Transitional alimony provides temporary financial support to help a spouse adjust to new living standards after a divorce, typically covering expenses like education or job training. This form of alimony is designed to bridge the gap until the recipient can become self-sufficient, reflecting the court's goal of fairness and practicality. Discover how transitional alimony could impact your post-divorce finances and what factors determine eligibility by reading the rest of the article.

Table of Comparison

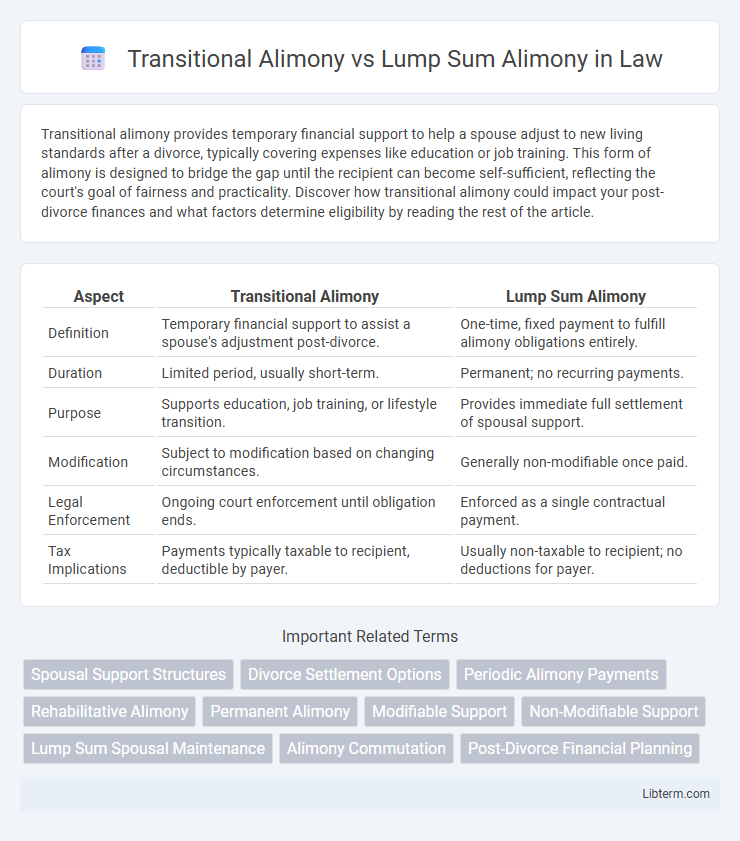

| Aspect | Transitional Alimony | Lump Sum Alimony |

|---|---|---|

| Definition | Temporary financial support to assist a spouse's adjustment post-divorce. | One-time, fixed payment to fulfill alimony obligations entirely. |

| Duration | Limited period, usually short-term. | Permanent; no recurring payments. |

| Purpose | Supports education, job training, or lifestyle transition. | Provides immediate full settlement of spousal support. |

| Modification | Subject to modification based on changing circumstances. | Generally non-modifiable once paid. |

| Legal Enforcement | Ongoing court enforcement until obligation ends. | Enforced as a single contractual payment. |

| Tax Implications | Payments typically taxable to recipient, deductible by payer. | Usually non-taxable to recipient; no deductions for payer. |

Understanding Transitional Alimony

Transitional alimony provides temporary financial support to a spouse adjusting to the economic changes following a divorce, typically lasting only as long as the recipient needs to become self-sufficient. It differs from lump sum alimony, which involves a fixed, one-time payment that settles spousal support without ongoing obligations. Understanding transitional alimony is essential for recognizing its role in easing the short-term financial impact of divorce while promoting independence.

What is Lump Sum Alimony?

Lump Sum Alimony is a fixed amount of money awarded by the court, paid in one single payment or in installments over a predetermined period, providing financial support without ongoing modifications. This type of alimony is typically used to settle financial obligations arising from divorce, ensuring immediate or scheduled payment to the recipient spouse. Unlike Transitional Alimony, Lump Sum Alimony does not depend on the payer's future earning capacity and remains enforceable as a judgment lien on the payer's property.

