Banking laws regulate the operations and practices of financial institutions to ensure stability, protect consumers, and maintain trust in the financial system. These laws cover areas such as lending practices, interest rates, anti-money laundering measures, and customer rights. Explore the rest of this article to understand how these banking regulations impact your financial activities.

Table of Comparison

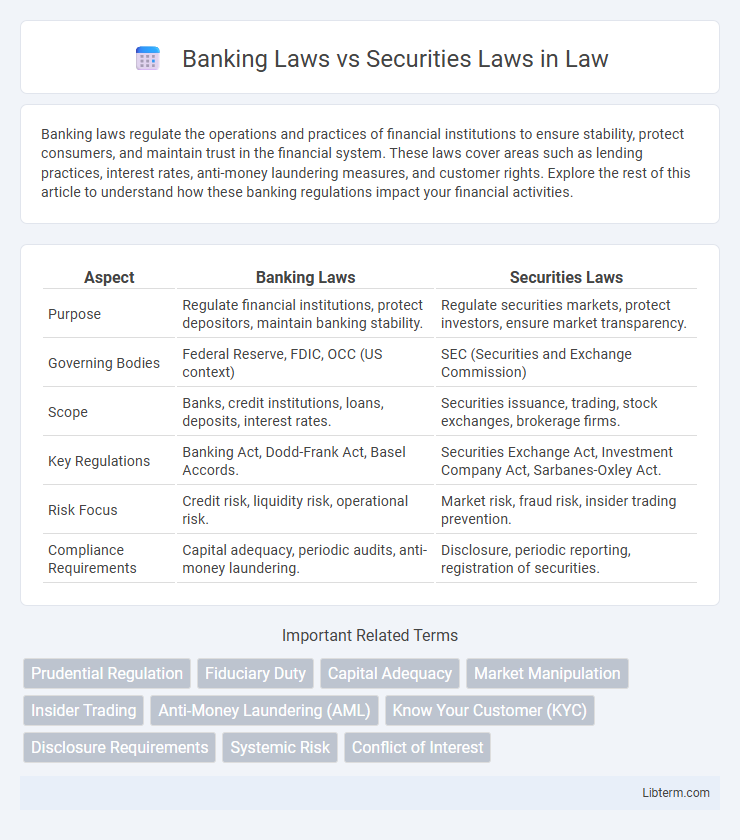

| Aspect | Banking Laws | Securities Laws |

|---|---|---|

| Purpose | Regulate financial institutions, protect depositors, maintain banking stability. | Regulate securities markets, protect investors, ensure market transparency. |

| Governing Bodies | Federal Reserve, FDIC, OCC (US context) | SEC (Securities and Exchange Commission) |

| Scope | Banks, credit institutions, loans, deposits, interest rates. | Securities issuance, trading, stock exchanges, brokerage firms. |

| Key Regulations | Banking Act, Dodd-Frank Act, Basel Accords. | Securities Exchange Act, Investment Company Act, Sarbanes-Oxley Act. |

| Risk Focus | Credit risk, liquidity risk, operational risk. | Market risk, fraud risk, insider trading prevention. |

| Compliance Requirements | Capital adequacy, periodic audits, anti-money laundering. | Disclosure, periodic reporting, registration of securities. |

Introduction to Banking Laws and Securities Laws

Banking laws regulate the operations, licensing, and activities of financial institutions to ensure stability, protect depositors, and maintain systemic integrity. Securities laws govern the issuance, trading, and disclosure requirements of financial instruments such as stocks and bonds, promoting transparency and protecting investors from fraud. The intersection of banking and securities laws is critical for financial institutions involved in both lending and capital market activities.

Key Differences Between Banking and Securities Regulations

Banking laws primarily regulate financial institutions like banks to ensure safety, soundness, and customer protection, focusing on deposit insurance, capital requirements, and lending practices. Securities laws govern the issuance, trading, and disclosure of investment instruments such as stocks and bonds, emphasizing market transparency, investor protection, and fraud prevention. The fundamental difference lies in banking laws managing deposit-taking and credit activities, whereas securities laws regulate investment activities and market conduct.

