Foreclosure occurs when a borrower fails to make mortgage payments, leading the lender to repossess the property and sell it to recover the loan balance. Understanding the foreclosure process can help you avoid significant financial loss and protect your credit score. Explore the rest of this article to learn how to navigate foreclosure and safeguard your home.

Table of Comparison

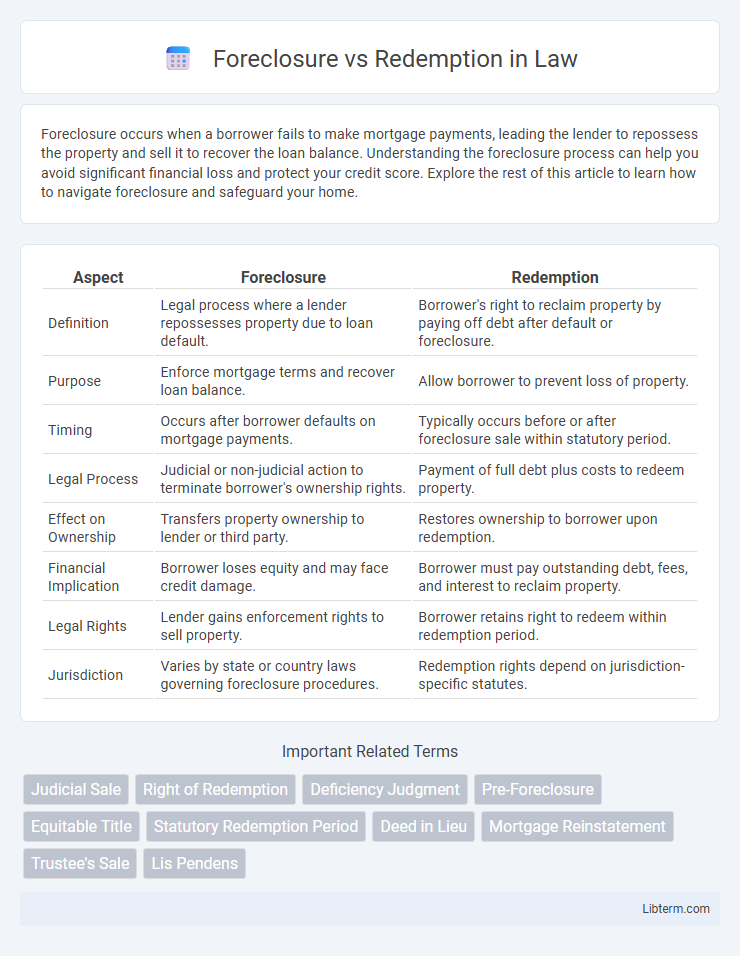

| Aspect | Foreclosure | Redemption |

|---|---|---|

| Definition | Legal process where a lender repossesses property due to loan default. | Borrower's right to reclaim property by paying off debt after default or foreclosure. |

| Purpose | Enforce mortgage terms and recover loan balance. | Allow borrower to prevent loss of property. |

| Timing | Occurs after borrower defaults on mortgage payments. | Typically occurs before or after foreclosure sale within statutory period. |

| Legal Process | Judicial or non-judicial action to terminate borrower's ownership rights. | Payment of full debt plus costs to redeem property. |

| Effect on Ownership | Transfers property ownership to lender or third party. | Restores ownership to borrower upon redemption. |

| Financial Implication | Borrower loses equity and may face credit damage. | Borrower must pay outstanding debt, fees, and interest to reclaim property. |

| Legal Rights | Lender gains enforcement rights to sell property. | Borrower retains right to redeem within redemption period. |

| Jurisdiction | Varies by state or country laws governing foreclosure procedures. | Redemption rights depend on jurisdiction-specific statutes. |

Introduction to Foreclosure and Redemption

Foreclosure is a legal process where a lender seeks to recover the balance of a loan from a borrower who has defaulted by forcing the sale of the collateral property. Redemption allows the borrower the right to reclaim the foreclosed property by paying the outstanding debt, including any fees and interest, within a specified redemption period. Understanding the nuances of foreclosure and redemption rights is crucial in real estate law to protect both lenders' interests and borrowers' property rights.

