of Holders

Defeasible fee holders possess ownership rights subject to conditions that, if violated, can result in termination of their interest, while they maintain the right to sell, lease, or bequeath the property during their tenure. Life estate holders have rights limited to their lifetime, including possession and use of the property, but cannot alter the estate's ultimate disposition and must preserve the property's value for remaindermen. Both holders bear obligations to avoid waste and uphold property upkeep, ensuring the estate's value remains intact for future interests.

Termination and Transferability

Defeasible fees terminate automatically upon the occurrence of a specified event, reverting ownership to the grantor or a third party, while life estates end upon the death of the life tenant, passing ownership according to the terms of the grant or to a remainderman. Transferability of defeasible fees allows the holder to sell or dispose of their interest, subject to the conditions that could trigger termination, whereas life tenants can transfer their possessory interest only for the duration of their life but cannot extend the estate beyond their lifetime. The key distinction lies in defeasible fees' conditional future interest versus life estates' fixed temporal duration tied to the life tenant's lifespan.

Common Uses in Real Estate Law

Defeasible fees are commonly used in real estate law to impose conditions on property ownership, allowing the grantor to reclaim the property if specific criteria are not met, such as maintaining the land for agricultural use. Life estates grant ownership rights limited to the duration of an individual's life, often utilized for estate planning to provide for surviving family members while preserving the remainder interest for heirs. Both conveyances help shape property interests by balancing control, usage rights, and future interests in real estate transactions and inheritance strategies.

Legal Implications and Case Examples

A defeasible fee grants property ownership subject to a condition or event that, if violated, can cause the estate to revert to the grantor, creating potential uncertainty in property rights and transferability. Life estates provide ownership for the duration of a person's life, after which the property automatically passes to a remainderman, reducing ambiguity in succession but limiting the life tenant's ability to encumber the property. Landmark cases such as *Wood v. Board of County Commissioners* clarify how breaches of conditions in defeasible fees result in forfeiture, while *Mahrenholz v. County Board* illustrates how life estate interests protect future ownership against premature alienation.

Choosing Between Defeasible Fee and Life Estate

Choosing between a defeasible fee and a life estate depends on the intended duration and conditions of property ownership. A defeasible fee allows the grantor to impose conditions that can terminate ownership upon certain events, making it suitable for conditional real estate transfers. In contrast, a life estate grants ownership only for the lifetime of the tenant, reverting to the grantor or another party afterward, which is ideal for lifetime use without permanent transfer of title.

Defeasible Fee Infographic

libterm.com

libterm.com