Fee tail is a legal estate in land that restricts inheritance to a fixed line of heirs, typically preventing the sale or transfer outside the family. This form of ownership aims to keep property within a bloodline, preserving family wealth and legacy across generations. Explore the full article to understand how fee tail impacts property rights and inheritance laws today.

Table of Comparison

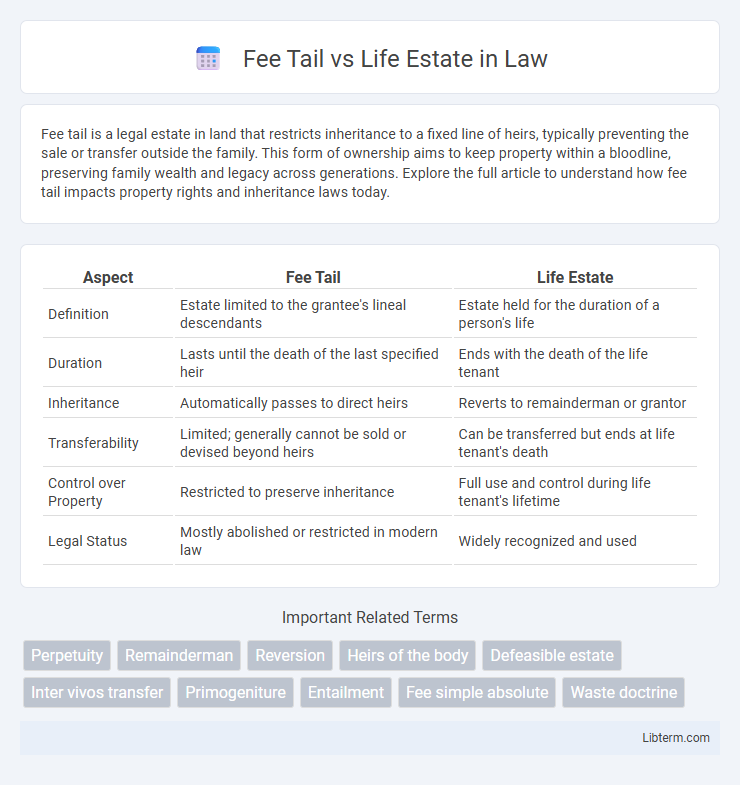

| Aspect | Fee Tail | Life Estate |

|---|---|---|

| Definition | Estate limited to the grantee's lineal descendants | Estate held for the duration of a person's life |

| Duration | Lasts until the death of the last specified heir | Ends with the death of the life tenant |

| Inheritance | Automatically passes to direct heirs | Reverts to remainderman or grantor |

| Transferability | Limited; generally cannot be sold or devised beyond heirs | Can be transferred but ends at life tenant's death |

| Control over Property | Restricted to preserve inheritance | Full use and control during life tenant's lifetime |

| Legal Status | Mostly abolished or restricted in modern law | Widely recognized and used |

Introduction to Fee Tail and Life Estate

Fee tail is a type of hereditary property ownership that restricts the sale or inheritance of land to direct descendants, ensuring the estate remains within the family lineage. Life estate grants ownership rights to an individual for the duration of their lifetime, after which the property passes to a designated remainderman or reverts to the original grantor. Both legal concepts serve to control property succession but differ significantly in duration and transferability.

Definition of Fee Tail

Fee tail is a type of freehold estate in real property that restricts inheritance to direct descendants, ensuring the estate remains within a specific family lineage. It differs from a life estate, which grants ownership for the duration of an individual's life without right of inheritance. The fee tail estate automatically passes to the grantee's heirs according to a predetermined succession, limiting alienation and preserving family ownership across generations.

Definition of Life Estate

A life estate grants an individual ownership of property for the duration of their lifetime, after which the property passes to a designated remainderman or reverts to the original grantor. Unlike a fee tail, which restricts inheritance to lineal descendants, a life estate provides possession without full ownership rights, limiting the life tenant's ability to sell or encumber the property beyond their lifetime. This arrangement ensures the property remains within a predetermined lineage or reverts to a specified party upon the life tenant's death.

Historical Background of Fee Tail

Fee tail originated in medieval England as a legal mechanism to keep estates within a family lineage, preventing heirs from selling or dividing the property. This form of inheritance restricted the transfer of land to direct descendants, ensuring the estate remained intact across generations. Over time, fee tail diminished due to legal reforms favoring greater flexibility in property ownership, while life estates evolved to grant ownership rights limited to a person's lifetime.

Historical Development of Life Estate

The historical development of the life estate traces back to medieval English common law, where it served as a legal mechanism allowing an individual to hold property rights for the duration of their life without transferring full ownership, distinguishing it from the fee tail estate that restricted inheritance to direct descendants. Life estates were essential in facilitating property use and control while preventing alienation or division of land through limited duration ownership, often employed for dowries or to protect family wealth. Over time, the life estate evolved into a flexible estate form in modern property law, allowing holders to benefit from property rights during their lifetime, with the remainder interest passing to designated heirs or remaindermen.

Key Differences Between Fee Tail and Life Estate

Fee tail grants ownership inheritance limited to direct descendants, ensuring property remains within a family lineage, while a life estate confers ownership for the duration of an individual's lifetime without inheritance rights. Unlike fee tail, which restricts alienation and imposes strict succession, life estates allow the owner to use and benefit from the property but revert it to a remainderman or grantor upon death. Fee tail is largely obsolete in modern law due to its rigidity, whereas life estates remain common for estate planning and property management purposes.

Legal Implications and Modern Use

Fee tail restricts property inheritance to direct descendants, limiting the owner's rights to sell or bequeath the estate freely, which can create long-term legal encumbrances. Life estate grants ownership only for the duration of an individual's life, after which the property automatically transfers to a remainderman, avoiding perpetual control but requiring clear designation of future interests. Modern use of fee tails is largely abolished or heavily restricted in many jurisdictions due to their inflexibility and legal complications, while life estates remain a practical tool for estate planning, enabling control over property succession and minimizing probate disputes.

Advantages and Disadvantages of Each Estate

Fee tail provides the advantage of preserving property within a family lineage by restricting inheritance to direct descendants, ensuring long-term estate control, but it limits flexibility in property transfer and can complicate modern estate planning. Life estate grants a person the right to use and benefit from property during their lifetime, offering clear and transferable ownership after their death; however, it restricts the life tenant from making major changes or disposing of the property, potentially reducing the estate's market value. Both estates impact future ownership and tax implications differently, with fee tail often attracting legal limitations in many jurisdictions, while life estates provide a simpler alternative for conditional use and succession planning.

Common Scenarios for Fee Tail vs Life Estate

Fee tail estates typically arise in inheritance situations where property must remain within a family line, preventing sale or transfer outside direct descendants. Life estates are common in elder care planning, granting a person the right to use property during their lifetime with remainder interests passing to others afterward. Both convey limited interests but differ in duration and transfer restrictions, influencing estate and property planning strategies.

Conclusion: Choosing Between Fee Tail and Life Estate

Choosing between Fee Tail and Life Estate depends on the desired control over property inheritance and duration of ownership. Fee Tail restricts property passage to direct descendants, preserving family estate across generations, while Life Estate grants ownership rights for the holder's lifetime with remainder interests passing to others afterward. Opt for Fee Tail for long-term ancestral preservation and Life Estate for flexible, temporary control.

Fee Tail Infographic

libterm.com

libterm.com