Historical Development of Banking and Securities Laws

Banking laws originated in the early 20th century with the establishment of the Federal Reserve System in 1913 and the Glass-Steagall Act of 1933, which introduced regulations to stabilize the banking sector and separate commercial banking from securities activities. Securities laws began to develop more robustly after the 1929 stock market crash, culminating in the Securities Act of 1933 and the Securities Exchange Act of 1934, which created the Securities and Exchange Commission (SEC) to regulate and enforce disclosure requirements in securities markets. Over time, these legal frameworks evolved to address systemic risks, investor protection, and market integrity, reflecting distinct but occasionally overlapping regulatory objectives.

Core Objectives of Banking Laws

Banking laws primarily focus on maintaining financial stability, protecting depositors, and regulating the operations of banks to ensure safe and sound banking practices. These laws implement frameworks for capital adequacy, liquidity management, and risk control to prevent bank failures and systemic crises. In contrast, securities laws aim to regulate the issuance and trading of financial instruments, ensuring transparency, fairness, and investor protection in the capital markets.

Core Objectives of Securities Laws

Securities laws primarily aim to protect investors by ensuring transparency, fairness, and efficiency in the securities markets through rigorous disclosure requirements and anti-fraud provisions. These laws regulate the issuance and trading of financial instruments like stocks and bonds to prevent manipulation and insider trading. Unlike banking laws, which focus on the stability of financial institutions and deposit protection, securities laws emphasize market integrity and investor confidence.

Regulatory Authorities: Banking vs Securities Enforcement

Banking laws are primarily enforced by regulatory authorities such as the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC), focusing on financial institution stability, consumer protection, and deposit insurance. Securities laws fall under the jurisdiction of the Securities and Exchange Commission (SEC), which oversees securities markets, enforces disclosure requirements, and combats fraud to protect investors. The distinction between banking and securities enforcement lies in their specialized regulatory frameworks aimed at maintaining systemic financial integrity and market transparency.

Compliance Requirements in Banking vs Securities Sectors

Banking laws mandate rigorous compliance with capital adequacy, anti-money laundering (AML), and customer protection regulations to ensure financial stability and consumer trust. Securities laws emphasize transparency, fair trading practices, disclosure requirements, and insider trading prohibitions to protect investors and maintain market integrity. Both sectors implement distinct regulatory frameworks; banking compliance centers on prudential standards, while securities compliance prioritizes market conduct and disclosure accuracy.

Impact of Banking Laws on Financial Institutions

Banking laws impose stringent regulatory frameworks on financial institutions, ensuring capital adequacy, liquidity, and risk management to maintain systemic stability. These regulations govern deposit insurance, lending practices, and anti-money laundering measures, directly affecting banks' operational decisions and compliance costs. In contrast to securities laws that primarily regulate market instruments and investor protections, banking laws focus on safeguarding depositors and preserving public confidence in the financial system.

Impact of Securities Laws on Capital Markets

Securities laws regulate the issuance and trading of financial instruments, ensuring transparency, investor protection, and market integrity in capital markets. These laws facilitate efficient capital formation by requiring disclosure of material information, reducing fraud, and promoting investor confidence. The enforcement of securities laws directly impacts market liquidity, pricing efficiency, and the overall stability of capital markets.

Emerging Trends: Convergence and Divergence of Banking and Securities Laws

Emerging trends reveal increasing convergence between banking laws and securities laws driven by financial innovation, such as the rise of digital assets and fintech platforms which require integrated regulatory frameworks to ensure investor protection and systemic stability. Despite overlaps, divergence persists as banking laws emphasize prudential regulation and deposit insurance, while securities laws focus on market transparency and disclosure obligations. Regulatory adaptations are ongoing to address challenges from decentralized finance, cross-border transactions, and evolving risk profiles in both banking and securities sectors.

Banking Laws Infographic

libterm.com

libterm.com