Power of Attorney grants you the legal authority to appoint someone to act on your behalf in financial, legal, or medical matters. Understanding the different types, such as durable, limited, or medical power of attorney, ensures that your interests are protected in various situations. Read on to explore how to choose the right power of attorney for your needs and safeguard your future.

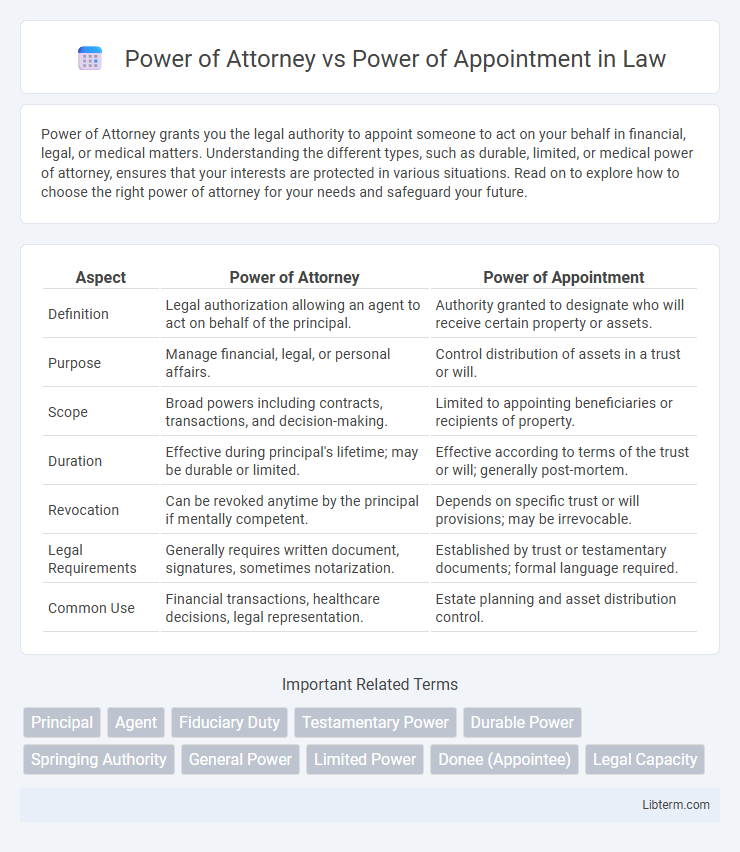

Table of Comparison

| Aspect | Power of Attorney | Power of Appointment |

|---|---|---|

| Definition | Legal authorization allowing an agent to act on behalf of the principal. | Authority granted to designate who will receive certain property or assets. |

| Purpose | Manage financial, legal, or personal affairs. | Control distribution of assets in a trust or will. |

| Scope | Broad powers including contracts, transactions, and decision-making. | Limited to appointing beneficiaries or recipients of property. |

| Duration | Effective during principal's lifetime; may be durable or limited. | Effective according to terms of the trust or will; generally post-mortem. |

| Revocation | Can be revoked anytime by the principal if mentally competent. | Depends on specific trust or will provisions; may be irrevocable. |

| Legal Requirements | Generally requires written document, signatures, sometimes notarization. | Established by trust or testamentary documents; formal language required. |

| Common Use | Financial transactions, healthcare decisions, legal representation. | Estate planning and asset distribution control. |

Introduction: Understanding Legal Authorities

Power of Attorney grants an individual the legal authority to make decisions and act on behalf of another person in financial, medical, or legal matters. Power of Appointment allows a person to designate who will receive certain property or assets under a will or trust. Understanding the distinctions between these legal authorities is crucial for effective estate planning and asset management.

Defining Power of Attorney

Power of Attorney is a legal document granting one person the authority to act on behalf of another in financial, medical, or legal matters. It enables the agent to make decisions and sign documents as if they were the principal, ensuring continuity in managing affairs during incapacity or absence. Understanding the scope and limitations of Power of Attorney is crucial for effective estate or financial planning.

Defining Power of Appointment

Power of Appointment refers to the legal authority granted to an individual, called the appointee, enabling them to decide how certain property or assets within a trust or will are distributed among beneficiaries. This authority can be general, allowing the appointee to distribute assets to themselves or their creditors, or limited, restricting distributions to a specified group or purpose. Understanding the distinctions in Power of Appointment is crucial for estate planning, as it influences control over asset allocation and potential tax implications.

Key Differences Between the Two Powers

Power of Attorney grants an agent the authority to act on behalf of the principal in legal, financial, or health matters, often with broad or limited powers. Power of Appointment allows a designated individual to decide how to distribute property or assets under a trust or estate plan, without granting general decision-making authority. The primary difference lies in the scope: Power of Attorney enables comprehensive representation, while Power of Appointment specifically governs asset allocation decisions.

Legal Implications and Uses

Power of Attorney grants an agent the legal authority to make decisions and act on behalf of the principal in financial, healthcare, or legal matters, with responsibilities and duties clearly established by the document's scope and duration. Power of Appointment allows an individual to designate who will receive certain property or benefits under a trust or estate, often influencing estate planning strategies and tax implications. Understanding the legal implications of each--such as fiduciary duties in Power of Attorney and the control over asset distribution in Power of Appointment--is crucial for effective use in legal and financial contexts.

Common Scenarios for Power of Attorney

Power of Attorney (POA) commonly applies to scenarios where individuals need to delegate decision-making authority for financial, medical, or legal matters during incapacity or absence. Typical instances include managing bank accounts, signing contracts, or making healthcare decisions when the principal cannot act independently. In contrast, Power of Appointment allows a person to designate who will receive certain property or assets, often used in estate planning to control asset distribution after death.

Typical Applications for Power of Appointment

Power of Appointment is frequently used in estate planning to allow a designated individual, known as the appointee, to decide the distribution of trust or estate assets among beneficiaries. It enables flexible management of asset transfers in compliance with the grantor's intentions and can help minimize estate taxes by granting limited or general powers. Common applications include trusts where beneficiaries have varying entitlements or when future circumstances require adaptive control over asset allocation.

Choosing the Right Legal Instrument

Power of Attorney grants an agent the authority to act on behalf of the principal in legal or financial matters, often used for managing affairs during incapacity. Power of Appointment allows an individual to designate who will receive certain property interests under a trust or will, providing control over asset distribution. Selecting the right legal instrument depends on whether immediate decision-making authority or future asset allocation is the primary goal, with clear distinctions impacting estate planning and legal control.

Potential Risks and Safeguards

Power of Attorney grants broad authority to an agent to act on behalf of the principal, posing risks such as financial abuse or unauthorized decisions if safeguards like clear limits in the document and regular oversight are not implemented. Power of Appointment allows the appointee to designate beneficiaries of assets, potentially leading to conflicts or misuse without precise definitions in the legal instrument and strict trust administration protocols. Employing durable clauses, requiring dual signatures, and periodic audits serve as critical safeguards to mitigate fraud, coercion, or mismanagement in both legal mechanisms.

Final Thoughts: Making an Informed Decision

Choosing between a Power of Attorney and a Power of Appointment depends on the specific legal authority and control desired over assets or decisions. Power of Attorney grants an agent authority to act on behalf of the principal in financial, medical, or legal matters, while Power of Appointment allows the holder to distribute property or assets under defined terms. Understanding these distinct functions ensures an informed decision aligned with estate planning goals and personal preferences.

Power of Attorney Infographic

libterm.com

libterm.com