Key Differences Between Transitional and Lump Sum Alimony

Transitional alimony provides temporary financial support to help a lower-earning spouse adjust to independent living after divorce, typically lasting for a specified period. Lump sum alimony is a fixed, one-time payment that settles alimony obligations in full, offering certainty and finality in financial matters. Key differences between transitional and lump sum alimony include payment structure, duration, and modification possibilities, with transitional alimony often modifiable and temporary, while lump sum alimony is non-modifiable and permanent once paid.

Eligibility Criteria for Each Alimony Type

Transitional alimony eligibility requires a spouse to demonstrate a need for temporary financial support while adjusting to a change in marital status, often granted when one party needs time to gain education or employment skills. Lump sum alimony eligibility depends on the ability of the paying spouse to make a one-time payment, typically awarded when financial resources are clearly defined and the parties prefer an immediate settlement. Courts consider factors such as the length of the marriage, the financial condition of both spouses, and the purpose of the alimony when determining the appropriate type.

Pros and Cons of Transitional Alimony

Transitional alimony provides temporary financial support to help a lower-earning spouse adjust to lifestyle changes after divorce, typically covering expenses like education or job training. Its pros include flexibility and limited duration, preventing long-term financial dependency, while cons involve potentially insufficient support if the recipient's economic situation worsens unexpectedly. Unlike lump sum alimony, which offers a one-time payment and immediate financial closure, transitional alimony requires ongoing payments that can be modified if circumstances change.

Advantages and Disadvantages of Lump Sum Alimony

Lump sum alimony offers the advantage of providing a fixed, one-time payment that finalizes support obligations, reducing long-term financial uncertainty for both parties. It eliminates the need for ongoing modifications and court interventions, offering closure and predictability. However, its disadvantages include the risk of insufficient payment if the payer's financial situation improves and the lack of flexibility for changing needs, potentially leaving the recipient vulnerable if circumstances evolve.

How Courts Decide Between Transitional and Lump Sum Alimony

Courts decide between transitional alimony and lump sum alimony by evaluating factors such as the duration of the marriage, the recipient's need for financial support to adjust to a new lifestyle, and the payer's ability to make immediate or periodic payments. Transitional alimony is favored when short-term support is necessary to help the recipient gain education, training, or job skills, facilitating financial independence. Lump sum alimony is often awarded when a clear, fixed amount can be determined based on marital assets or when a clean break between parties is needed, ensuring finality in financial obligations.

Tax Implications of Alimony Payments

Transitional alimony payments are typically considered taxable income for the recipient and tax-deductible for the payer, impacting annual tax liabilities during the payment period. Lump sum alimony is treated differently, as it is not taxable to the recipient nor deductible by the payer, making it a fixed financial obligation without ongoing tax consequences. Understanding these distinctions is crucial for effective financial planning and compliance with IRS regulations on spousal support.

Modifying or Terminating Alimony Obligations

Transitional alimony is usually temporary and can be modified or terminated when the recipient spouse becomes self-supporting or circumstances significantly change, reflecting its purpose to bridge financial gaps after divorce. Lump sum alimony involves a fixed payment that is not subject to modification or termination once paid, providing finality and certainty to alimony obligations. Courts typically allow modification of transitional alimony based on changes in income, employment, or needs, while lump sum alimony is treated like a property settlement with no ongoing obligations.

Choosing the Best Alimony Option for Your Situation

Transitional alimony provides temporary financial support during a spouse's adjustment period after divorce, typically based on factors like the duration of marriage and income disparity. Lump sum alimony offers a fixed, one-time payment, advantageous for those seeking finality and avoiding future modification or enforcement issues. Evaluating your financial needs, tax implications, and long-term goals is essential to selecting the best alimony option tailored to your unique situation.

Transitional Alimony Infographic

libterm.com

libterm.com