The Guarantee Clause, found in Article IV, Section 4 of the U.S. Constitution, ensures every state a republican form of government and protection against invasion and domestic violence. This clause empowers the federal government to intervene if a state fails to uphold a representative system or faces threats to its stability. Explore the full article to understand how this critical provision impacts your state's governance and security.

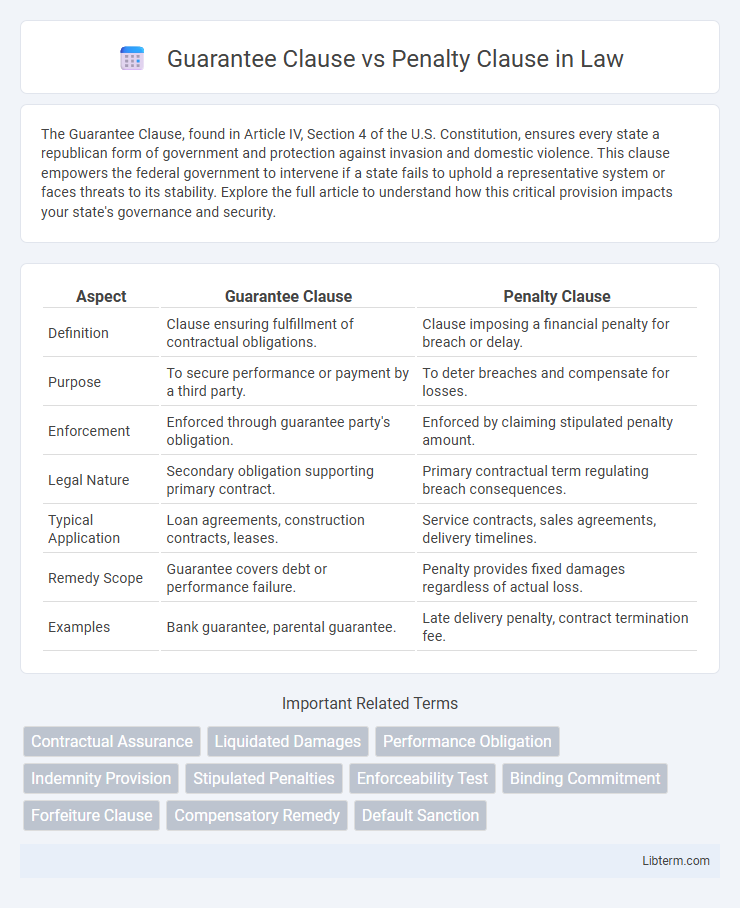

Table of Comparison

| Aspect | Guarantee Clause | Penalty Clause |

|---|---|---|

| Definition | Clause ensuring fulfillment of contractual obligations. | Clause imposing a financial penalty for breach or delay. |

| Purpose | To secure performance or payment by a third party. | To deter breaches and compensate for losses. |

| Enforcement | Enforced through guarantee party's obligation. | Enforced by claiming stipulated penalty amount. |

| Legal Nature | Secondary obligation supporting primary contract. | Primary contractual term regulating breach consequences. |

| Typical Application | Loan agreements, construction contracts, leases. | Service contracts, sales agreements, delivery timelines. |

| Remedy Scope | Guarantee covers debt or performance failure. | Penalty provides fixed damages regardless of actual loss. |

| Examples | Bank guarantee, parental guarantee. | Late delivery penalty, contract termination fee. |

Understanding Guarantee Clauses

Guarantee clauses ensure the performance of contractual obligations by providing a third party's commitment to fulfill the primary party's duties if they default. These clauses involve a surety who assumes responsibility to safeguard the obligee, enhancing trust and security in business transactions. Guarantee clauses differ from penalty clauses, which impose a predetermined sum as a consequence for breach rather than securing performance.

Defining Penalty Clauses

Penalty clauses impose punitive damages that exceed the actual harm caused by a breach, aiming to deter non-performance rather than to compensate for losses. Courts typically refuse to enforce penalty clauses because they are not a genuine pre-estimate of damages but a penalty designed to punish the breaching party. In contrast, guarantee clauses ensure performance or payment without imposing excessive or disproportionate fines beyond the owed obligation.