Understanding Foreclosure: Definition and Process

Foreclosure is a legal process where a lender seizes and sells a property due to the borrower's failure to meet mortgage obligations, typically initiated after multiple missed payments. The process involves filing a public notice, a foreclosure auction, and ultimately transferring the property title to a new owner if the debt remains unpaid. Understanding foreclosure is crucial for homeowners to recognize their rights and potential options before losing ownership.

The Legal Framework of Foreclosure

The legal framework of foreclosure establishes the statutory procedures and timelines creditors must follow to repossess and sell a property when the borrower defaults on a mortgage. It involves rights of redemption, which allow borrowers a specified period to reclaim their property by paying the outstanding debt before the foreclosure sale is finalized. Jurisdictional variations impact redemption periods, notice requirements, and foreclosure methods such as judicial or non-judicial processes.

What is Redemption in Real Estate?

Redemption in real estate refers to the right of a homeowner to reclaim their property after a foreclosure sale by paying off the outstanding mortgage balance, including any fees and interest, within a specified redemption period. This legal provision varies by state but generally allows owners to prevent the final loss of their home by settling their debt. Understanding redemption periods is crucial for borrowers facing foreclosure, as it offers a last opportunity to retain ownership before the sale is finalized.

Redemption Period: How It Works

The redemption period allows a homeowner to reclaim their property after a foreclosure sale by paying the full amount owed, including fees and interest, within a legally specified timeframe. This period varies by state and can range from a few days to several months, providing a critical opportunity for borrowers to avoid permanent loss of ownership. Understanding the redemption period's duration and conditions is essential for navigating post-foreclosure rights and obligations effectively.

Key Differences Between Foreclosure and Redemption

Foreclosure is the legal process by which a lender takes ownership of a property due to the borrower's failure to repay the mortgage, resulting in the borrower's loss of rights to the property. Redemption allows the borrower or a third party to reclaim the foreclosed property by paying the full amount owed, including fees and penalties, within a specific redemption period. The key difference lies in ownership transfer timing: foreclosure ends the borrower's equity rights, while redemption provides a window to reverse foreclosure consequences before final sale.

Pros and Cons of Foreclosure

Foreclosure allows lenders to recover outstanding loan balances by repossessing and selling the property, providing a clear legal resolution and minimizing financial losses. However, foreclosure can negatively impact the borrower's credit score for up to seven years, reduce home equity to zero, and involves lengthy legal procedures that increase costs and delay recovery. Despite these drawbacks, foreclosure offers certainty in repossession compared to redemption, where borrowers can reclaim the property by paying off dues but may prolong financial instability.

Benefits and Drawbacks of Redemption

Redemption allows homeowners to reclaim foreclosed property by paying the outstanding debt plus fees, providing a critical opportunity to avoid permanent loss of their home. This process can help preserve credit ratings and gives borrowers a chance to regain financial stability, yet it often requires substantial funds upfront and may not be feasible for all individuals. The primary drawback of redemption lies in its financial burden and limited time frame, which can impede borrowers from fully benefiting despite its protective benefits.

Foreclosure vs Redemption: Impact on Homeowners

Foreclosure results in the complete loss of property rights, leaving homeowners unable to reclaim ownership once the process is finalized. Redemption provides a critical opportunity for homeowners to repurchase their home within a specific redemption period, mitigating the long-term financial and emotional consequences of losing their property. Understanding the differences between foreclosure and redemption is essential for homeowners to protect their rights and explore options before losing their homes permanently.

Choosing the Best Option: Foreclosure or Redemption

Choosing between foreclosure and redemption involves evaluating financial stability and long-term goals. Foreclosure allows the lender to repossess and sell the property, ending the borrower's ownership, whereas redemption offers the borrower a chance to reclaim the property by paying off due amounts within a legal timeframe. Understanding state laws, the cost implications, and potential credit impact helps determine the best option for managing mortgage default situations effectively.

Foreclosure Infographic

libterm.com

libterm.com