Legal Foundations: Guarantee vs Penalty Clause

The legal foundation of the Guarantee Clause lies in ensuring performance or compensation for non-performance without punitive intent, emphasizing the creditor's security rather than punishment. In contrast, the Penalty Clause is designed to impose a predetermined punishment or financial penalty on the debtor for breach of contract, reflecting a deterrent purpose and is often subject to strict judicial scrutiny. Guarantee Clauses typically conform to legal frameworks that support contractual certainty and enforceability, whereas Penalty Clauses may be limited or invalidated to prevent excessive penalties beyond actual damages.

Key Differences Between Guarantee and Penalty Clauses

The Guarantee Clause ensures the performance of a contractual obligation by involving a third party who promises to fulfill the obligation if the primary party defaults, emphasizing security and assurance. The Penalty Clause imposes a predetermined monetary punishment on the party that breaches the contract, focusing on deterrence rather than compensation. Key differences lie in their purpose: guarantee clauses provide risk mitigation and enforcement support, while penalty clauses serve as punitive measures to prevent contract violations.

Use Cases in Contracts: Guarantee vs Penalty

Guarantee clauses in contracts ensure one party's obligation will be fulfilled, providing security for performance and payment, commonly used in construction and loan agreements. Penalty clauses impose financial consequences for breach or delay, motivating compliance and protecting interests in service contracts and sales agreements. Choosing between guarantee and penalty clauses depends on the contract's risk allocation, enforcement ease, and desired remedies for non-performance.

Enforceability in Court

Guarantee clauses are generally enforceable in court when they clearly outline the obligations and conditions, providing financial assurance without imposing excessive punishment. Penalty clauses are often deemed unenforceable as courts typically view them as punitive measures rather than a genuine pre-estimate of damages. Courts favor clauses that protect legitimate interests and discourage punitive fines, requiring clear proportionality to the actual harm or loss incurred.

Jurisdictional Variations and Interpretations

Jurisdictional variations significantly impact the interpretation and enforceability of Guarantee Clauses versus Penalty Clauses in contract law, with common law jurisdictions like the US and UK typically upholding Guarantee Clauses as enforceable promises while scrutinizing Penalty Clauses for proportionality and damages. Civil law countries such as Germany and France often apply specific statutory regulations that distinguish these clauses based on intent and economic effect, influencing the scope of remedies available. Courts assess factors like the clause's reasonableness, the actual loss incurred, and contractual context, resulting in divergent judicial outcomes across different legal systems.

Practical Implications for Businesses

The Guarantee Clause ensures that a party fulfills contractual obligations by providing a third-party assurance, minimizing risk for businesses in transactions involving credit or performance uncertainty. In contrast, the Penalty Clause imposes a predetermined financial consequence for breach, incentivizing timely and faithful contract execution, but may lead to disputes if deemed excessive or unenforceable. Businesses benefit from carefully drafting these clauses to balance risk mitigation with enforceability, promoting smoother contract management and dispute resolution.

Common Pitfalls and How to Avoid Them

Guarantee Clause often leads to disputes when the guaranteed obligations are vaguely defined, causing confusion over the extent of responsibility. Penalty Clause commonly faces challenges due to excessive or unenforceable damages that courts may deem punitive rather than compensatory. To avoid these pitfalls, clearly specify the scope and limits of guarantees, and ensure penalty clauses align with actual harm incurred, maintaining proportionality and legal enforceability.

Best Practices for Drafting Contract Clauses

In drafting contract clauses, clearly distinguishing between guarantee clauses and penalty clauses ensures enforceability and clarity. Guarantee clauses should specify precise obligations and conditions for remedy without imposing punitive measures, aligning with legal standards to avoid being deemed penalties. Best practices recommend using clear language, setting reasonable performance expectations, and avoiding excessive damages that could invalidate the clause under contract law.

Guarantee Clause Infographic

libterm.com

libterm.com